In the world of semiconductors, precision is key.

Semiconductors are the microchips that store data and operate devices like your phones, thermostats and smart TVs. Manufacturers need precise tools to create these chips that are smaller than your fingernail.

If a manufacturer makes one incorrect calculation on the production line, the entire line has to be recalibrated.

That’s where metrology experts come in. Semiconductor companies rely on experts who study measurement to ensure chips are built accurately.

Many companies specializing in metrology will grow rapidly in the next few years as semiconductor production ramps up.

And one company’s stock is already on the right track.

A Precise Play in the Semiconductor Sector

Nova Measuring Instruments Ltd. (Nasdaq: NVMI) is an Israeli company that develops, produces and sells precise measurement equipment within the semiconductor industry.

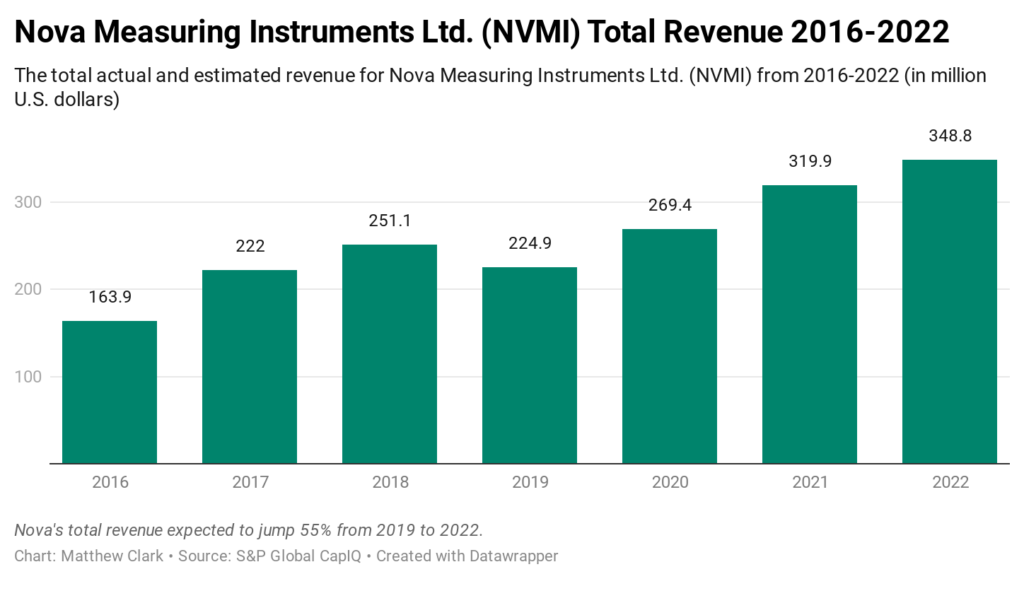

The company’s revenue grew from $163.9 million in 2016 to $251.1 million in 2018.

Nova capped off a strong 2020 with fourth-quarter revenues of $76.3 million — an 18% increase year-over-year. That figure beat Wall Street expectations by $6.4 million.

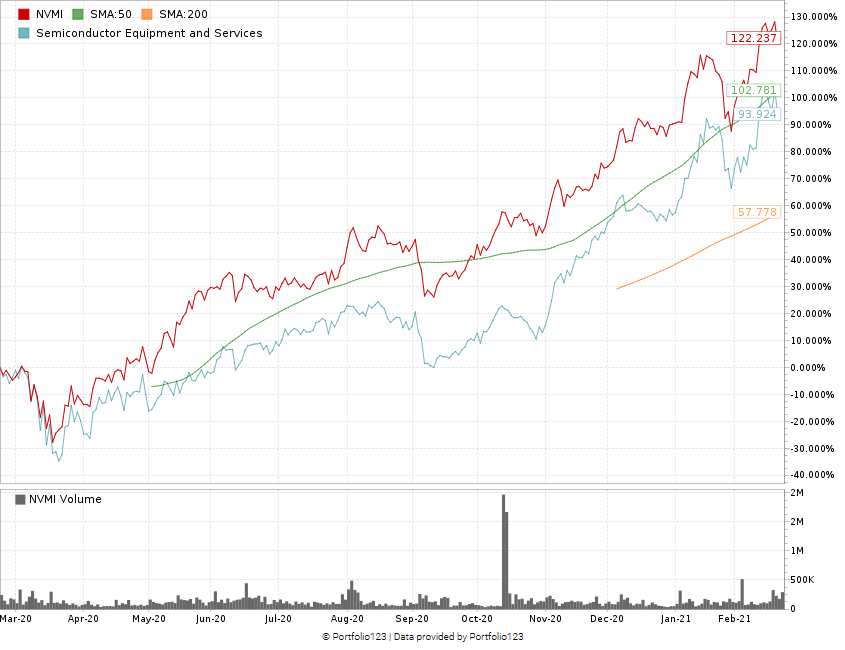

Nova’s stock price has also followed an upward trend.

NVMI (Red) Sees 221.4% Bump In 12 Months

Nova’s stock price experienced mild dips throughout 2020, but it continues to hit new highs.

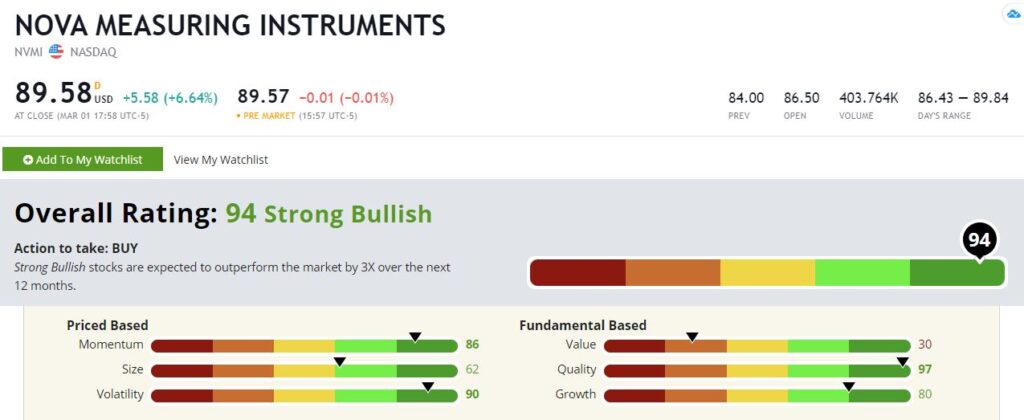

NVMI’s Green Zone Rating

Nova rates a 94 overall in our Green Zone Ratings system, meaning we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

Nova Measuring Instruments’ Green Zone Rating on March 2, 2021.

Quality — Nova’s strong overall rating is boosted by a 97 on quality. Nova’s returns on investment, assets and equity are all at or near double-digits and much better than the semiconductor equipment and services industry. The company has a gross margin of nearly 60% and a net margin close to 20%.

Momentum — NVMI rates a 86 on momentum, a solid score for this company. Its one-year annual sales growth rate of nearly 20% indicates a promising future.

Size — NVMI rates a 72 on size because of its $2.32 billion market capitalization. Also, NVMI’s actual sales beat Wall Street expectations in each of the last five quarters, so continued growth is inevitable.

Bottom Line: Nova Measuring Instruments Ltd. is a high-quality, strong momentum stock that will capitalize on the need for accurate semiconductor production.

NVMI is a different way to buy into the future growth of the semiconductor sector, and it should provide market-tripling gains in the coming months.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.