Libertarian economist Ron Paul, a non-interventionist in foreign policy who loathes the Federal Reserve, said President Donald Trump’s tariffs are “far removed from capitalism” and when paired with recent interest rate cuts, are giving credibility to socialists for the first time in his life.

“We’re so far removed from capitalism. Yet we get blamed. Socialists come in and say, ‘See what you guys did to our economy.’”

“It’s a real incentive for the socialists to chime in — and for the first time in my lifetime, socialists sort of have credibility,” the doctor and former Texas Congressman said Friday on CNBC’s “Squawk Box.”

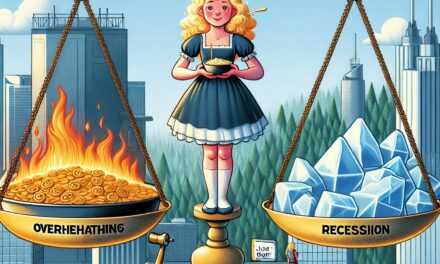

Paul, a three-time presidential candidate who has written a number of books on economics and central bank policy, said the Fed is “doing too much” as far as monetary easing while the economy is strong.

“It is central economic planning, mainly through manipulation of money and credit,” Paul said, sounding much like Money and Markets columnist Bill Bonner, who constantly decries the U.S. central bank and its phony-money policies.

The Fed has cut rates twice this year, once in July and again in September, the first rate cuts in more than a decade, and the stock market is already pricing in another rate cut by the end of the year.

Fed Chair Jerome Powell, often the target of Trump’s ire for not cutting rates far and fast enough, said the central bank will begin blowing up its balance sheet soon — but denied it was restarting quantitative easing, or QE.

“In no sense is this QE,” Powell said after a recent speech, which economists have largely scoffed at.

The Fed ran three rounds of QE amid the Great Recession while people like Paul believe it stayed in easing mode for far too long, not raising rates soon enough. And here we are, easing again after a short period of tightening. The long period of easing, Paul said, also inflated stock prices.

Then Paul switched gears back to Trump’s trade war, saying “we get into manipulating trade.”

“We’re so far removed from capitalism. Yet we get blamed,” Paul said. “Socialists come in and say, ‘See what you guys did to our economy.’”

The first step, Paul said, is we need to cut spending — which has soared under Trump with little resistance from formerly deficit-conscious Republican lawmakers — and stop the Fed’s “pretending they can do economic planning.”

“Unfortunately, that’s not going to happen,” Paul said. “I believe we’re going to see a collapse that will force us to reassess the monetary policy, and that will be very disruptive.”

Editor’s note: Do you agree that Trump’s tariffs and the Fed’s easing while the economy is strong are giving rise to socialism? Share your thoughts below.