Generating power from oil, gas, coal or other fuel sources once expended a lot of wasted heat.

Companies are becoming more efficient by using one fuel source to create power and heating and cooling.

The process is called combined heat and power (CHP).

The American Council for an Energy-Efficient Economy said that policy changes quadrupled CHP capacity in the U.S. in the early 2000s.

And that’s been a lucrative development for this burgeoning market:

The chart above shows the growth of the CHP market worldwide.

From 2021 to 2030, Precedence Research expects the market to expand by more than 60% to $46.3 billion.

Today's Power Stock mines coal used for electricity, heat and steel production: Peabody Energy Corp. (NYSE: BTU).

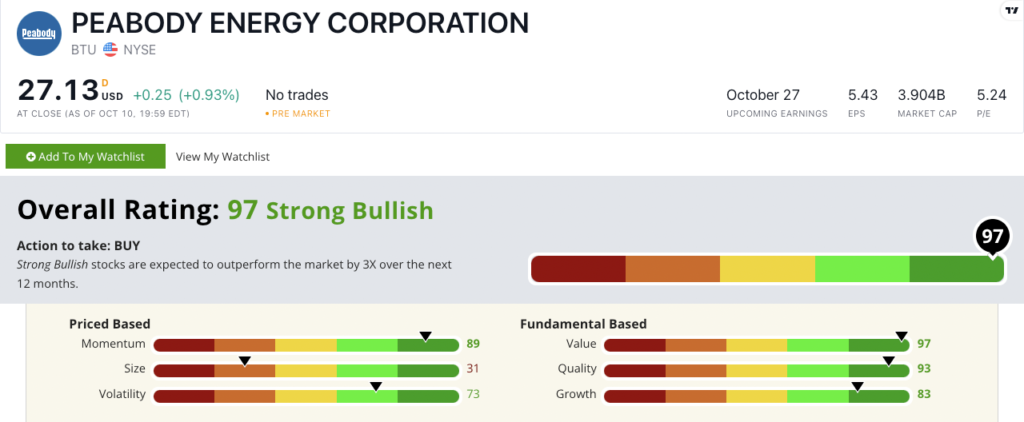

BTU's Stock Power Ratings in October 2022.

BTU mines metallurgical and thermal coal in the Midwest, Southwest and Australia.

Peabody Energy Corp. stock scores a "Strong Bullish" 97 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months.

BTU Stock: "Strong Bullish" Momentum, Value and Quality

BTU released outstanding quarterly results:

- Net income was a record $409.5 million — a massive improvement from the $28.6 million loss from the same quarter a year ago!

- The company increased its full-year guidance by $8 per ton, meaning BTU expects to generate more revenue in the last quarter of the year!

Those numbers show why BTU scores an 83 on our growth metric.

It's also an excellent value stock, with a price-to-earnings ratio that's nearly half the industry average. This tells me BTU is a much better value when compared to its peers.

The company is pulling double-digit returns on assets, equity and investments. Its peers are averaging negative returns.

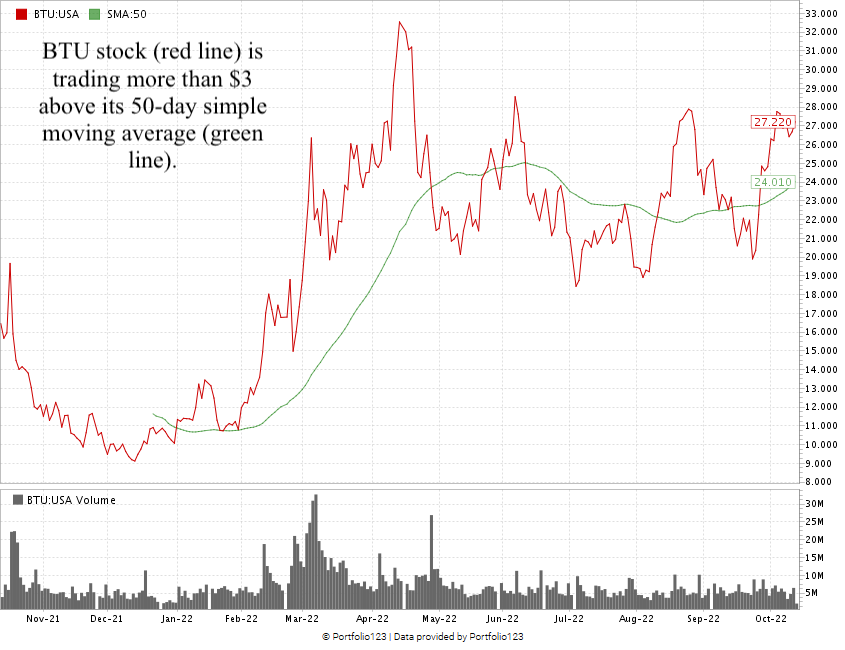

BTU also has strong momentum.

Created in October 2022.

From its low in December 2021 to its high in April 2022, BTU raked in a 197.5% gain.

Broader market volatility has pared some of those gains, but the stock is trading more than $3 above its 50-day simple moving average … a bullish indicator for stocks.

Peabody Energy Corp. scores a 97 overall on our proprietary Stock Power Ratings system.

That means we're “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Energy producers are adapting to a more efficient way of using oil, gas and coal.

Rather than producing just power or heat, companies can now produce both at the same time.

BTU has potential for your portfolio as a leader in mining coal for energy and heat production.

Stay Tuned: Perfect Green Tech Stock Patented Lead-Based Battery Replacement

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for Monday’s issue, where I’ll share all the details on a 100-rated green tech stock that redefines wind energy generation.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.