In today’s Marijuana Market Update, I cover two topics:

- The advancement of the SAFE Banking Act through the U.S. House of Representatives.

- Reader mailbag: Analysis of Slang Worldwide Inc. (OTC: SLGWF).

Let’s start with money.

SAFE Banking Act

Late Monday night, the U.S. House of Representatives approved the SAFE Banking Act — a bill that allows banks to provide services to cannabis companies in states where it’s legal.

The measure passed the House 321-101.

Today, banks are hands-off when it comes to cannabis businesses. They don’t want to break federal law.

But the SAFE Act stipulates that proceeds from legitimate cannabis companies aren’t considered illegal.

It also directs regulators to create rules for supervising banking activity in the cannabis industry.

Remember, 36 states have legalized medical cannabis use, and 17 have legalized adult-use cannabis.

Nearly 70% of Americans live in states where cannabis is now legal in some form.

What’s Next for the SAFE Banking Act

This is positive for cannabis companies and could help cannabis become a national industry. However, I’m cautious.

The bill now moves to the Senate, where, despite Democrat control, its fate is uncertain.

Remember, this bill passed the House in 2019, but the Republican-controlled Senate shelved it.

Sen. Sherrod Brown, a Democrat from Ohio, said in February that he would like to tie the banking bill to sentencing reform for drug offenses. Brown is the chair of the Senate Banking, Housing and Urban Affairs Committee, which will likely start the Senate proceedings on the House version of the SAFE Banking Act.

Slang Worldwide (SLGWF) Stock

Now, I want to address an email from a viewer.

Dr. Zeke wrote:

Can you do a full analysis and give us your thoughts on Slang Worldwide (SLGWF) cannabis company? Buy, sell, hold or neutral?

I appreciate the email!

Slang Worldwide Inc. (OTC: SLGWF) is a Canada-based cannabis company that owns, licenses and markets 11 different brands of cannabis.

It started as Fire Cannabis but changed its name to Slang Worldwide in 2018.

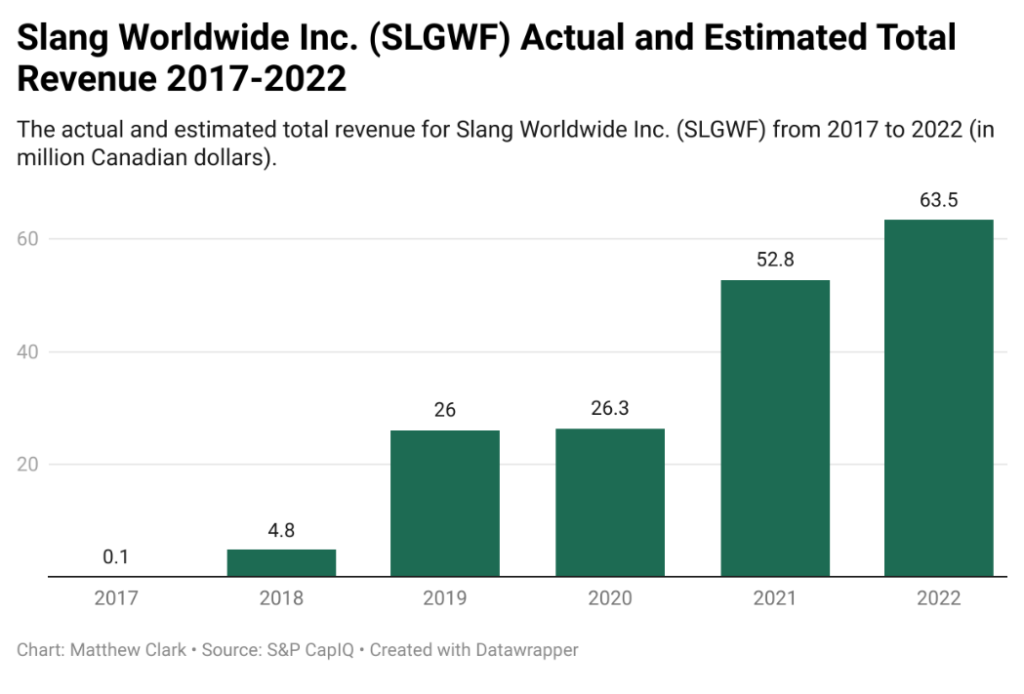

The revenue data in the chart below suggests that Slang’s future looks bright:

The company’s total revenue rose even during the height of the coronavirus pandemic.

Projections show revenue growing from CA$26.3 million to more than CA$63 million by 2022 — a 141% jump in just two years.

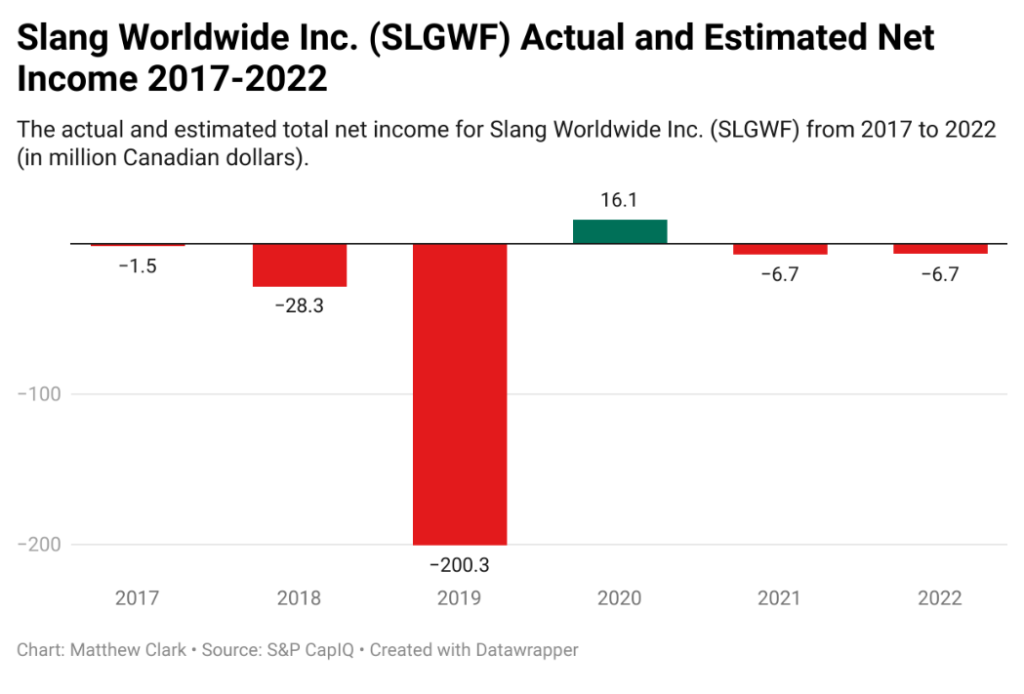

However, the company’s projected net income, which you can see in the chart below, tells a different story:

The company had a disastrous 2019, when its net income dipped to negative CA$200 million, despite a CA$21 million jump in total revenue.

It generated positive net income last year — CA$16.1 million.

However, it’s projected to lose $6.7 million in each of the next two years — again, despite a rise in total revenue.

Take a look at the stock chart below:

SLGWF Falls

Slang’s stock price jumped to around $0.53 per share back in February, but it’s dropped more than 61% since.

Its price is below its 200-day moving average.

Slang’s previous high was more than $2 per share back in 2019.

Slang’s huge loss in net income projected over the next two years coupled with its massive downward movement in stock price tells me to stay away from this stock.

I need to see a much better financial picture and strong upside momentum.

Thank you, Dr. Zeke, for your question.

Cannabis Watchlist Update

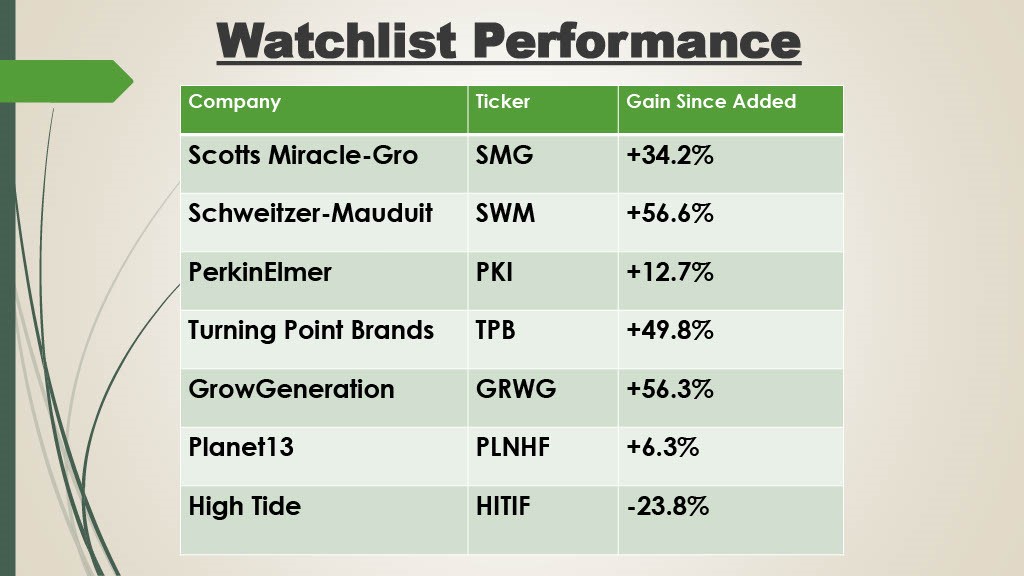

Now, I want to take a look at our Money & Markets Cannabis Watchlist:

Watchlist performance pulled on April 20, 2021.

GrowGeneration Corp. (NYSE: GRWG) remains our best performer.

On Tuesday, the company announced the acquisition of Downriver Hydroponics for an undisclosed amount.

The deal gives GrowGeneration a foothold in Michigan as Downriver is Wayne County’s — Detroit’s — largest hydroponics store.

Another strong performer, Turning Point Brands Inc. (NYSE: TBP), invested $8.7 million with Docklight Brands to expand Bob Marley cannabis and CBD products.

Finally, our latest addition to the watchlist, High Tide Inc. (OTC: HITIF) celebrated 4/20 by opening a new Canna Cabana Cannabis retail store in Edson, Alberta, in Canada.

If you would like me to look at a cannabis stock, email my team and me at feedback@moneyandmarkets.com.

Where to Find Us

I’m now on the Clubhouse app. Each week, I will review the stock market and look ahead to the coming week on Wall Street.

You can check that out every Friday at 10 a.m. Eastern time.

We may launch different rooms on Clubhouse in the future, including a cannabis investing discussion.

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our new Ask Adam Anything video series, where we ask your questions to Chief Investment Strategist Adam O’Dell.

Green Zone Fortunes co-editor Charles Sizemore also has a weekly series called Investing With Charles where he breaks down dividend stocks each week.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.