Editor’s note: On Monday, Money & Markets Daily will start hitting your inbox at 11 a.m. ET. And we’re going to kick off this new schedule with a brand-new weekly feature. Stay tuned…

Retail Stocks … in This Economy?!

Here’s What Green Zone Power Ratings Says

Despite expectations, the Federal Reserve has not cut its benchmark interest rate in 2024.

And the stock market doesn’t seem to care.

“Higher for longer” rates are traditionally a headwind for the stock market, but that hasn’t been the case in 2024.

Instead, U.S. indexes have posted higher highs throughout the first half of the year.

On the last trading day of May, the Dow Jones Industrial Average jumped 1.5% while the S&P 500 gained 0.8% — both indexes’ largest daily gains since November 2023.

All of this while inflation has been stuck above the Fed’s benchmark of 2%.

Now, investors are wondering how long bullish action in the market can continue.

Today, I’ll look at how we got here and zero in on one sector that hints at what’s next.

Market Rises While Inflation Stalls

From June 5, 2023, to June 3, 2024, the S&P 500 had its second-strongest 52-week gain ever of 23.6% — falling short only to 34.3% gain following the Covid crash:

While the gain in the S&P 500 is something to cheer as an investor, it comes at a time when inflation has leveled off.

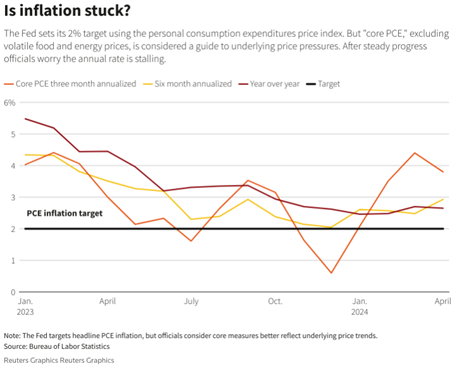

The U.S. personal consumption expenditures (PCE) index jumped 0.3% in April — matching the increase from the month before.

The PCE has come down on an annualized basis, but not the level the Fed is comfortable with in order to start cutting its benchmark funds rate:

The PCE stalling out doesn’t provide a compelling argument for the Fed to start cutting its rates in the immediate future.

While some indexes have notched fresh highs this week, the data suggests we could see some summertime blues ahead.

If the stock market rally is going to continue, it needs two things:

- Higher consumer confidence.

- A stronger U.S. economy.

Let’s shine a spotlight on the first and look at retail stocks as a base for that consumer confidence.

In Focus: Consumer Confidence and the Retail Sector

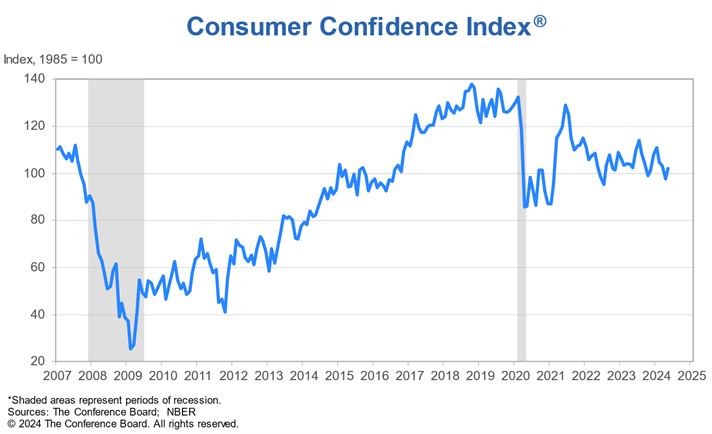

The Conference Board’s May consumer confidence data is telling:

Consumer confidence did tick up in May after three months of declines, but it remained in the narrow range it’s been in for the last two years.

This tells me that American consumers may be trying to replenish their depleted savings rather than buy a new T.V.

To examine consumer spending more closely, I ran the SPDR S&P Retail ETF (NYSE: XRT) through an X-ray of Adam O’Dell’s Green Zone Power Ratings system. XRT is an exchange-traded fund (ETF) with 77 cyclical and non-cyclical stocks — giving us a solid picture of the retail sector.

Retail sales (and stocks) can signal contraction or expansion in the U.S. economy. When consumers are out spending money on everything from food and clothing to new appliances and cars, these stocks look more bullish. Of course, the opposite is also true.

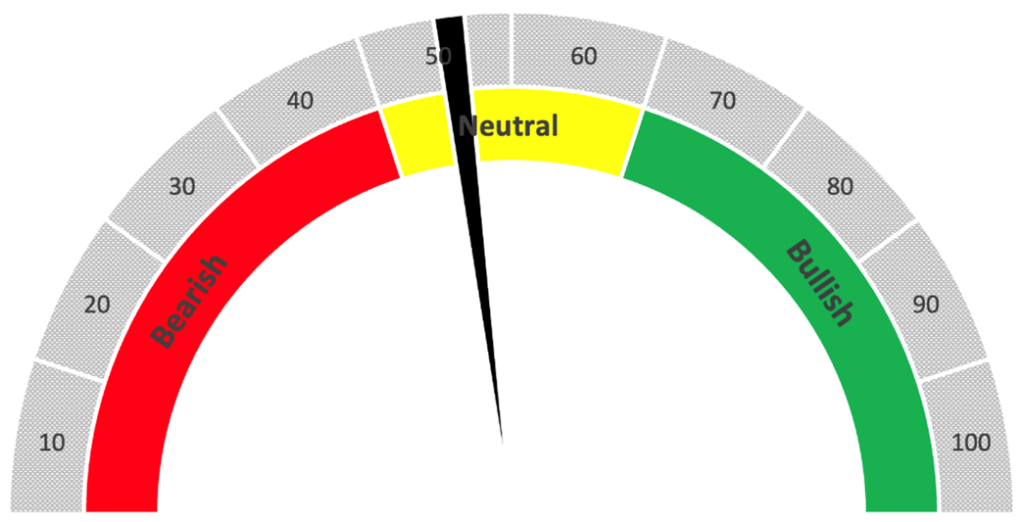

After seeing where consumer confidence sat, the results of my ETF X-ray of XRT were not surprising:

XRT Rates “Neutral” 55

The average rating of stocks in XRT is a “Neutral” 55 out of 100.

This rating, coupled with only a slight improvement in consumer confidence, leads me to believe we could be in for a choppy summer on the stock market.

The signals also suggest the U.S. economy could be weakening … not to the point of a recession, but at least to where consumers are making more difficult decisions on where to spend their hard-earned money.

But the market and the economy have indeed been walking to the beat of different drummers. Investors may continue to overlook these slowdown signs.

That’s why Green Zone Power Ratings is a critical tool for markets like this. It gives each stock a simple rating, telling you how that stock should perform over the next 12 months.

Go ahead and try it here.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets