The coronavirus panic has hammered just about every sector imaginable and while the impacts will be felt for the foreseeable future, there are a few restaurant stocks to buy once the pandemic panic settles and the dust clears a bit.

New York, New Jersey and Connecticut governors agreed to a common set of standards for the tri-state area Monday that include closing restaurants, movie theaters and gyms while also limiting gatherings to crowds of no more than 50 people.

“We have agreed to a common set of rules that will pertain in all of our states, so don’t even think about going to a neighboring state because there’s going to be a different set of conditions,” New York Gov. Andrew Cuomo said during a joint press call featuring all three governors.

States have adopted a range of policies in an effort to combat the spread of the coronavirus, known more specifically as COVID-19, and many new states are likely follow suit with mandatory closures going forward. That means restaurant stocks, much like airline and travel stocks, could be in for a rude awakening, setting up a major buying opportunity for investors.

Restaurant Stocks to Buy Once the Dust Settles

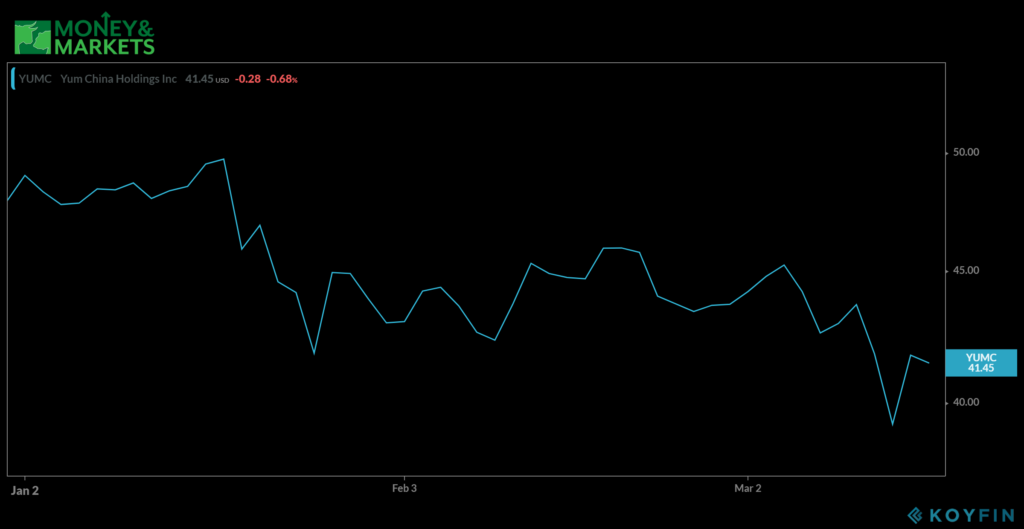

To get an idea of how restaurant stocks could be affected in the coming weeks, Yum China Holdings (NYSE: YUMC) could be a decent predictor. The company operates popular fast food chains like KFC, Taco Bell and Pizza Hut in China, where the coronavirus, also known as COVID-19, originated.

The stock saw a 20% drop from around $49 per share in mid-January, when the number of daily cases reported in China was ramping up. It rose slightly as the number of cases in China fell throughout February, but then it suffered another sell-off along with the broader market at the beginning of March.

While the company hasn’t given specifics for the virus’ impact on quarterly earnings, it has hinted that it will be meaningful.

“Many of our restaurants located within mainland China have been temporarily closed, have shortened operating hours and/or have otherwise been adversely affected by the impact of the coronavirus,” the company’s annual report that was filed on Feb. 20 said, according to Barron’s.

The stock was trading around $42 Monday at afternoon, which was mostly flat after rebounding from a 6% earlier in the day, making it one of our restaurant stocks to buy once the dust settles from the viral outbreak.

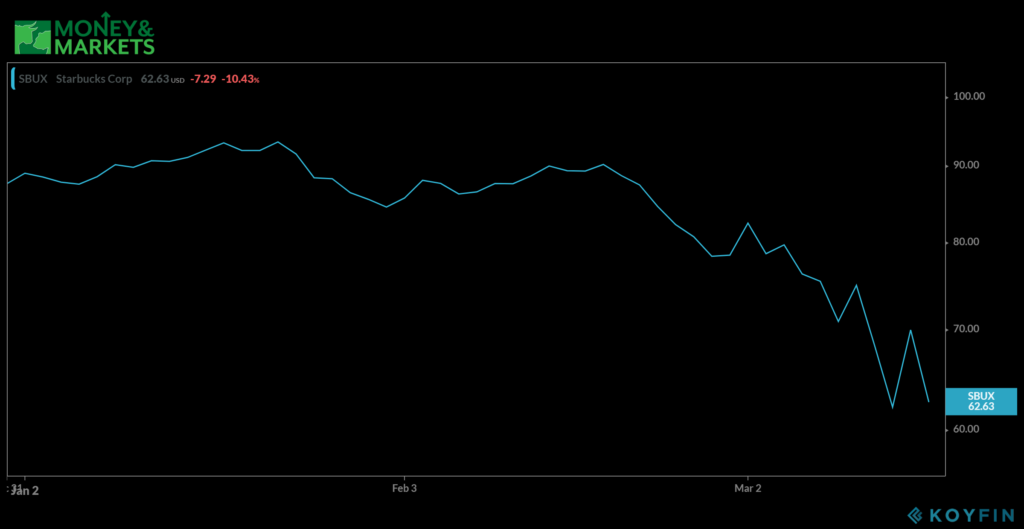

Starbucks

American coffee giant Starbucks (NASDAQ: SBUX) announced Sunday it is shifting to an all “To Go” model until further notice in an effort to keep people from hanging out and spreading the virus in one of its over 15,000 U.S. locations.

The news hammered Starbucks stock before Monday’s open, when it fell from just under $70 per share to $60.32 per share at the opening bell. It recovered slightly, but was trading down about 13.5% by 2:45 p.m. EDT.

That’s just above the stock’s 52-week low $58.11 (the stock is now down over 30% in the past three months) which means Starbucks could present a decent buying opportunity as the coronavirus continues to spread, making it one of our restaurant stocks to buy.

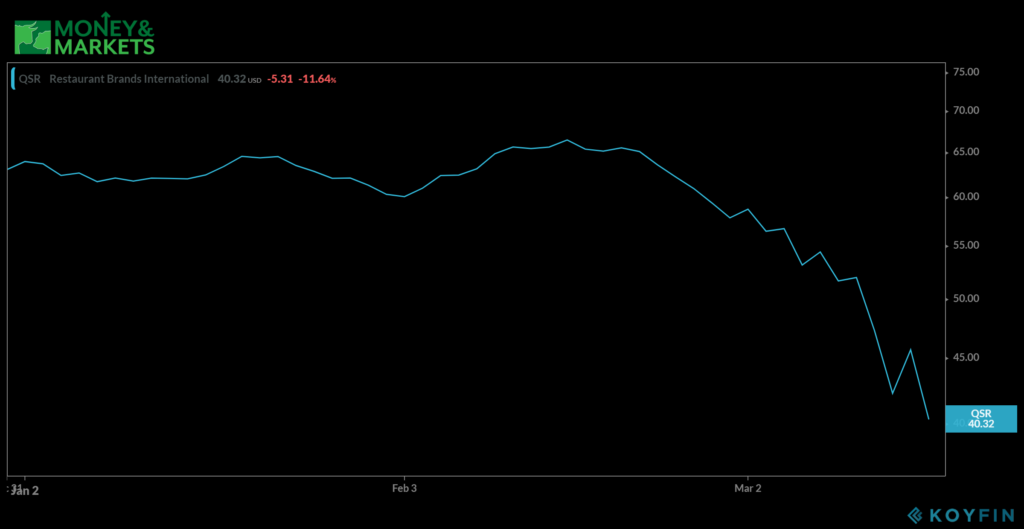

Restaurant Brands International Inc.

Restaurant Brands International Inc. (NYSE: QSR) was in a similar spot as Starbucks on Monday, with shares trading around $39, or 15% lower than Friday’s close, at noon. That’s just a hair above its 52-week low of $38.11 per share.

The conglomerate owns fast food chains Burger King, Tim Hortons and Popeyes. The stock has lost 40% of its value since closing at $66.42 on Feb. 14, which has brought its price-to-earnings ratio down to only 11.5. While a low price-to-earnings ratio typically signals concern for growth, it’s also seen as a buying opportunity for some.

Stocks have lost value across the board, and RBI’s stock could continue to drop as people hunker down amid the coronavirus. Long-term investors could see a big opportunity amid the restaurant stocks to buy going forward, though, as the virus passes and business picks back up.

These are only a few examples of restaurant stocks that will most likely take a hit, thanks to the coronavirus. While the short-term impact will be felt presumably more as states step up to control the outbreak, the long-term investment opportunities seem to be there.