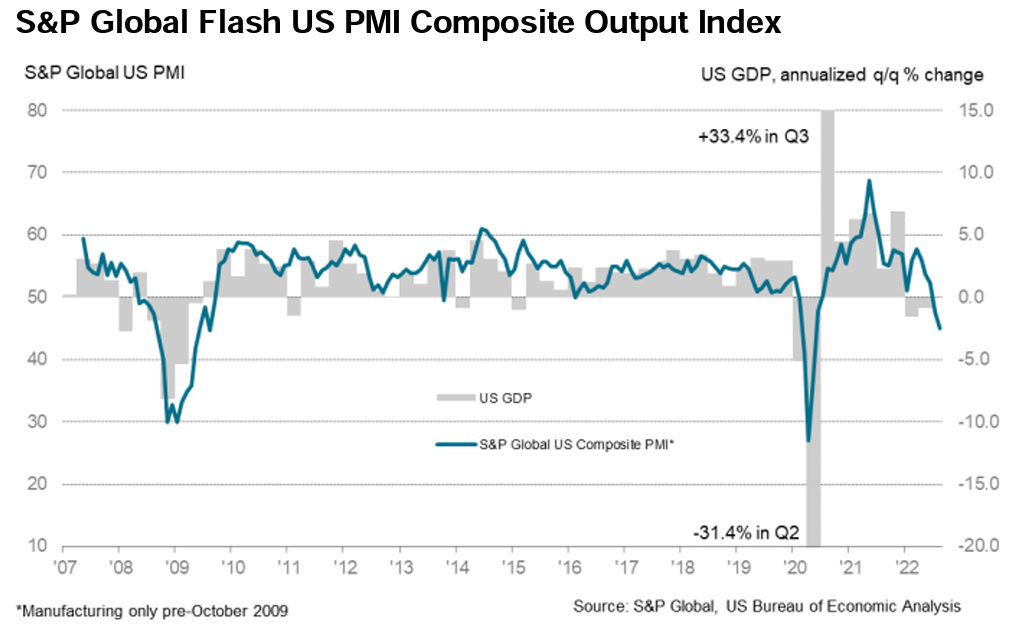

We got our first insight into the current economy this week with the S&P Flash Purchasing Managers’ Index (PMI).

One of the most important economic indicators, this index reports on a survey of purchasing managers at factories around the country.

Readings above 50 indicate growth in a country’s manufacturing sector, while readings below 50 indicate contraction.

China’s reading of 49.6 warns that growth is slowing in that country. The U.S. is in a tough spot as well.

Purchasing Managers Are Key for the Economy

Purchasing managers are at the forefront of economic trends.

In a factory, they are responsible for ensuring workers stay busy.

They are aware of incoming orders and expected maintenance downtime. They need to maintain enough inventory to meet demand without ordering too much.

Over-ordering can lead to tied-up capital or spoiled supplies.

Profitability depends on purchasing managers doing their jobs well.

Economists have long recognized the important role factories play in economic growth.

The PMI was one of the first indicators developed to forecast the economy.

Right now, it’s dropping into recession territory.

The left-hand scale of the chart shows the composite index fell below The right-hand scale shows the amount of GDP growth associated with a specific reading.

Current levels forecast an economic contraction.

Additional data in the S&P report confirms that outlook.

Bad News Outweighs Good in PMI Report

The Flash U.S. Services Business Activity Index is at a 27-month low.

U.S. Manufacturing PMI is at a 25-month low.

Even the good news in the report is bad.

Inflationary pressures eased for the third month in a row.

Purchasing managers indicated inputs they needed were at the slowest pace in a year and a half.

Manufacturers are passing the cost savings on to customers.

They’re doing that to increase orders.

Backlogs are decreasing, and new orders are declining at the fastest pace since the pandemic.

This leads firms to delay their hiring plans.

Bottom line: We’ll get more updates in the coming weeks.

But it appears a recession is approaching fast.

Click here to join True Options Masters.