I grew up in Wichita, Kansas.

During my childhood, it was known as the “Aircraft Capital of the World.” Boeing, Cessna and Raytheon all had huge facilities there.

I visited my grandfather at the Boeing plant one day. He was an engineer and pointed out these massive piles of steel and aluminum on the plant floor.

When I asked why all that metal was stacked up his reply was simple:

“If it wasn’t there, we couldn’t build all of these airplanes.”

Steel is critical for producing aircraft — from the body of a plane to its engines and landing gear.

And metal suppliers are dealing with a demand boom headed into the next decade.

This chart shows the global market value of aerospace materials.

From 2021 to 2030, Precedence Research expects industry revenues to increase 85.2%.

Today’s Power Stock produces the steel used in aerospace manufacturing: Reliance Steel & Aluminum Co. (NYSE: RS).

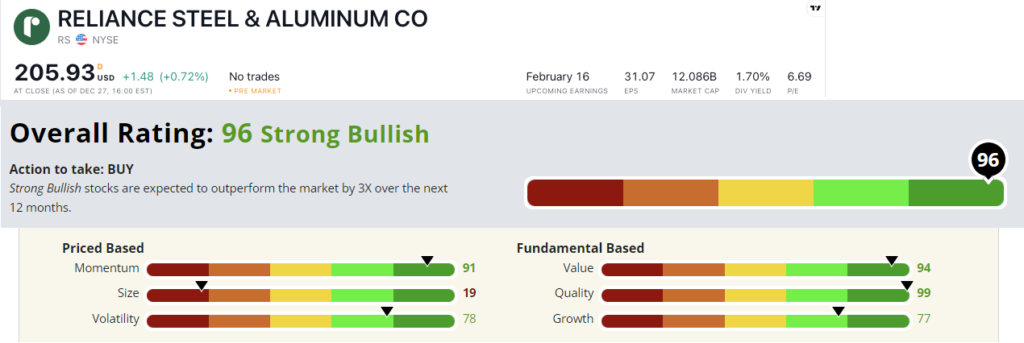

RS’ Stock Power Ratings in January 2022.

RS produces alloy, carbon and stainless steel products used in the aerospace and automotive industries.

Reliance Steel stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Reliance Steel Stock: No Value Trap Here

Reliance Steel had a strong third quarter.

Here are two high points:

- Net sales were $4.2 billion — a 10.4% year-over-year increase.

- The company’s free cash flow was $540.2 million — up 195.7% over the same period last year.

These sales figures show why RS is a strong growth stock — scoring a 77 on that factor in our Stock Power Ratings system.

It’s also an outstanding value and quality stock.

RS’ price-to-earnings ratio of 6.73 is lower than the metal products industry average of 8.13 … earning it a 94 on our value metric.

Reliance Steel stock avoids the value trap (where a stock lures you in with a cheap price, but doesn’t actually appreciate in value) by having strong returns on assets, equity and investment.

All three of those are double-digits for RS, compared to single-digit industry averages.

That’s why the stock earns a 99 on our quality metric.

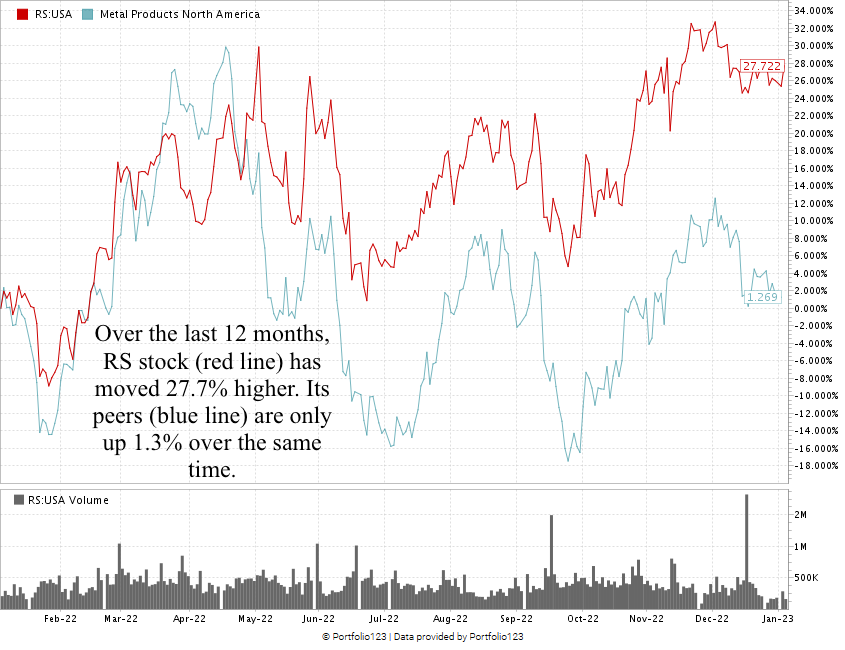

Over the last 12 months, RS stock is up 27.7%. That’s pretty good considering the overall market is down 19% over that span of time. And its industry peers are only averaging 1.3% gains.

I want to focus more on what the stock has done since the end of September.

From its recent low in September 2022, the stock has run up 22% into January … showing the “maximum momentum” we love to see in stocks.

Reliance Steel stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Steel is a critical component used in the aerospace and automotive industries.

And RS is a leading supplier for this booming industry.

This makes it a great addition to your portfolio.

Bonus: RS stock comes with a 1.7% forward dividend yield, paying shareholders $3.50 per share per year.

Stay Tuned: A Gold Miner Gains Momentum

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a gold miner that’s well set for gains as production soars around the world.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets