Sir John Templeton and his 16 rules for investment success are required reading for any serious investor. And amid the volatility lately, I’ve been thinking a lot on one of these rules in particular:

The investor who says, “This time is different,” when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.

Yes, it feels like the Russian invasion of Ukraine has opened a new chapter in geopolitics. And yes, it feels like we are on the cusp of something big with inflationary pressures, the threat of higher interest rates and other disruptions.

But before you panic, keep in mind Sir John Templeton’s words.

The headlines may be new, but we’ve been here before.

Successful investing in the long run relies on fundamental truths that are worth following regardless of short-term gyrations in the S&P 500 or the Dow. If we let hard times shake our resolve and take our eye off long-term total returns, we ultimately live to regret it.

As long-time Contrarian Outlook readers know, one of the tried-and-true rules of investing is to focus on low-risk investments that offer reliable income over the long-run.

And right now, you won’t find better examples of this approach than these three commercial real estate investment trusts (REITs).

Commercial Real Estate Is Still a Cash Cow

First, let’s talk some fundamentals about commercial real estate that are worth remembering, and remain relevant even now despite the risks of war, inflation and higher rates.

- Inflation hedge: Historically, commercial real estate has provided a hedge against inflation. Just as land is a hard asset for homeowners or real estate speculators, it’s also a store of value for the office operators who own space in in-demand areas.

- Persistent urban demand: Though the pandemic has changed life in the big city, it certainly hasn’t driven people into the wide open spaces of the Midwest for good. There is still strong demand for prime real estate in Manhattan, San Francisco or Washington, D.C., among top businesses who see value in urban workforces and in-office collaboration.

- Long-term rent reliability: Most commercial real estate leases are a minimum of three years in length. That means you can bank on reliable revenue that rolls in to landlords from tenants.

These bullish factors have been big reasons for income investors to focus on this sector in the past. And in 2022, these reasons only seem more relevant than ever before.

So why get tied up in knots, trying to figure out why this time is “different?”

Why not just ride these time-tested truths to consistent income — quarter after quarter, year after year?

3 Rock-Solid REITs Yielding 7.8% or Better

Let’s get right into three of my favorite stocks and what they have to offer:

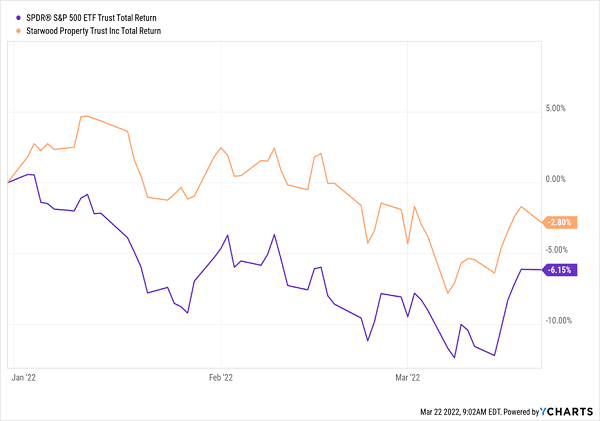

STWD Is Beating the Market

Starwood Property Trust Inc. (NYSE: STWD) operates as a real estate investment trust in the U.S., Europe and Australia. It does a bit of residential mortgage business, but cashes in big on its commercial and infrastructure lending. Shares have held up better year-to-date in 2022 than the rest of the stock market, and throw off a tremendous 8.1% yield to give investors incentive to buy and hold.

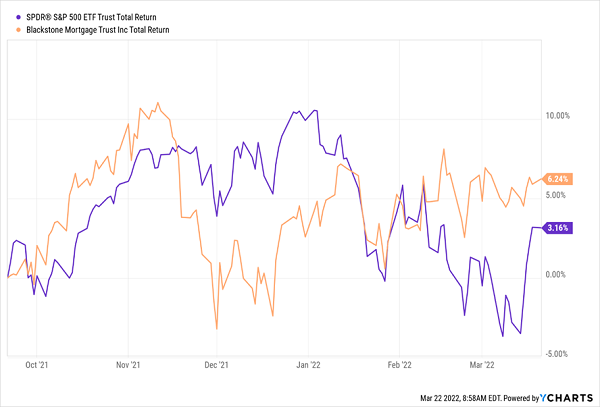

BXMT Is Well Diversified

Blackstone Mortgage Trust Inc. (NYSE: BXMT) is a real estate finance company that originates senior loans collateralized by commercial properties in North America, Europe and Australia. Its diversified portfolio has done quite well over the last six months even amid broader challenges for the stock market, and it yields 7.8% right now.

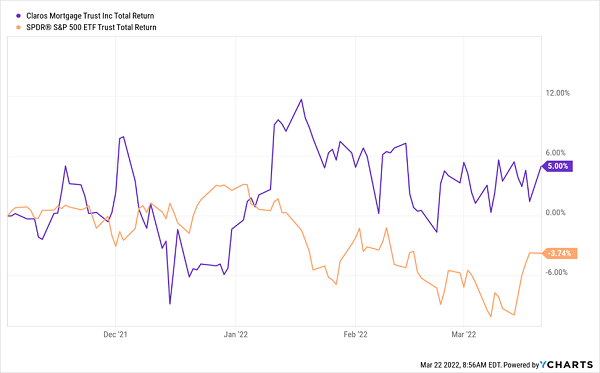

CMTG Offers a Mortgage Play

Claros Mortgage Trust Inc. (NYSE: CMTG) specializes in commercial real estate mortgages. The dynamics are obviously a bit different than the residential market, but similarly driven by tight inventories. CMTG yields an impressive 8.2% at current pricing, and shares have been rock solid over the last several months despite uncertainty and volatility. Shares have only been listed since November, but have outperformed the broader market since then.

To learn more about generating monthly dividends as high as 8%, click here.