News from the holiday season was mixed for retailers. Mastercard reported that sales increased 7.6% between November 1 and December 24.

While that’s good news, it still lags the 8.5% boost we saw during the same time frame in 2021.

Additionally, there are indications that discounts boosted overall sales.

The credit card processor noted: “Retailers discounted heavily but consumers diversified their holiday spending to accommodate rising prices and an appetite for experiences and festive gatherings post-pandemic.”

Restaurants reported the biggest boost with sales up 15.1%. Sales of jewelry and electronics were each down about 5%, possibly reflecting discounts.

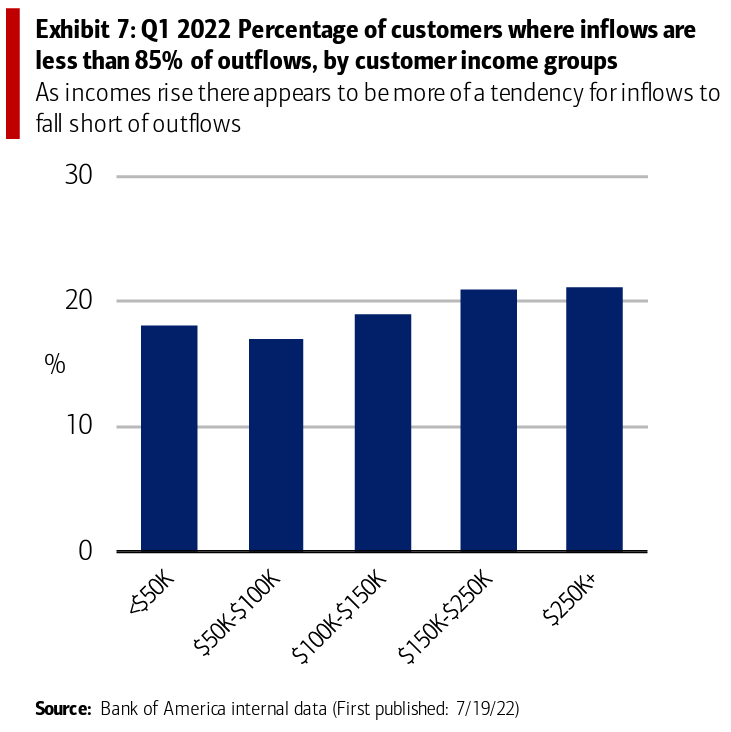

Other data indicates consumers are struggling to maintain spending. Members of higher income groups are struggling more in certain areas compared to lower income groups.

Bank of America reported that more than 20% of households making more than $150,000 a year are showing shortfalls in inflows relative to outflows. The chart below shows the percentage of households with income covering less than 85% of spending.

This doesn’t bode well for 2023. Savings increased during 2020 and 2021 as the government sent stimulus checks and piled other benefits on families to reduce the impact of the pandemic.

Eventually, savings can’t support spending. That will force a slowdown in spending that will ripple across the economy.

Shortfalls in higher-income households will slow growth significantly. Higher incomes allow for more spending and the loss of spending from this group will reduce jobs at all levels throughout the economy.

There is a small piece of good news for 2023. The cost-of-living adjustment for Social Security will be 8.7% which could add almost $9 billion per month to consumer spending. Government workers will also receive billions in raises, as will many private sector employees.

This will allow some breathing room for consumers that are struggling. But eventually, savings will run out and the economy will suffer.

Michael Carr, CMT, CFTe is the editor of two investment trading services — One Trade and Precision Profits — and a contributing editor to The Banyan Edge. He teaches Technical Analysis and Quantitative Technical Analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.