The economic recovery seems to be gaining steam in the U.S.

That indicates the dollar could move higher. Currencies like the dollar tend to trade based on the relative strength of a country. In other words, for the dollar to move higher, the U.S. should be stronger than another country or region.

That seems to be the case. In Europe, the vaccination drive has been less successful, and some countries are increasing restrictions — even returning to lockdowns in some areas.

That fact alone explains recent strength in the dollar.

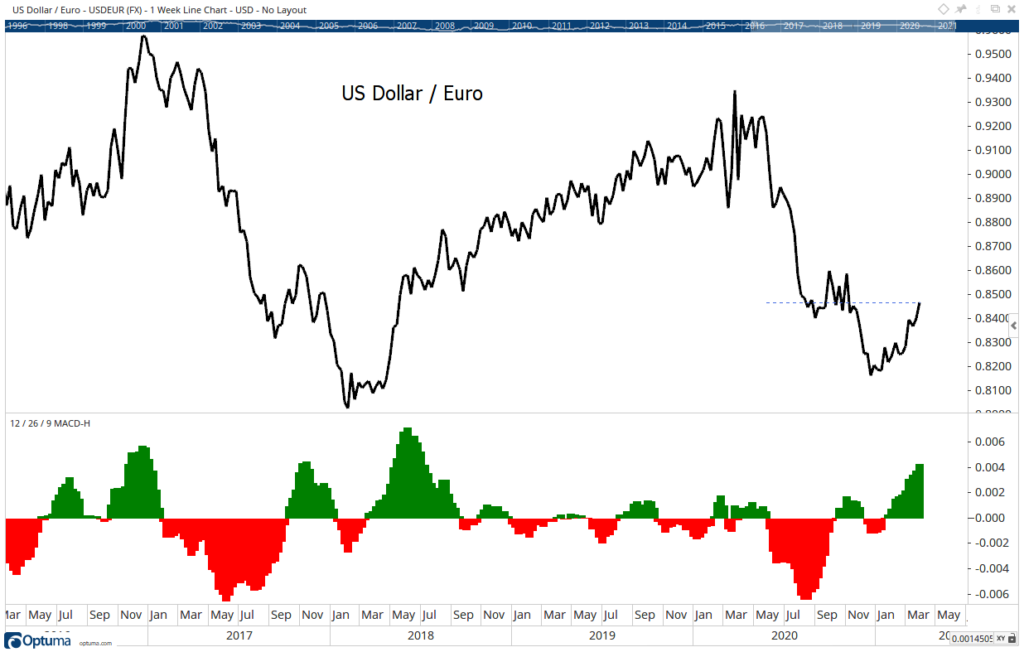

Dollar and Euro Exchange Rate

Source: Optuma.

Deficit Spending Can Be Bearish for the Dollar

From a technical perspective, the chart is bullish for the dollar.

The dashed line shows the dollar is at a four-month high. Momentum is shown at the bottom of the chart and is a three-year high. Momentum is consistent with a strong rally like that seen in 2018.

This is surprising given the news that deficit spending is expanding and is likely to increase. Some economic research has found that large deficits are bearish for currencies.

It does seem that the lack of fiscal discipline should be a negative for the dollar. But remember that currencies are priced relative to each other. In some ways, it can be helpful to think of the market as a race to the bottom.

While the U.S. may be spending significantly more than it raises through taxes, so are other countries. In fact, other governments may be considered to be just as irresponsible as the U.S.

In the race to the bottom, for now, the U.S. is not the worst government in the world, and that means the dollar could move up. It’s not a good reason for the rally, but it’s good enough to expect additional gains.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.