A year ago, one event halfway around the world changed the global energy landscape … likely forever.

Russian troops marched toward the country’s southwestern border and invaded their neighbor — and former republic — Ukraine.

The chain reaction of events that followed has led to a dramatic change in global energy consumption.

And that’s created lucrative ways to invest in the new energy market.

Europe Shut Off the Russian Valve

In response to the invasion of Ukraine, the European Union did the only thing it could do short of sending troops to combat Russia: It levied sanctions.

In this context, sanctions force a country to obey international law.

So the EU tried to hit Russia where it hurt the most — its wallet — and shut off access to Russian oil and gas.

On the other side, the Kremlin bet that a desperate Europe would restore the normal flow of that oil and gas at some point and throw Ukraine under the bus.

Well, Moscow’s strategy has failed so far.

Consider that, in 2021, Europe imported 15 billion cubic feet per day of Russian natural gas. That’s about a third of what the continent needs.

By the end of 2022, that figure fell to just 3 billion cubic feet per day — an 80% reduction in a year.

Demand for natural gas was still there, so the EU turned to the U.S. and Middle East to offset what it wasn’t getting from Russia.

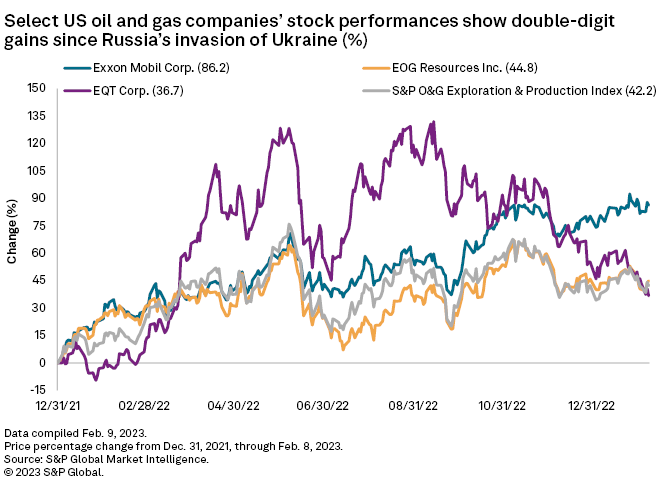

And that has produced a nice boom in American oil and natural gas stocks:

The S&P Oil & Gas Exploration & Production Index — a bucket of 51 North American oil and gas stocks — rose more than 42% from the end of 2021 to early February 2023.

Oil and gas supermajor Exxon Mobil Corp. (NYSE: XOM) stock climbed more than 86%!

Investors who spotted this trend early and jumped into previously struggling oil and gas stocks made out big.

But Russia’s invasion and the subsequent shut off of its oil and gas supplies has triggered another energy evolution … not just in Europe, but across the globe.

Renewable Energy’s Role Amid the Shift

Analysts project that Europe will continue to rely on U.S. and Middle Eastern oil and natural gas for energy through 2023 at least.

That means prices for these resources will remain higher around the world as companies work to meet elevated demand.

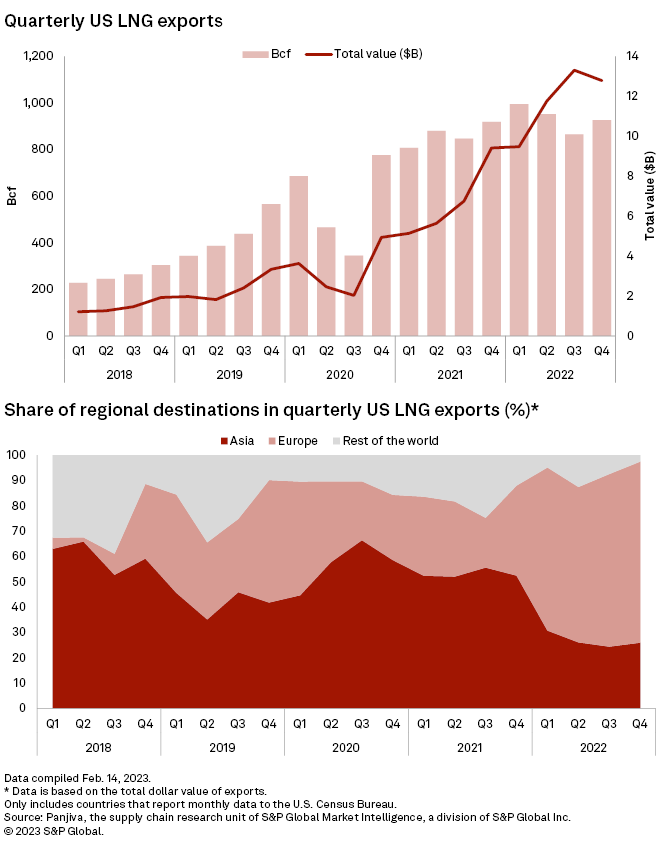

U.S. natural gas exports have climbed rapidly since 2018. You can see that in the first chart below.

The biggest increase in those exports is to Europe. Check out the lighter red in the second chart. The continent accounted for around 70% of U.S. liquefied natural gas exports last year!

I’ll tell you more about how to follow this trend below.

However, global energy companies are trying to meet that heightened demand for oil and natural gas while also increasing the role renewables, like wind and solar power, play as the world tries to create a greener future.

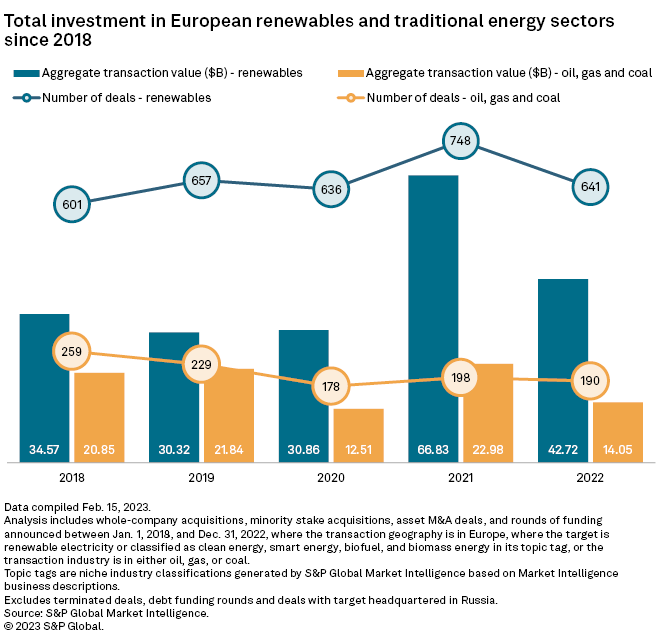

It started with the implementation of REPowerEU — a plan to accelerate the bloc’s energy transition and close its dependence on Russia for oil and gas.

The plan aims to increase the EU’s 2030 renewables share from 40% to 45%.

And it looks like the plan is working.

According to global think tank Ember Energy, wind and solar accounted for 22% of the EU’s electricity production last year compared to 20% for fossil fuels.

And European companies invested $42.7 billion in renewables while only spending $14.1 billion on traditional fossil fuels.

It’s not a massive amount in the grand scheme of things, but the trend is in: Europe is aggressively pursuing its renewable energy goals.

That raises an interesting question for investors…

Buy Clean or Dirty Energy Stocks?

Last week, our chief investment strategist, Adam O’Dell, wrote for his Green Zone Fortunes subscribers addressing this very question.

Here’s one point that stood out to me:

I believe it will take 20-plus years before the war between fossil fuels and green energy is decided. Ultimately, one side should win … but it will be of little consequence to investors who, today, are assessing the market’s best opportunities over the next three, five and 10 years.

In short, “both sides” will create a trove of lucrative opportunities for investors.

He is 100% correct.

Around the world, governments, institutional investors, venture funds and other entities are pouring billions of dollars into green-energy infrastructure.

But we can’t ignore that oil and gas companies are raking in cash right now. These companies already run lean, so every extra dollar they make selling product goes right to their bottom line … then to shareholders through dividends, share buybacks and capital gains.

While you may have a preference in terms of clean energy versus dirty energy, you can maximize your returns by looking at both sides of the fight.

In the short term, that means capitalizing on the demand for oil and gas, while also investing in companies that are focused on the transition from old to new.

In the medium and long term, the transition from traditional fossil fuels and into renewables should accelerate and create opportunities for even greater outsized gains in the clean energy space.

So which side is the best investment now?

Both.

As an investor, you shouldn’t look at this as a “one vs. the other” scenario. There are massive opportunities on both sides of this energy revolution.

Pro tip: Adam and Charles Sizemore just unveiled their latest recommendation to Green Zone Fortunes readers.

It’s a natural gas company stock that pays a dividend yield of almost 9%.

And Charles estimate that it trades for less than the liquidation value of its high-quality assets on top of that!

This is a must-own stock that could give market-beating returns as our global energy war continues.

If you aren’t subscribed to Green Zone Fortunes, make sure to click here and learn how you can join and gain access to a model portfolio chock full of stocks that play both sides of the energy sector.

Stay Tuned: A Company That Can’t Connect Right Now

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

But sometimes I have to let you know about a stock bomb that could blow your portfolio up at any moment.

That’s the case with this company that’s trying to make a name for itself as a space-based internet provider.

I’ll have all the details in tomorrow’s Stock Power Daily.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. Tell us what you think about this energy revolution. Are you investing in traditional fossil fuels or renewable energy … or both? What is driving your decision? Email us at StockPower@MoneyandMarkets.com and let us know!