Sprawling across the southern Kansas plains are hundreds of wind turbines.

These turbines generate enough energy to power almost 1.6 million homes.

But these turbines are massive. Each fan blade requires a motor to change its angle for maximum efficiency and protection from high winds.

These components are part of green tech — using technology and science to minimize human impact on the environment.

The chart above shows the growth of green technology and sustainability products worldwide.

Precedence Research projects the market will grow 1,075.8% between 2021 and 2030.

Today’s Power Stock creates a key component in wind turbines: Richardson Electronics Ltd. (Nasdaq: RELL).

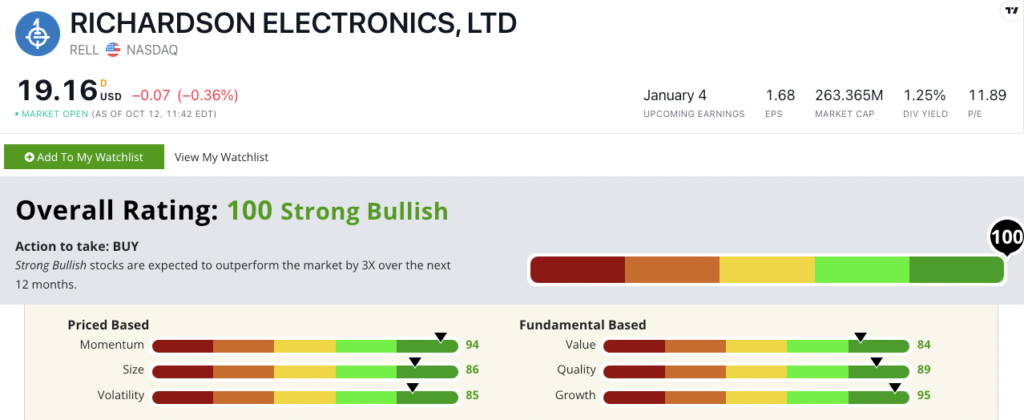

RELL’s Stock Power Ratings in October 2022.

The company has patented a replacement for the lead-based batteries used in wind turbine blade motors.

These replacements can plug right into a blade motor without modification … and provide 15 years of maintenance-free operation.

Richardson stock scores a “Strong Bullish” 100 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

RELL Stock: High Momentum & Strong Fundamentals

Richardson Electronics reported a strong quarter.

Highlights include:

- Net sales of $67.6 million — a 25.8% year-over-year increase!

- Growth of 7% in green energy sales for the quarter.

RELL earns a “Strong Bullish” 95 on growth — spurred by its Green Energy Solutions division.

It scores an 84 on value, thanks to its price-to-earnings ratio of 11.9. Compare that to the industry average of 14.6, and you can see RELL stock is a bargain compared to its peers.

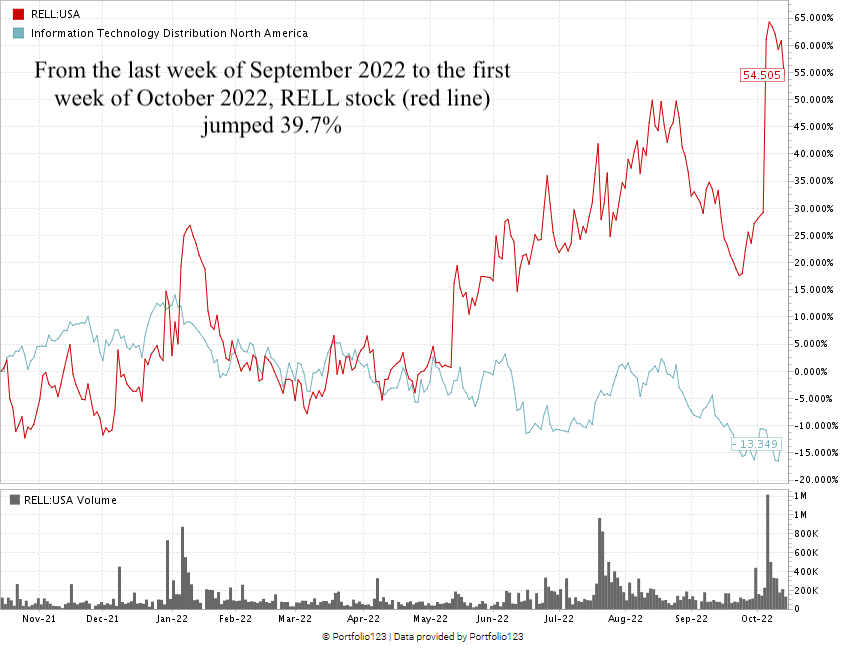

RELL is only 8% away from its 52-week high set in early October 2022. It’s crushing the information technology distribution industry (blue line in the chart below) — down 13.3%.

Created October 2022.

RELL saw a nice run at the end of September 2022 into October, thanks to better-than-expected earnings.

Market headwinds pared back some of those gains, but RELL is still up 54.5% over the last 12 months … showing the “maximum momentum” we love to see in stocks.

RELL scores a 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The green technology market is poised to skyrocket.

RELL has developed a key component in the long-term operation of wind turbines.

This is a compelling reason to add it to your portfolio.

Bonus: The company’s 1.25% dividend is an annual payout of $0.24 per share you own.

Stay Tuned: 99-Rated Aluminum Supplier to Profit From Growing Demand

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an aluminum supplier to take advantage of the $277 billion market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.