For now, the U.S. is dependent on oil and natural gas for power.

Getting into the winter months means our dependence on natural gas will go higher from here.

The holidays mean more people traveling … thus more gasoline consumption.

Over the long term, we plan to drill for more oil and gas than ever before.

This chart shows the amount of oil and natural gas pulled out of the ground from shale and tight plays from 1999 to 2050.

Shale and tight oil plays are pulled from rock formations in the ground.

From 2000 to 2050, the amount of oil and gas pulled this way will increase by 1,802.3%.

Today’s Power Stock is an American operator of drilling rigs used to pull oil and gas from those rock formations: Ranger Energy Services Inc. (NYSE: RNGR).

RNGR sends its oil and natural gas drilling rigs all over the U.S.

Its services are used in states that produce the most from shale extraction:

- Louisiana.

- Oklahoma.

- North Dakota.

- Wyoming.

- Colorado.

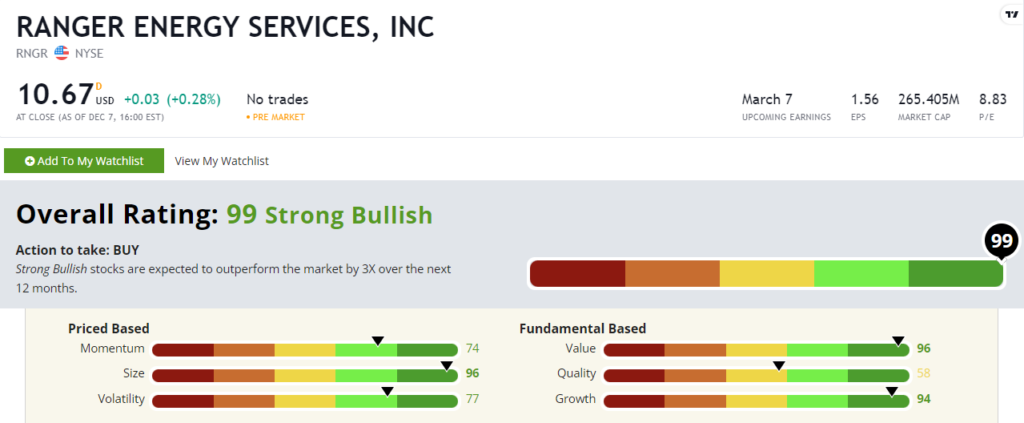

Ranger Energy stock scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

RNGR Stock: Fantastic Value and Growth

Here’s what stood out from RNGR’s most recent earnings report:

- Quarterly revenue was $177 million, up more than 100% over the same quarter last year.

- The company’s net income was $13.6 million for the quarter — a 250% jump year over year!

Those figures illustrate why RNGR earns a 94 on our growth factor.

RNGR is also a fantastic value stock.

Its price-to-earnings and price-to-cash flow ratios are all half that of its peers in the support activities for the oil and gas exploration industry. Remember, lower is better.

RNGR’s price-to-sales ratio is three times lower than the industry average.

This tells us RNGR is a better value stock than most of its competitors … it earns a 96 on our value factor.

RNGR Stock: Fantastic Value and Growth

Here’s what stood out from RNGR’s most recent earnings report:

- Quarterly revenue was $177 million, up more than 100% over the same quarter last year.

- The company’s net income was $13.6 million for the quarter — a 250% jump year over year!

Those figures illustrate why RNGR earns a 94 on our growth factor.

RNGR is also a fantastic value stock.

Its price-to-earnings and price-to-cash flow ratios are all half that of its peers in the support activities for the oil and gas exploration industry. Remember, lower is better.

RNGR’s price-to-sales ratio is three times lower than the industry average.

This tells us RNGR is a better value stock than most of its competitors … it earns a 96 on our value factor.

RNGR stock saw some ups and downs over the last 12 months.

It gained 5%, while the S&P 500 declined 15% over the same time.

Ranger Energy stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

The amount of oil and natural gas we pull out of the ground is only expanding.

RNGR specializes in the equipment to extract these critical resources safely and efficiently.

With a robust presence in the sector, you can see why RNGR is a strong candidate for your portfolio.

My colleague Adam O’Dell is watching the oil market closely. He sees a “super bull” forming in the coming months. And when it hits, he expects his No. 1 stock to soar 100% higher in just 100 days.

Adam and the rest of the team are putting the final touches on a presentation that will show you everything you need to capitalize on the next oil super bull market. Click here to put your name on the list for his December 28 presentation.

You don’t want to miss this.

Stay Tuned: A Canadian Oil Stock Targets Massive Growth

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

On Monday I’ll share all the details on a company that’s become a key player in Canadian oil.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets