Robotics stocks are a great way to buy into a technology that is growing rapidly.

Innovation has moved a little slower in the last several months, thanks to the COVID-19 pandemic.

Sure, new phones and computers continue to come to market, but the elements that power those products saw development slow significantly.

Remote work and supply chain shutdowns have hindered further development of technologies like artificial intelligence, robotics and even 5G.

But robotics and automation have helped companies work around limitations set by the pandemic.

Robotics Stocks: An Innovative Investment

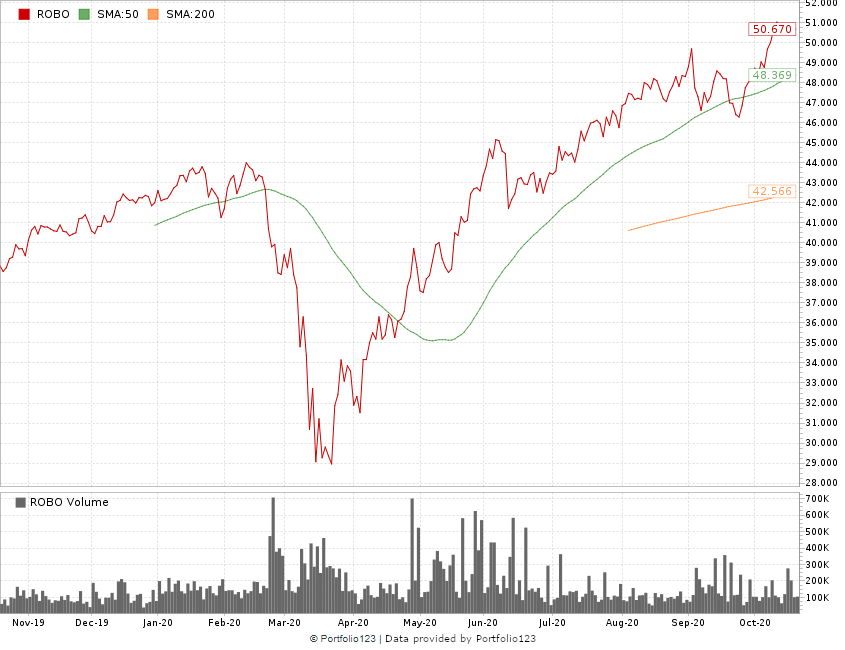

The Robo Global Robotics and Automation Index ETF (NYSE: ROBO) — an exchange-traded fund (ETF) tracking robotic and automation stocks— jumped more than 74% since reaching a low in March 2020.

After a dip in late September, the ETF has risen almost 10% to its current price, indicating an upswing.

The ETF holds companies like NVIDIA Corp. (Nasdaq: NVDA), industrial programming giant Rockwell Automation Corp. (NYSE: ROK) and semiconductor powerhouse Qualcomm Inc. (Nasdaq: QCOM).

Robotics ETF Moves 74% Higher off March 2020 Lows

In this episode of The Bull & The Bear, I’ll talk with Adam and contributor Charles Sizemore about two robotic and automation stocks.

We’ll examine what each of these companies does and how they’ve performed recently.

What’s even better is you’ll get insight on what you should do with these two robotics stocks — if you are thinking about buying or already have them in your portfolio.

Remember, knowing the data and the details about a specific company helps you determine whether it is worth investing in.

That’s why we do the work for you by looking at these specific stocks and giving our analysis of each one.

The Bull & The Bear

Led by Adam and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos and information.

Have something you want us to talk about? Email us at thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.