It’s been rough for investors, with the S&P 500 still in bear market territory.

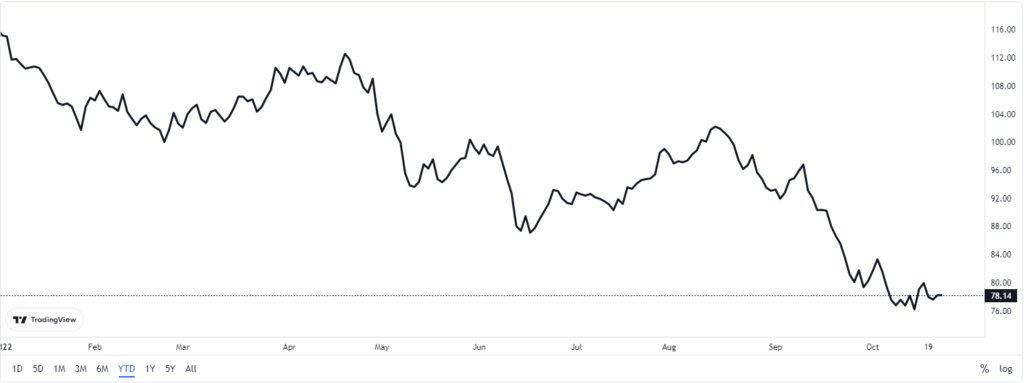

But if you want to see a nasty chart, take a look at the Vanguard Real Estate Index Fund (NYSE: VNQ):

Real Estate Sinks in 2022

Source: TradingView.

This is an index exchange-traded fund (ETF) that owns a basket of the largest and best-known real estate investment trusts (REITs). As I write this, it’s down just over 32% in 2022 after topping out on December 27, 2021.

With the pounding it’s taken this year, VNQ is now sitting at 2014 prices.

But what’s remarkable is that most of the damage happened in just the past two months. The REIT sector rolled over and died around the middle of August.

What gives?

Big Reason for the Crash

It comes down to bond yields.

Yields on 10-year and 30-year bonds exploded higher, starting over the summer. Rising bond yields mean falling bond prices … and falling prices for assets that are viewed as bond substitutes, such as REITs.

But here’s the thing…

Over time, real estate is one of the best inflation hedges because the value of the land and improvements rises with inflation, even as the mortgage debt associated with it gets inflated away. Plus, the rents earned also rise, making the income stream inflation-proof as well.

Furthermore, while the surge in bond yields is painful, it shouldn’t last all that long.

Higher interest rates tend to self-correct, albeit on a bit of a lag. Higher rates create slowdowns in growth and inflation, which in turn pressures market rates to fall.

I’m not promising it’ll happen tomorrow. Inflation is still running hot without any inclination of slowing.

But that day is coming … and soon.

Meanwhile, the VNQ ETF sports a current dividend yield of about 4%, more than double the S&P 500’s yield of just 1.7% and just below the 10-year Treasury bond yield (4.1% as I write). But unlike the 10-year (or any bond), VNQ’s payout is almost guaranteed to rise over time.

You could buy shares of VNQ and be done. It’s solid, well diversified and the 4% yield is fantastic.

But I’d rather pick and choose the best REITs backed by the strongest trends.

One REIT With Promise

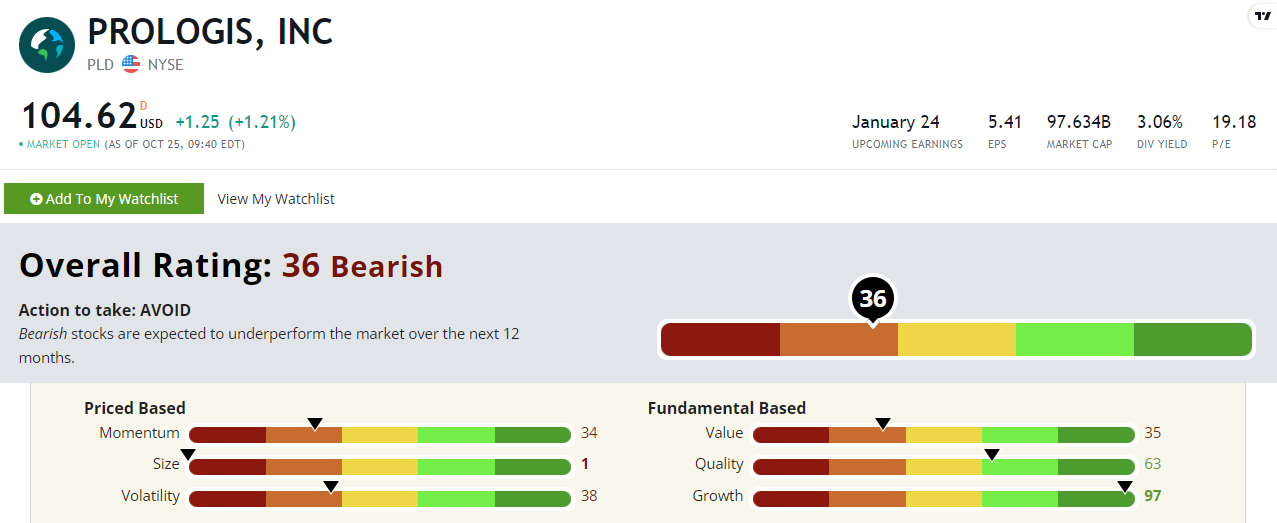

Along those lines, take a look at logistics REIT Prologis Inc. (NYSE: PLD). It’s not the highest rated on our Stock Power Ratings system. In fact, it carries a 36 score at the moment.

PLD’s Stock Power Ratings in October 2022.

But remember, the entire REIT sector has been in free fall. It’s natural that PLD stock would lose serious points on our momentum and volatility factors.

It’s the growth factor that gets my attention, where Prologis rates a stellar 97!

This is one of the fastest-growing companies in our universe. If you know a thing or two about Prologis’ business model, you’d understand why.

Prologis owns a vast portfolio of logistics properties, such as warehouses and distribution facilities. And its focus is e-commerce.

If you believe that Amazon and other e-tailers will continue to thrive, then it makes sense to own Amazon’s landlord.

Prologis’ stock has been trading sideways for the past month. Selling may be exhausted, and the stock is forming a base to move higher.

We’ll see.

If you want to wait a little longer to make sure the stock doesn’t have another leg down, that might be prudent in this market. We like buying stocks that are already in established uptrends.

But don’t wait too long.

PLD stock is trading at early 2020 levels and is sporting its highest dividend yield in years at 3%.

Bottom line: This is one of those stocks you can buy, drop in a drawer and forget about for years or even decades.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.