When I lived in rural southeast Kansas for nearly a decade, I developed special relationships with a lot of people.

There’s just something about small-town living that makes everyone neighborly.

I became good friends with the president of the local community bank.

It started because I was the editor of the local paper. But he was also just a nice guy.

When we talked about personal finance, I always felt he had my best interests at heart.

He never steered me toward a financial decision that would hurt me in the long run.

I may not bank with him anymore, but I always valued his “extra mile” approach.

That kind of relationship led me to today’s stock.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a regional bank with the potential to grow its revenue 43% in the next two years — making it a solid company for your portfolio. It’s one we are “Strong Bullish” on.

The underlying stock is situated to outperform the broader market by at least three times over the next 12 months.

Before we get into the regional bank stock, let’s look at how regional banks weathered the COVID-19 pandemic.

Regional Banks = Big Profits

The COVID-19 pandemic put a big dent in American businesses.

Shutdowns and restrictions forced many businesses to either scale back operations or close completely.

One industry that thrived amid the pandemic recession was banks.

Regional Banks Remain Profitable During COVID-19

Regional banks were the second-most profitable business in 2020, scoring profit margins of more than 30%.

That was second only to their larger money-center rivals.

Now that business is picking up again, these profit margins should only get higher for regional banks in the future.

A Strong Regional Bank Stock: MetroCity Bancshares Inc.

Using Adam’s Green Zone Ratings system, I found MetroCity Bancshares Inc. (Nasdaq: MCBS) — a regional bank headquartered in Georgia.

It provides a full suite of banking products:

- Checking and savings accounts.

- Money transfers.

- Commercial and individual loans.

MetroCity operates 19 full-service branch locations in Alabama, Florida, Georgia, New York, New Jersey, Texas and Virginia.

MetroCity Total Revenue to Reach New Highs in 2021

MetroCity’s total annual revenue was trending higher, until COVID-19.

Revenue went from $100.9 million in 2019 to $90.5 million in 2020.

However, the future looks much brighter for this regional bank as it is forecasting annual total revenue of $129.7 million by 2023 — a 43% rise from 2020 and a 29% jump from its previous high in 2019.

In its recent quarterly report, MetroCity said its total assets increased by 16%, and its net income was up $1.4 million over the previous quarter.

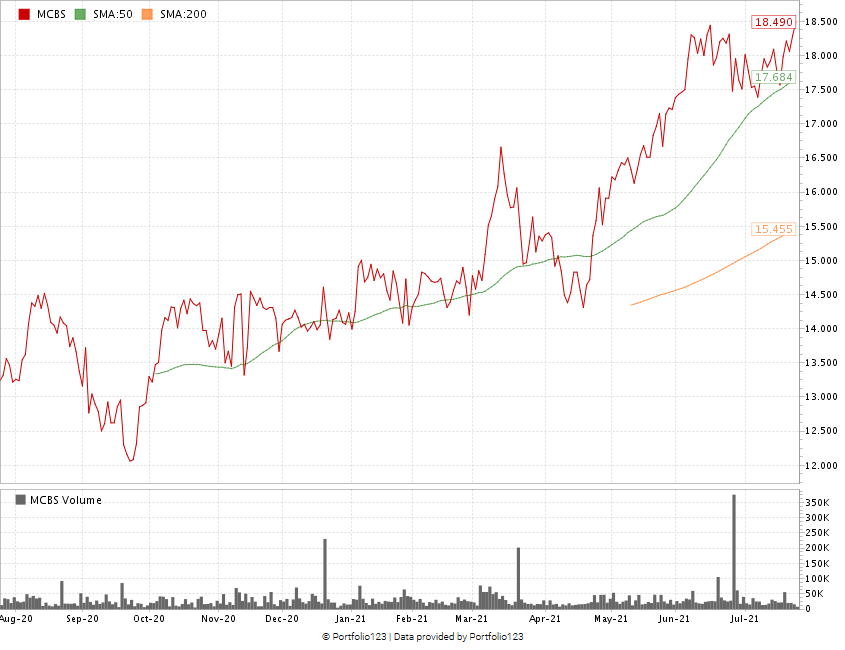

MetroCity Stock Reaches New Highs

Twelve months ago, MetroCity stock was priced at around $13 per share.

Over the year, the stock price has reached a new 52-week high and is at $18.50 currently — a 42% jump in price.

MetroCity’s Stock Rating

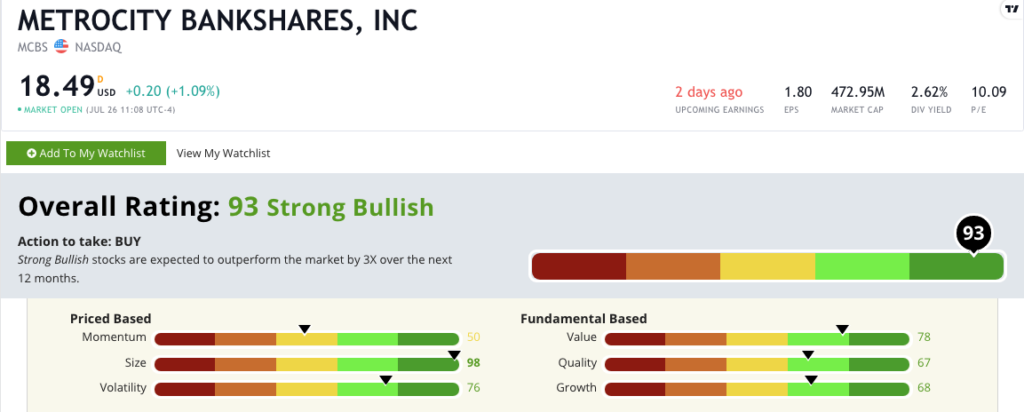

Using Adam’s six-factor Green Zone Ratings system, MetroCity Bancshares scores a 93 overall. That means we are “Strong Bullish” on the regional bank stock and expect it to outperform the broader market by three times in the next 12 months.

MetroCity Bancshares’ Green Zone Rating on July 26, 2021.

MetroCity rates in the green in five of our six factors:

- Size — MCBS comes in with a market cap of $473 million, putting it well under $1 billion and a perfect size for companies we look for to produce big gains. It scores a 98 on this metric.

- Value — At its current stock price, MetroCity’s price-to ratios (earnings and book) are all lower than the banking industry average, making it a good value stock. It scores a 78 on this metric.

- Volatility — Despite its up and down movement at the end of 2020, MetroCity’s stock price continues to find higher highs and higher lows. It earns a 76 on volatility.

- Growth — MCBS has a trailing-12-month annual earnings-per-share growth rate of 11.6% and a five-year annual sales growth rate of 18%. Its quarterly sales have risen in each of the last three quarters. That earns it a 68 on growth.

- Quality — The company’s returns on assets, equity and investments are all positive and higher than the banking industry averages. MetroCity earns a 67 on quality.

MetroCity earns a 50 on momentum — right in the middle of all other stocks rated. This is because of that up and down movement in the stock price. However, the movement continues to produce higher highs and higher lows in the share price.

Bottom line: Regional banks did well for themselves during the COVID-19 pandemic.

Their unique relationship with the smaller communities they serve should only help as the country tries to get back to pre-COVID normalcy.

Bank stocks are trending higher off their 2020 lows. However, the sector remains relatively cheap. MetroCity is trading at just 1.8-times its book value and just 4-times its sales.

This signals that MetroCity Bancshares is worth a look at for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.