Everything is a bubble and the worst-kept secret in the finance sector has been officially confirmed: The U.S. Federal Reserve is inflating said bubbles via more quantitative easing on the repo market. The hard part is determining when said bubbles will blow up in all our faces and the greatest recession in history crushes the U.S. because the Fed, which lowered its benchmark interest rate three times in 2019 while the economy was strong (the opposite of sound monetary policy), is out of bullets.

“It’s a derivative of QE when we buy bills and we inject more liquidity — it affects risk assets. This is why I say growth in the balance sheet is not free. There is a cost to it.”

Dallas Federal Reserve Chief Robert Kaplan admitted everything in a recent interview with Bloomberg, saying the Fed’s perpetually low interest rates, the high bar in place for future rate hikes and the continued expansion of the central bank’s balance sheet through the repo market are helping to boost asset prices.

“All three of those actions are contributing to elevated risk-asset valuations,” Kaplan said during an interview on Bloomberg Television. “And I think we ought to be sensitive to that.”

There it is, folks; the cat’s out of the bag.

Of course, Kaplan’s cohorts at the Fed disagree — at least in public.

Fed Chair Jerome Powell says flooding the repo market with freshly printed dollars starting in September is “not QE.”

Money and Markets contributor Bill Bonner discussed the repo market massacre and what led to this “not QE” in a column here Thursday:

It’s “Inflate or Die.” There’s no other way. And if there was ever any doubt about it, it was resolved on September 17, 2019.

That’s when liquidity dried up in the “repo” markets — an important corner of the lending markets. The rate to borrow overnight spiked to 10%, and the Fed came to the rescue.

It’s been pumping billions of dollars into the repo market ever since.

Kaplan admitted to inflating assets via the repo market.

“My own view is it’s having some effect on risk assets,” Kaplan said. “It’s a derivative of QE when we buy bills and we inject more liquidity — it affects risk assets. This is why I say growth in the balance sheet is not free. There is a cost to it.”

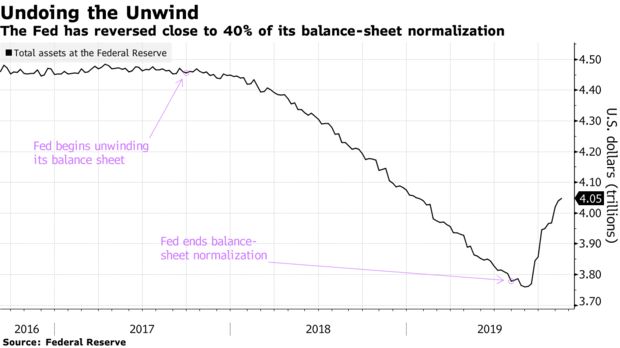

The Fed set out to reduce its balance sheet in 2019 but that didn’t last long, and it has already reversed about 40% of its balance sheet reduction.

San Francisco Fed Chief Mary Daly towed the company line Wednesday at a speaking engagement.

“The way to think about QE versus solving the repo problem and getting the reserves back up is QE is stance of monetary policy,” she said. “This was just a plumbing exercise and by plumbing I mean we say we want to have an ample reserves regime.”

Kaplan, a voter on the Federal Open Market Committee that sets U.S. interest rates, called for caution.

“I think we’ve done what we need to do up until now,” Kaplan said. “But I think it’s very important that we come up with a plan and communicate a plan for winding this down and tempering balance sheet growth.”

Editor’s note: Do Kaplan’s surprisingly honest comments cause any concern for your regarding the market?