Streaming platforms changed my viewing habits.

When I first plugged in my Roku, I didn’t leave my house for a few days.

I couldn’t believe all the channels I could get for free.

And then the bundles!

Some of these bundles included many favorites, such as:

- Paramount+ uses its ownership Showtime to form a premium package.

- Peacock Premium made by NBC, brought along USA Network, Bravo and many other cable favorites.

- Dinsey+ made waves aquiring Star Wars and National Geographic for content.

Any taste you may have for TV can be satisfied with one of these many bundles.

But many people, including myself, wonder if these packages will eventually looks a lot like … cable, the service that so many are trying to run from.

Critics say we are far from streaming services going that route.

Until then, let’s take a look at one service that’s made a name for itself in the streaming world: Roku Inc. (Nasdaq: ROKU).

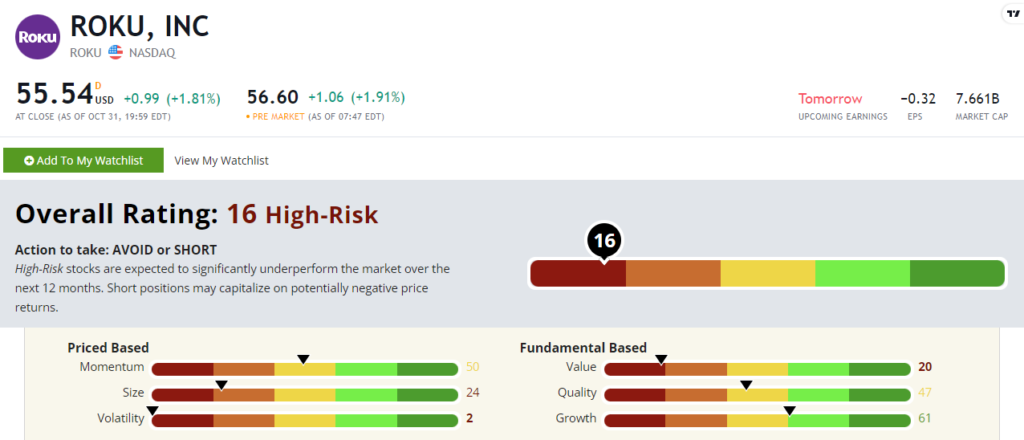

Roku stock rates a “High-Risk” 16 out of 100 on our proprietary Stock Power Ratings system.

Let’s take a closer look.

Roku’s Bundle Falls Short

Roku is an ad-reliant streaming platform and hardware provider.

I discovered the wonderful world of The Roku Channel, which offers premium and regular TV, movies and even sports.

And it makes managing all of my subscriptions easy by keeping them all in one place.

But competition within the industry is only growing tougher.

In the second quarter, Roku reported widening losses. This is due to a drop in total active accounts.

Roku’s total number of active accounts is a crucial metric that investors focus on.

In simple terms, more accounts mean more ads bringing in revenue for the company.

According to third-quarter estimates, the company expects the number of active users to rise year over year … but at the slowest pace in at least 21 quarters.

Roku had a tough second quarter and in a few days, we will know if it’s recovered or slipped further.

But for now, let’s see why ROKU rates “High-Risk” in our system.

Roku’s Stock Power Ratings & Low Value

Roku’s stock is in rough shape for a competitive market. Its value is even worse.

We’ll get to that factor in a minute, but I wanted to look at its overall score first.

Roku earns an overall 16 out of 100 on our ratings system.

ROKU’s Stock Power Ratings in October 2022.

As shown above, Roku doesn’t rate in the green on any of our six fundamental factors.

It rates in the red for size (24) and volatility (2).

This means that the company is large ($7.67 billion market cap) and risky in terms of returns.

Regarding value, our Stock Power Ratings system doesn’t just look over a company’s most recent quarter, but looks at multiple valuation metrics over many time frames.

Most importantly, it checks to see if the metrics are improving or deteriorating.

Roku’s deteriorating fundamentals mean it is overvalued compared to its industry peers.

This earns Roku a score of 20 on our value factor.

The Bottom Line

Roku scores a “High-Risk” 16 out of 100 on our Stock Power Ratings system.

But we have much more in store for you using our system.

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why — for free!