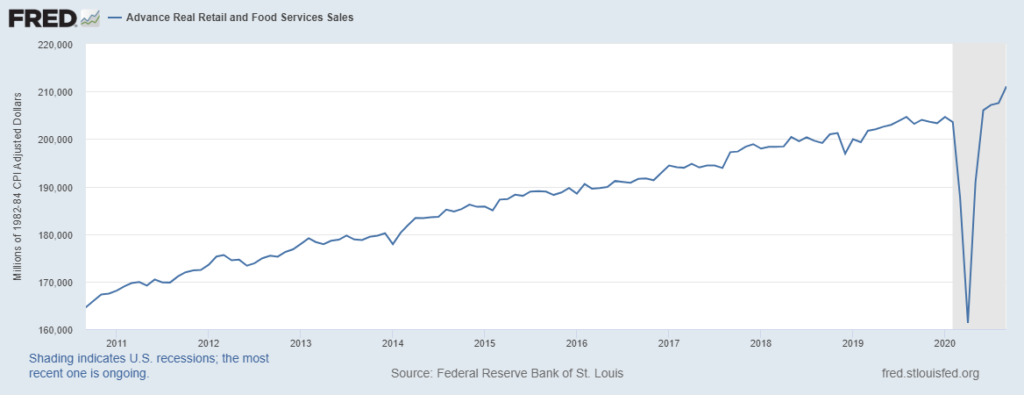

Data from the Census Bureau surprised investors last week. In September, retail sales increased for the fifth month in a row and reached a new all-time high.

Compared to a year ago, sales were up 5.4%.

Retail Sales Surge

Source: Federal Reserve.

Almost every retail category was higher.

Online sales increased 23.8% in the last year. Among brick-and-mortar stores, the home improvement category posted the biggest year-over-year gains with sales up 19.4%.

Even department stores saw gains in September. After the bankruptcy of several big chains, the category posted a 9.7% month-over-month gain.

Even September’s restaurant sales bumped up.

Some analysts think this may signal the end of the recession. LPL Research told clients that “the economy has never been in a recession after four or more consecutive monthly gains. Historically, new highs in retail sales happen in expansions—and this is yet another clue the recession is likely over.”

Looking past the headlines, this report isn’t as bullish as it seems.

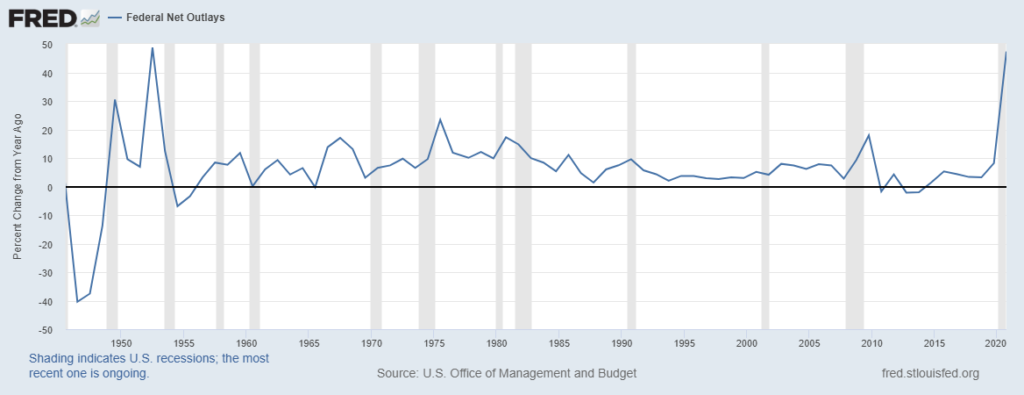

Unemployment is high, and government spending boosted sales. The next chart shows government spending soared 47.3% in the last 12 months— the fastest increase since the Korean War.

Government Spending Surges Too

Source: Federal Reserve.

Some of that money went directly to consumers through extended unemployment benefits and stimulus programs. Which, in turn, boosted retail sales.

Given that government spending is responsible for the record high in retail sales, it’s too early to turn bullish on the economy.

The government can keep spending at current levels, but that’s reckless and unlikely. Remember, debt finances today’s spending and must eventually be repaid. When the bill comes due, spending will slow, and the economy will struggle again.

In the short run, the government could prop up retail sales and the economy. This only makes the long-run challenges more difficult.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.