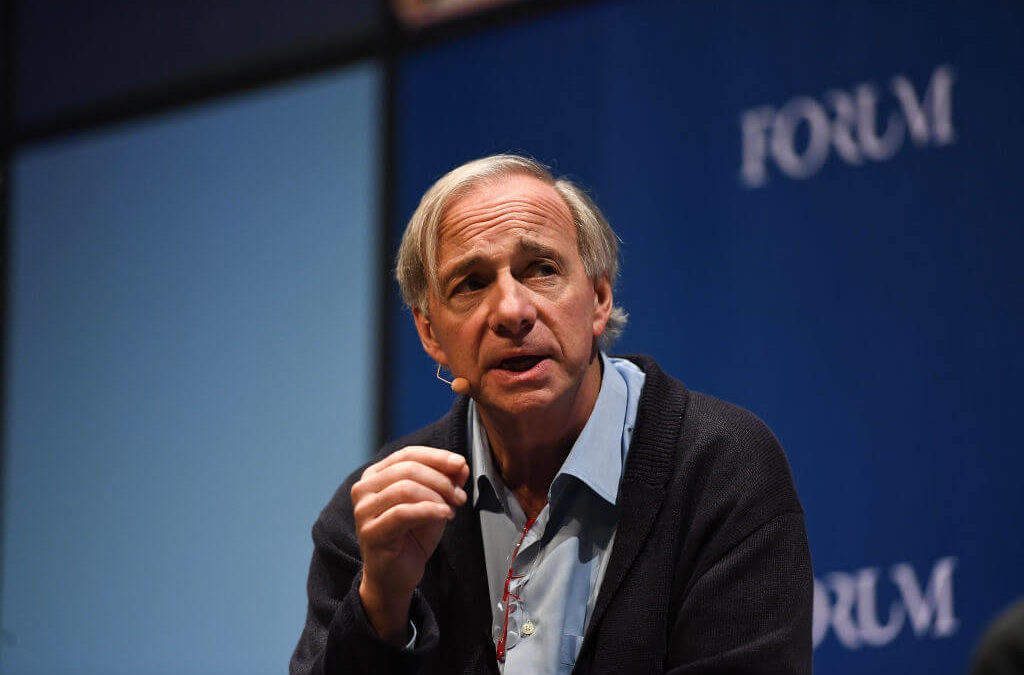

Bridgewater founder Ray Dalio said recently he’s not sure how bad things are going to get regarding the coronavirus and its effect on stock markets, but he has some advice as far as how investors should play things to best guard against big losses.

Your best bet is to diversify your portfolio across geographic locations, asset class and different currencies.

“Terrible, unimaginable things could happen anywhere. What we don’t know is much greater than what we do know,” Dalio wrote in a recent note to clients, noting that Bridgewater has studied what’s happened during past pandemics.

Dalio said there’s no way to predict exactly what will happen, but past pandemics have had major impacts on global markets.

“Generally speaking these once-in-a-lifetime big bad things initially are under-worried about and continue to progress until they become over-worried about, until the fundamentals for the reversal happen,” he wrote, meaning how the spread of the virus switches from accelerating to decelerating.

As far as the SARS outbreak from 2002-03, the market in Hong Kong reversed as the number of infections peaked, before starting to decline.

“This is all logical and would be the type of market action we would expect if the coronavirus crisis remains concentrated in China,” he wrote, noting that the greatest stock market impact will be felt again in China and Hong Kong.

Dalio’s Bridgewater also studied the impact of the swine flu outbreak in 2009-10.

Per CNBC:

With this virus and SARS, the markets acted in a risk-off way, responding to falling growth and the flight to quality. Stocks fell, while gold and bond prices went higher, but these market moves faded and markets could have been responding instead to policy and economic developments that weren’t related to the virus. H1N1 also coincided with the beginning of the financial crisis.

The worst pandemic of modern history was the Spanish flu, which happened at the same time as World War I in 1918, infecting 500 million people and killing 50 million, peaking at the end of the war.

“The impacts of the war and the pandemic are hard to disentangle in market and economy charts, but it looks like positive developments in the war … were overshadowed by the pandemic, marking the end of an equity rally,” Dalio wrote.

The economy in the U.S. fell into a sharp decline during the outbreak. According to a study by the St. Louis Federal Reserve, retail grocery business declined by a third and coal mine operations were cut in half.

“So far, China’s response is much more transparent and decisive compared to the SARS outbreak, which affects both the statistical comparison and the rate of dealing with the problem,” Dalio wrote.