I’m refinancing my house.

The process is a beat down. The mortgage broker now knows more about my personal finances than my wife does.

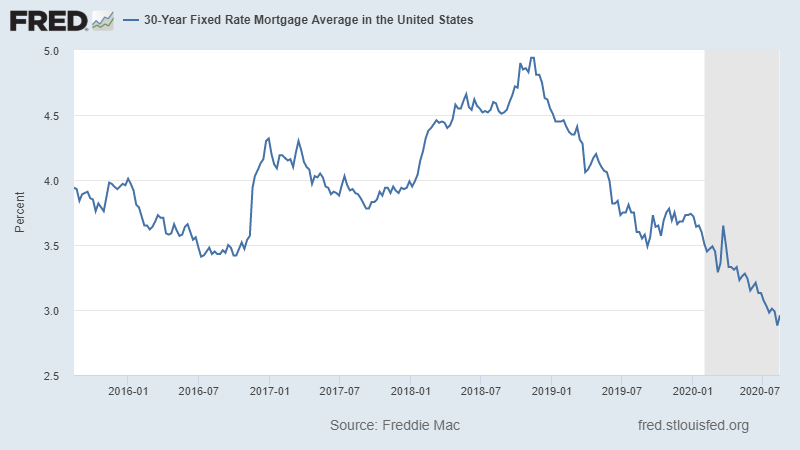

But with rates where they are today, it was worth it to me.

My refinance rate is less than 3%. I was paying 4% before, which is still phenomenal.

But that extra 1% matters. On a $400,000 mortgage, that’s $4,000 per year in interest savings. If you bought a house two years ago and are paying close to 5%, the savings would be roughly double.

That’s real money.

Mortgage Rates Hit New Lows

Source: Federal Reserve

Shaving a full 1% off my mortgage rate allows me to keep my payment the same and pull out approximately $100,000 that I may use for a down payment on another property if I find an opportunity I like.

Until I do, I’m content to just sit on the cash. At a 3% interest rate, it’s not costing me much.

I don’t like to take on new debt. In fact, I hate debt. It’s like a massive ball and chain weighing me down.

I pay cash for what I can, and I do everything possible to accelerate the few debt payments I have. I was a full 15 years ahead of schedule on my old mortgage before refinancing.

But in an “infinity dollar” market, carrying debt suddenly makes a lot more sense.

The dollars borrowed today, at record low rates, will be paid back with depreciated future dollars. We may see a time when inflation wipes the debt slate clean. (That would be a disaster for the financial system, of course, but it would bail out debtors.)

Take Advantage of Refinancing

But there is an important caveat here: Not all debt is created equal.

When you can borrow cheaply to buy a productive asset that’s likely to benefit from inflation, you’re winning in life. The price of the asset rises even while the debt remains fixed.

But you should use the debt to buy an asset with a long expected life and a positive return expectation.

A boat, car, TV or set of living room furniture will not appreciate in value. They start depreciating the minute you buy them.

If you borrow at a cheap interest rate — or even at zero percent interest — the value of the asset will decline relative to the value of the debt financing it. If your financial situation deteriorates, selling the asset won’t cover the loan in most cases.

Now, compare that to a house, a warehouse or even a piece of land.

While prices can fluctuate, and not every investment works out as planned, the value of these assets should rise over time. You have something of value to offset the debt. And it’s not a major burden to you.

I’m not 100% sure what I’ll do with the equity I extracted in my refinancing. I may just put it back into the mortgage in six months if I don’t see any opportunities I like.

But at today’s rates, it’s worth having a little extra cash on hand.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.