Ronald Reagan must have been a great investor.

The 40th president’s famous “trust but verify” plan for Soviet arms control applies to investing as much as to nuclear warheads.

Investors should reconsider what they believe they know.

Today I want to examine the myth that risks and rewards are correlated.

This myth states: Investors receive compensation for high risks with high rewards.

While on the other hand, there is often a connection between low risk and low rewards.

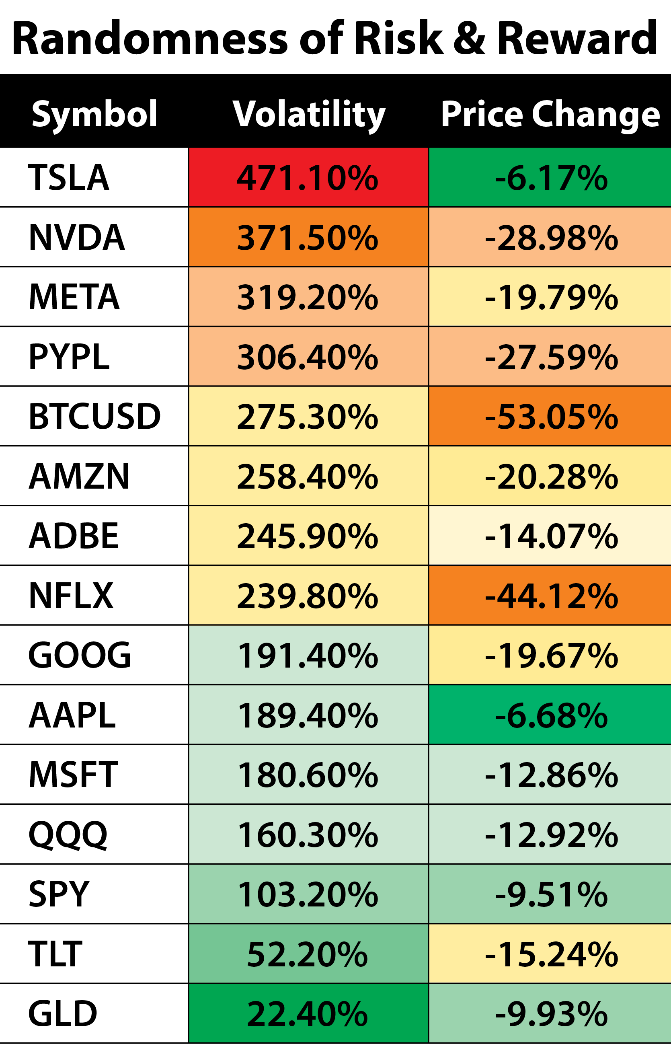

The chart below shows a near random relationship exists between risks and rewards.

This chart includes popular stock market investments — SPDR S&P 500 ETF (NYSE: SPY) and Invesco QQQ Trust (Nasdaq: QQQ). It also shows the top ten holdings of QQQ, which include some of the most volatile stocks.

It also includes bonds (iShares 20+ Year Treasury Bond ETF (Nasdaq: TLT)), gold (SPDR Gold Shares (NYSE: GLD)) and bitcoin.

How This Volatility Chart Was Created

You can calculate volatility as the sum of the percentage price moves over the past 100 days.

For the technically inclined, the true range is calculated every day, and this is summed over the past 100 days.

To make the values comparable, analysts divide the sum by the closing price the day before the sum begins.

Then they sort the list by volatility.

It’s interesting that low-priced stocks like PayPal (Nasdaq: PYPL) can be as volatile as higher-priced ones.

What This Means for Investors

Investors can earn profits by focusing on any volatile stock.

The price change column shows the close-to-close change over the past 100 days.

As you can see, there is no discernible pattern between volatility and returns.

Traders with a short-term focus should keep their eyes on the top half of the list.

Gold or bonds may be interesting, but they don’t offer much bang for your buck.

Bottom line: To get the most out of market volatility, traders should look at the top few lines of the chart.

My True Options Masters colleague Mike Carr has been developing a strategy to benefit from volatility.

I’ve known Mike for years now, and he never fails to surprise me with his inventiveness, especially when it comes to finding creative ways to extract money from the market.

Mike has exceeded my expectations once again with a new trading strategy that would have crushed the market by five times after thorough back testing.

And it centers around one of the most volatile assets: bitcoin.

Click here, and Mike will show you how it all works.

Click here to join True Options Masters.