Recent retail sales data was greeted with relief by analysts.

The Wall Street Journal reported:

“U.S. retail sales rose sharply in October, a sign of economic strength that leaves the Federal Reserve likely to keep raising interest rates as it tries to reduce persistently high inflation.

Retail sales rose a seasonally adjusted 1.3% in October compared with September…”

The data looked good. But another report raised some concerns.

What’s Going on With Credit Card Debt?

A day earlier, the New York Federal Reserve issued its latest quarterly report on household debt and credit.

That report noted a large increase in household debt. Total household debt increased 2.2%. That’s an increase of 8.3% from a year earlier, the biggest annual increase since the first quarter of 2008. That was the beginning of the recession that would lead to a drop of more than 50% in the stock market.

After growing by $282 billion, mortgage debt makes up 71% of the debt that totals $16.51 trillion.

There are signs that consumers are once again using their homes as a source of savings. Home equity lines of credit grew for the second quarter in a row.

Another sign that consumers are stretched is the 15% year-over-year increase in credit card balances. That’s the largest increase in more than 20 years.

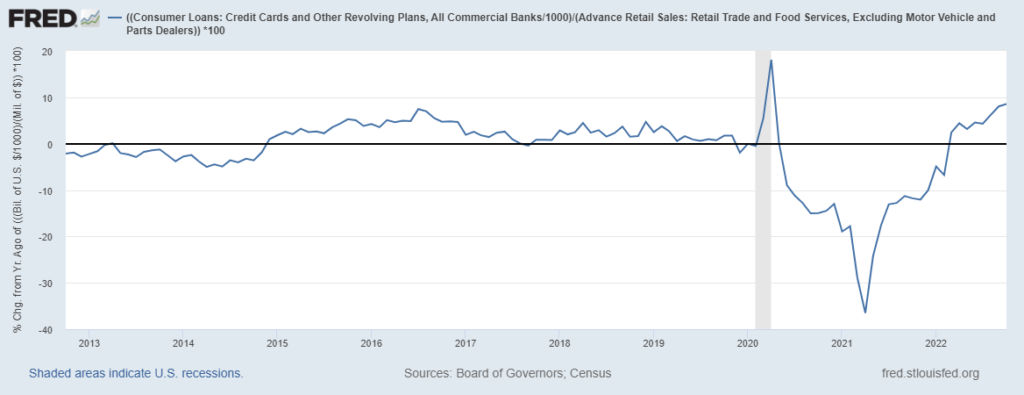

The chart below combines the two reports, showing the change in credit card debt as a percentage of retail sales. The ratio reached a level that would be considered high before the pandemic distorted the data series.

Credit Card Debt Creeps Higher

We now have signs that consumers are using debt to fund their current living expenses. This is consistent with the beginning of a recession, as is the increase in debt delinquencies.

The Fed reported that approximately 6% of consumers have a third party collection account on their credit report, with an average balance of $1,266. This number should rise in the next few quarters as consumers become increasingly stressed.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.