Renewable energy had a banner year in 2021. And there’s more to come.

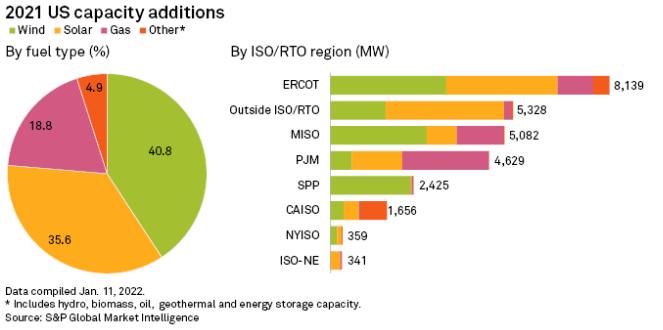

In the U.S. alone, power plant operators added nearly 28,000 megawatts of new generating capacity to the grid — a 12% increase over 2020.

That’s enough electricity to power around 4.5 million homes!

Dig a little deeper, and we see that wind and solar power accounted for almost 80% of that increased capacity.

On the other side of the coin, new natural gas capacity fell below 20%. It made up almost a quarter of new capacity just a year earlier.

It signals a broad shift in how we generate electricity in the U.S. And this transformation will expand in the years to come.

In this episode of The Bull & The Bear, I tell you how you can profit as the world’s power goes green.

Buy a Wind ETF for the Next Stage of U.S. Wind Power

This month, developers are set to start construction on the largest offshore wind farm in the U.S.

Danish energy giant Orsted and Boston-based Eversource are working together to build the $2 billion, 132-megawatt South Fork Wind farm off the coast of Long Island, New York.

Once complete, these 12 oversized wind turbines will produce enough to supply power to around 70,000 homes every year.

It may not seem like a lot — South Fork will produce 0.01% of the capacity in the U.S. — but we are in the early stages of a mega trend that will transform the energy industry.

Keep in mind that South Fork will only be the third offshore wind farm in the U.S. — most wind power is generated by much smaller onshore wind turbines.

In this episode of The Bull & The Bear, I share one way you can invest with a wind ETF (exchange-traded fund) to maximize your profits as the U.S. — and the rest of the world — targets greener opportunities with renewable energy.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update. You can find more investing insights from Adam and Green Zone Fortunes co-editor Charles Sizemore in our Ask Adam Anything and revamped Investing With Charles videos.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out MoneyandMarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.