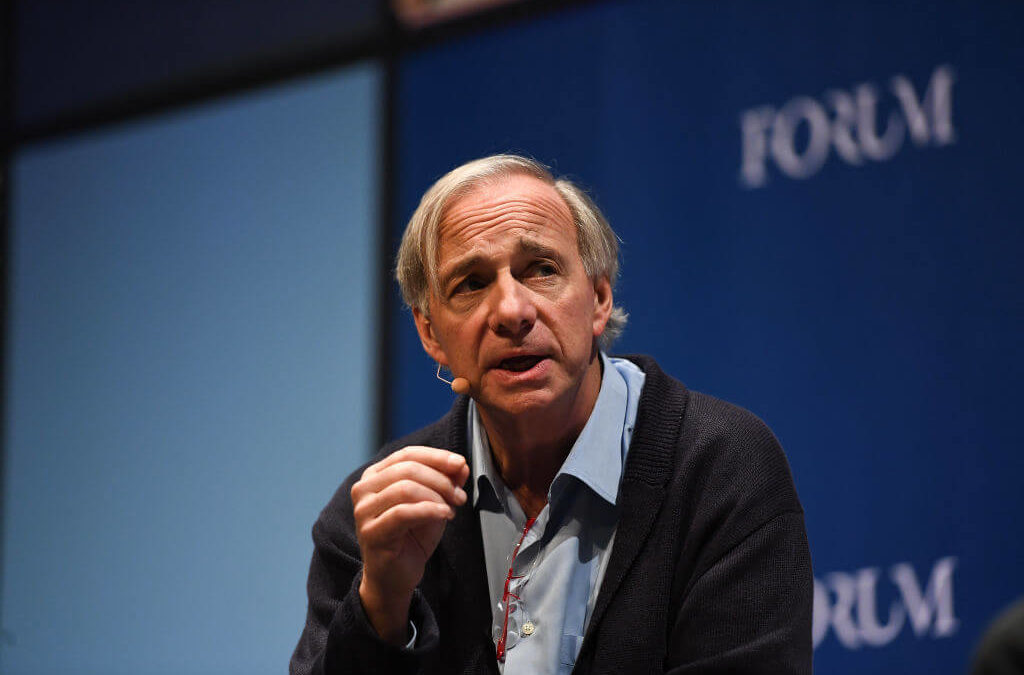

Billionaire Bridgewater founder and CEO Ray Dalio said Tuesday that politicians will have no choice but to raise taxes in the coming years to offset the exploding national debt that no one in Congress seems to care about now that Donald Trump is in office.

“The national debt, pension and health-care liabilities will lead us down a path where the government will have no choice but to raise taxes since defaulting on the debt isn’t an option,” Dalio said.

Then-citizen Trump promised to wipe out the national debt after eight years in office while he was on the campaign trail.

And yet through August of this year, his first 2 1/2 years in office, the self-described “King of Debt” has gone in the total opposite direction, and virtually no one in the GOP has tried to stop him while all the Democrats ever want to do is spend, spend, spend.

Trump also has previously said “I won’t be here” in office to take the blame when the national debt finally explodes in all our faces.

On Aug. 2., Trump signed a costly, bipartisan budget bill into law that will add an estimated $1.7 trillion to the national debt over the next decade. According to the nonpartisan Congressional Budget Office, once other bills Trump has signed are factored in, such as the Tax Cuts and Jobs Act, his total contribution to the debt as president is projected to be more than $4 trillion — and that’s just for one term.

The national debt is currently $23 trillion, or about 103% of GDP, and total debt held by the public is about $16.9 trillion, or about 78% of GDP. The second total is thought of as the more important economic burden, and it is expected to surge to 105% by 2028.

“Our national debt is a self-inflicted wound,” CBO President Maya MacGuineas said in August. “It will take the kind of leadership that currently doesn’t exist in Washington to fix.”

The only way to fix it, Dalio said this week on CNBC, is to raise taxes.

“We’re dealing with almost a currency issue, longer term, in terms of what is the value of currency when those liabilities — not only the debt liabilities, but the pension liabilities and the health-care liabilities, which are like debt. They are promises that have to be paid — they will either be paid by higher taxes or they’ll be not paid and defaulted on,” Dalio said. “I don’t think they will be defaulted on. I think by-and-large they’re going to be paid. But if they raise taxes too much, then it changes the nature of that economics.”

The U.S. Treasury said recently that the federal budget deficit for 2019 was $984 billion, just short of the projected $1 trillion but an overall increase of 26% over 2018 — all while the economy is supposedly great and not recovering from a recession, which is generally when you run up the debt.

Are there any fiscal conservatives left in Washington?