Managing Editor’s Note: Mike Carr and Amber Hestla chime in on the state of the economy and markets every week here in our Chart of the Day feature, but to see them flex even more of their market expertise, you need to check out True Options Masters.

Our own Adam O’Dell — no stranger to this lucrative market approach — trades blows with Mike, Amber and the rest of the TOM crew each week in their Options Arena. They tackle unique market angles and tear down the myth that options trading is reserved for the Wall Street elite.

You can sign up for the FREE True Options Masters newsletter here, and look forward to Adam, Mike and Amber’s next bout every Sunday.

For a preview of what to expect, check out Adam’s latest insights from this week’s Options Arena below. — Chad Stone, managing editor, Money & Markets

Russia’s invasion of Ukraine aside, the seeds of a multiyear commodity bull market were already sown.

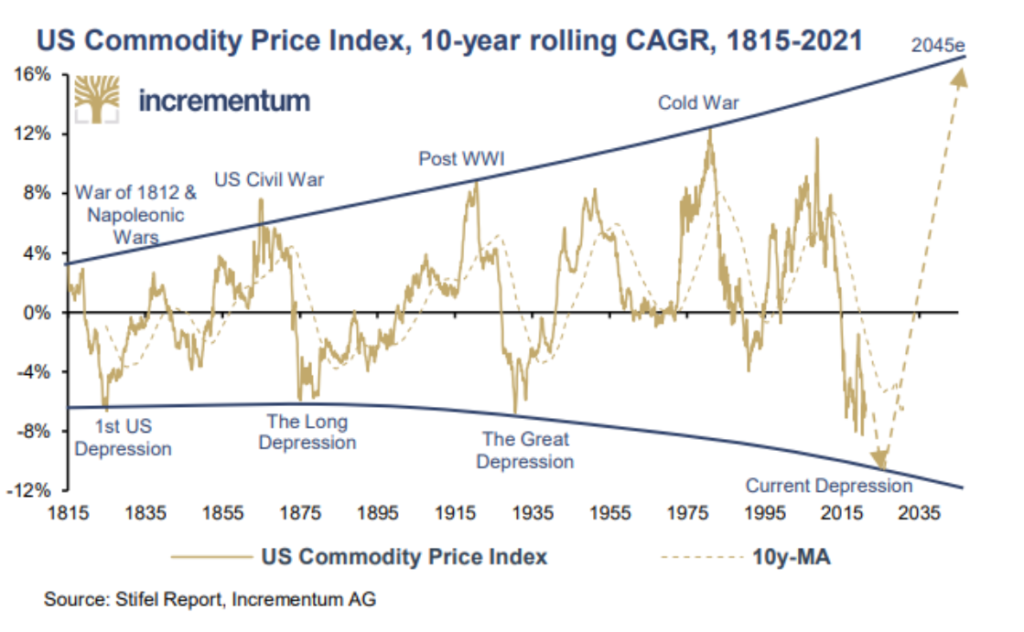

Here’s a chart of the 10-year rolling returns of the U.S. Commodity Price Index, going all the way back to the early 1800s.

The current 10-year compound annual growth rate (CAGR) sits at about negative 8%, the lowest it’s been since the Great Depression.

Realize commodity cycles are driven by major pendulum swings in the balance of supply and demand.

When demand for commodities is greater than supply, eager buyers push prices up. In turn, commodity producers are incentivized to increase stores. And then, as that additional supply comes online, the balance shifts: Supply becomes greater than demand.

Once that happens, commodity producers are willing to accept lower and lower prices and start to pull back on production and capital expenditures. Prices fall until the glut of supply and/or the dearth of demand is brought back into balance.

Looking at the current commodity cycle, the last “top” came between 2008 and 2011. Commodity prices have been falling for over a decade, and that’s led to a significant underinvestment in commodity production infrastructure.

In short, oil and gas producers were drilling far fewer wells and building far fewer pipelines throughout the 2010s. Falling commodity prices made the economics of new investment unfavorable.

The result of that, even prior to Russia’s invasion of Ukraine, was a growing imbalance between supply and demand: Demand remained strong and growing, while supply was constrained. This is the age-old recipe for higher commodity prices.

How Russia Affects Supply and Demand

Case in point, the Invesco DB Commodity Index Tracking Fund (NYSE: DBC) gained 70% in 2021, even before Russia’s invasion.

Of course, Russia’s move into Ukraine and Europe’s heavy dependence on Russian-piped gas has further exacerbated the global imbalance between energy supply and demand. The situation has caused a more acute and regional imbalance on the supply side.

How long that situation lasts is anyone’s guess.

I’ve recommended bearish options trades on European stocks in my short-term Max Profit Alert service, where we hold most trades for two to three months at a time. And we’ve almost doubled our money in three and a half weeks on one of them already.

But I’m well aware that the Russia-Europe energy situation could turn on a dime at any time.

Because of that, I see the value in finding smart ways to play the longer-term commodity bull market…

Buy-and-Hold for the Commodity Bull Market

One way I suggest doing that is with a buy-and-hold purchase of the Direxion Auspice Broad Commodity Strategy ETF (NYSE: COM).

This is a diversified, systematically managed commodity fund that can be either “long” or “flat” a broad mix of commodity markets, including:

- Precious metals, such as gold, silver and copper.

- Agricultural commodities, such as corn, soybeans and wheat.

- And, of course, energy commodities, such as crude oil, natural gas, heating oil and gasoline.

COM uses a systematic trend-following model to decide whether to be flat or long each commodity market. This allows it to adapt to changing trends and capitalize on price rallies, while minimizing the volatility and drawdowns associated with price pullbacks and crashes.

I believe this diversified long-or-flat commodity strategy is ideal for the current situation, where I expect a long-term commodity bull market — regardless of Russia and even more acute geopolitical disruptions in supply. This creates the potential for dramatic price spikes, just as we’ve seen in natural gas prices in Europe.

I wouldn’t recommend “trading” COM, rather adding a small strategic allocation to an otherwise diversified portfolio. I believe COM will provide positive returns over the next five years, while also reducing overall volatility to a balanced portfolio, due to its low correlation to stocks and bonds.

To good profits,

Adam O’Dell

Chief Investment Strategist