Money & Markets Week Ahead for March 28, 2021: Here’s some analysis of Riot Blockchain Inc. (Nasdaq: RIOT) before it reports earnings.

It’s a shortened trading week as the New York Stock Exchange and Nasdaq are closed Friday for the Good Friday holiday.

Bond markets will close at 12 p.m. Eastern on Friday as well.

Here’s more of what to look for in the week ahead on Wall Street:

On the IPO Front

There are several IPOs expected to price this week, but there is one that stands out.

Compass Inc. is expected to price its IPO on Thursday, April 1. The company plans to trade on the New York Stock Exchange under the ticker COMP.

What it is: The company is an online, independent real estate brokerage that has developed a cloud-based software platform.

The platform is used for customer relationship management, marketing and client services.

According to Reuters, the company was founded in 2012 by former Twitter engineer Ori Allon and former Goldman Sachs exec Robert Reffkin.

It works with more than 19,000 agents across 46 metro areas in the U.S.

In its S-1 filing with the Securities and Exchange Commission, it had revenue of $3.7 billion in 2020. That was up from $2.4 billion in revenue reported in 2019.

However, the company’s operating expenses have also increased over the last two years.

Its expenses were $2.7 billion in 2019. That increased to nearly $4 billion in 2020.

The net losses were attributed to investment into technology development as well as recruitment and training of new real estate agents.

The offering: The company is offering 36 million shares at a price range of $23 to $26 per share.

It hopes to raise around $882 million with the offering, which will be used to increase capitalization and financial flexibility to include working capital and to pay for operating expenses.

According to Renaissance Capital, at a mid-point of $24.50 per share, the company would see a market value of $12.5 billion.

Bookrunners on the deal include Goldman Sachs, Morgan Stanley, Barclays, Deutsche Bank and UBS Investment Bank.

The skinny: This is an interesting company.

It’s managed to increase its revenue and lower its losses, but it is still a long way from being profitable.

It is considered to be the largest independent real estate brokerage by gross transactional volume with a 4% share of the U.S. market.

But that is still relatively small.

Plus, it competes against much larger, more established firms.

Overall, if you were looking to invest in this IPO, I would pass for now as there are too many lingering questions about profitability.

Deeper Dive: Riot Blockchain Inc. Earnings

Cryptocurrency has been a hot-button topic for several years now.

However, headlines surrounding currencies like bitcoin and Etherium have gained steam as they gain wider acceptance in the marketplace.

It doesn’t hurt that bitcoin recently hit the $50,000 mark.

Wednesday, bitcoin producer Riot Blockchain Inc. (Nasdaq: RIOT) will report its earnings.

The company has been known as Venaxis and Bioptix.

It is one of the largest publicly traded bitcoin miners in North America, with a market cap of $2.24 billion.

RIOT Stock Sees Rapid Takeoff

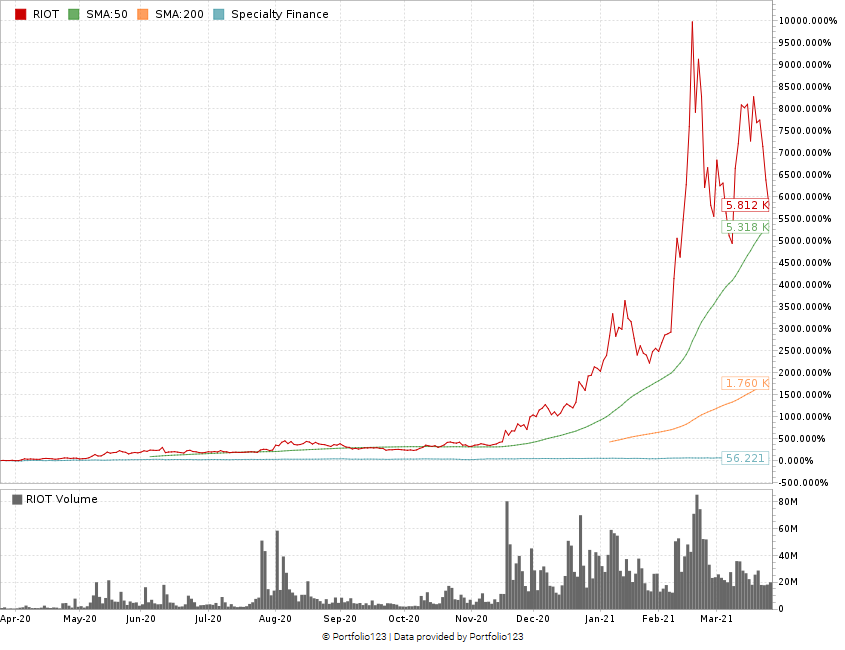

The company’s stock traded mostly flat between $1 and $3 per share for most of 2020.

In late November, the stock started to skyrocket.

Between December 28 and January 4, the stock price grew from $16.99 to $26.59 as positive blockchain headlines pushed investors into Riot.

It currently trades at around $45 per share after reaching as high as $71 in mid-February.

Over the last 12 months, the stock price has swelled by 5,800%.

In June 2018, the company brought in $2.79 million in total revenue, but it has struggled to replicate that.

It has only topped $2 million in total revenue in three quarters since then — including last quarter’s $2.46 million.

So far, Riot Blockchain has failed to bring its earnings per share into positive territory.

Over the last 10 quarters, the company has reported an average earnings loss of $0.45 per share.

However, its best earnings quarter was the third quarter of 2020 where it reported an earnings loss of just $0.04 per share — beating Wall Street consensus of an $0.08 per share loss.

For the fourth quarter, analysts project earnings of minus-$0.08 per share on revenue of $3.6 million.

If it holds, it would be the best quarter, in terms of revenue, for the company since June 2018.

There is a big interest in blockchain, especially cryptocurrency like bitcoin. As it gains wider acceptance, that demand is only going to get bigger.

Money & Markets Week Ahead: Data Dump

On Tuesday, the Conference Board will release its latest monthly Consumer Confidence Index.

The index measures the overall confidence in economic activity.

A neutral reading of the index is 100. Anything below is considered weak confidence, and anything above is strong confidence.

Consumer Confidence Ticks Higher

The index hit a low of 84.8 in August 2020 but rebounded sharply in the following two months.

However, since November 2020, the index has read below neutral 100.

Consumer confidence has been on the rise over the last three months. Analysts expect March’s index reading to be around 96 — higher than the 91.3 reading in February.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Cal-Maine Foods Inc. (Nasdaq: CALM)

Vaxcyte Inc. (Nasdaq: PCVX)

Rubicon Technology Inc. (Nasdaq: RBCN)

Tuesday

Lululemon Athletica Inc. (Nasdaq: LULU)

Carnival Corp. (NYSE: CCL)

Chewy Inc. (NYSE: CHWY)

Wednesday

Micron Technology Inc. (Nasdaq: MU)

Wallgreens Boots Alliance Inc. (Nasdaq: WBA)

Riot Blockchain Inc. (Nasdaq: RIOT)

Thursday

CarMax Inc. (NYSE: KMX)

Franklin Covey Co. (NYSE: FC)

Consolidated Water Co. Ltd. (Nasdaq: CWCO)

Friday

Greenbrier Companies Inc. (NYSE: GBX)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.