Commission-free trading is a huge moneymaker for brokers. That’s because they never made much money from commissions in the first place. Getting investors to believe trading is free increases other sources of revenue and is something Robinhood has mastered.

Brokers make money in a variety of ways. Many investors keep cash in their accounts, and brokers pay low interest rates while earning higher rates investing the money. Brokers lend your shares to short sellers and get paid for those loans.

Some brokers sell your orders to high-frequency trading firms. This is the primary source of income for Robinhood, the pioneer of commission-free trading. It realized investors would look at trading as a game if they hid the costs.

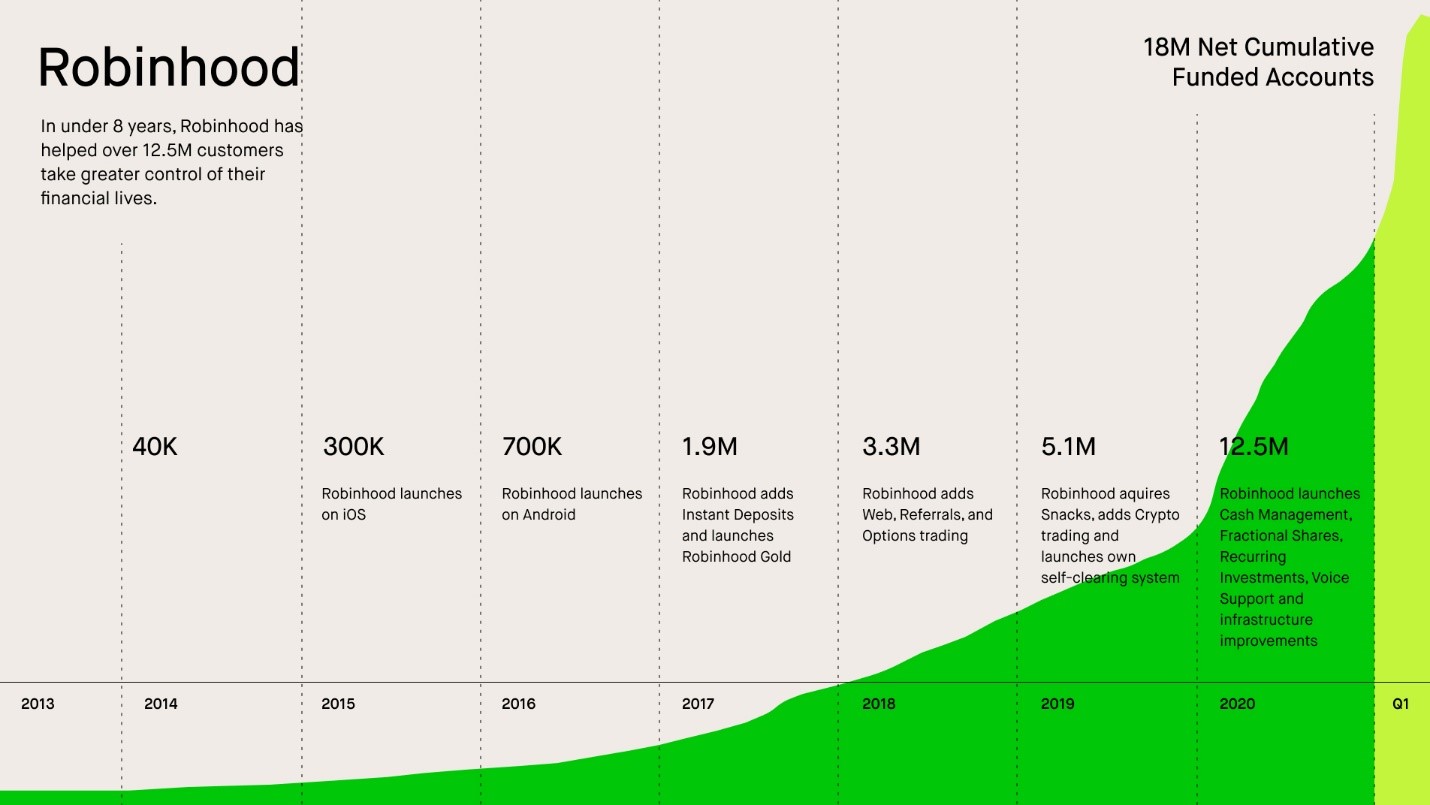

Now that it’s filed to go public, Robinhood has revealed how profitable its strategy is. The number of accounts at Robinhood more than doubled in 2020 and increased by almost 50% more in the first quarter of 2021.

Robinhood’s Customer Count Spiked Amid Pandemic

Source: Robinhood’s SEC Filing.

Robinhood Profits Off “Free” Trading

The firm’s regulatory filing is dense, but it says that Robinhood made a lot of money. Bloomberg’s Matt Levine summarized how Robinhood generates significant profits from free trades:

Robinhood extracted 9.5% of the value of its customers’ options portfolio for itself in the first quarter, $197.9 million of revenue on $2 billion of assets. That’s a lot!

That’s some combination of (1) people may not own a ton of options, but they trade them a lot; you get more volume from options traders than you do from boring stock investors, and (2) spreads are high, and it is lucrative to trade against retail options traders, so market makers are delighted to pay Robinhood large amounts of money for the privilege.

On average, if you have $1,000 worth of options in your Robinhood account, and you’re an average Robinhood options trader, by the end of the year, Robinhood will have made … $380? … on your options trades? Presumably, that money comes from somewhere.

If you trade at Robinhood, now is a good time to consider how much free trades really cost.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.