My wife and I used to joke about how I would die at my desk before I ever retired.

As a journalist, I spent hours chasing down stories and poring over source material. Many 18-hour days prompted our joke about my post-work life. But considering the current state of retirement, it’s not nearly as funny as it was 10 years ago.

Inflation has pushed the cost of goods and services to all-time highs. Taxes do us no favors, either.

While I may be years away from hanging it up, the fact is that unless I live with my children for the rest of my life, retiring comfortably is more of a pipe dream than a reality.

Today, I’ll show you two disturbing facts I’ve uncovered about retirement.

But don’t worry…

It’s not all doom and gloom.

Contrary to what you might think, the faraway dream of a comfortable retirement isn’t as far away as you might think … I’ll show you that, too.

What It Takes to Retire Comfortably

If you asked 10 people on the street how much they thought they needed for retirement, you’d get 10 different answers.

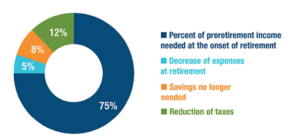

Conservative estimates say you should have 75% of your annual salary saved for each year of retirement. If you made $100,000 while working, you need $75,000 annually in your golden years.

The estimate is based on lower taxes, fewer expenses and savings you won’t need when you retire.

Income Needed When You Retire

Source: T. Rowe Price.

Sticking with that example, you’d need $6,250 of income every month.

One big problem is that the Social Security Administration averages a benefit payout of just $1,800 per month to retirees. That leaves a $4,450-per-month deficit.

It means that rather than retiring at 67 — the regular Social Security retirement age — many Americans are working through their retirement to make ends meet.

Remember the recent story I told you about Robert?

It’s real.

Retirees don’t have enough to live comfortably, and current workers are scared of being in the same situation as Robert.

That’s disturbing fact No. 1.

“Retirement Confidence” Falls in 2023

The Employee Benefit Research Institute (EBRI) and Greenwald Research ask thousands of American workers and retirees annually how they feel about their retirement situation.

I call it “retirement confidence.”

The idea is to see how confident workers and retirees are about their nest eggs.

Last year, the results were telling:

Last year, only 64% of American workers felt “very confident” in their retirement savings, while 18% were “very or somewhat” confident.

That may seem high, but those numbers dropped from 73% and 28%, respectively, in the previous year.

Workers lost a boatload of retirement confidence between 2022 and 2023.

Retirees had a similar outlook:

Last year, 73% of retirees felt “very comfortable” with their retirement savings, and 27% were “very or somewhat comfortable.”

Just like with workers, these numbers are down from 77% and 33%, respectively, in 2022. it was the third straight year of declines in overall “retirement confidence.”

Basically, fewer Americans feel like they have enough money in the bank to live comfortably after leaving the working world.

That’s disturbing fact No. 2.

It’s Not All Doom and Gloom

After reading these facts, you’re probably thinking the same thing I was— there’s no hope for a comfortable retirement.

If you didn’t do anything, you’d be right.

However, my colleague, Money & Markets Chief Market Technician Mike Carr, is focused on income with his latest system.

He spent the last 20 years developing a way to give those worried about their savings the tools they need to potentially bolster their savings.

He calls it the “Accelerated Income System.”

This system has the power to grow an account by 199% with a 95%-win rate over the last year.

It’s honestly phenomenal … not just how accurate and successful this system is… but also how simple it is to use.

Mike aims to produce profits in just 24 to 48 hours every week.

He’s just unveiled this system, but it’s not too late to learn how this simple strategy can achieve a significant and sustainable payout.

If you haven’t already … click here to find out how you can potentially bolster your portfolio for your golden years ahead.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets