Businesses need companies like Salesforce to help them navigate customer service in the digital age. But does that mean Salesforce stock is one to buy now?

Our proprietary Stock Power Ratings system should help answer that question.

Salesforce is one of the most influential companies in the world.

It has become a leader in customer relationship management (CRM) software, with over 150,000 customers around the globe, including some of the biggest names in business.

But what do you need to know about Salesforce’s business and its outlook for 2023?

Let’s take a look.

Salesforce’s Products and Services

Salesforce offers a variety of products and services to help businesses manage their customer relationships.

Its flagship product is its CRM software suite, which includes:

- Sales Cloud.

- Service Cloud.

- Marketing Cloud.

- Commerce Cloud.

- Other, more specialized services.

The company also offers cloud-based applications such as Analytics Cloud and Collaboration Cloud that help businesses gain insights into their data and collaborate more effectively with customers and partners.

On top of all of that, Salesforce provides professional services such as consulting, training, support and implementation to ensure businesses get the most out of its CRM solutions.

Salesforce Stock and Growth Potential

Over the last several years, Salesforce has seen tremendous growth in revenue thanks to its innovative products and services.

In the third quarter of its fiscal year that ended on October 31, 2022, Salesforce reported $7.84 billion in revenue. That’s up 14% year over year!

And according to a report from Gartner Inc., Salesforce is expected to become even more dominant over the next few years as demand for cloud-based CRM solutions continues to grow at an impressive rate.

In fact, Gartner predicts that by this year, the global CRM market will be worth $80 billion — an increase of 40% from 2021 levels — with Salesforce commanding a massive 38% share of that market.

We’ll see if that plays out as Gartner expects.

For now, let’s see how investable Salesforce stock is using our Stock Power Ratings system.

Salesforce Stock Power Ratings

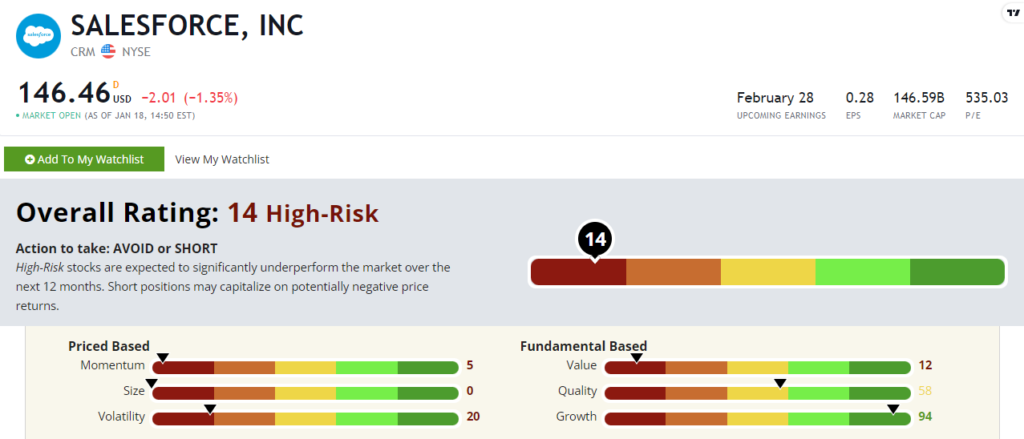

Salesforce stock rates a “High-Risk” 14 out of 100. That means our system expects the stock to underperform the broader market over the next 12 months!

Like many tech stocks, CRM has not been able to dodge the sell-off. The stock is 35% lower than it was a year ago — and it was a rocky trip lower.

That why Salesforce stock rates so poorly on momentum, at 5 out of 100, and volatility, 20 out of 100.

A bright spot for CRM is its growth factor rating at 94. I mentioned its strong revenue growth above, and the company has revised its own guidance higher for the fourth quarter of 2022. It now expects revenue to hit $8.03 billion, up from $7.93 previously.

Bottom Line: It’s clear that Salesforce is already an incredibly successful company and has a bright future ahead of it. But if you follow our Stock Power Ratings system, this stock is one to avoid for now.

Do you own shares of Salesforce stock? Or have you used our Stock Power Ratings system to look up any other companies? Let us know about your experience by dropping a line to us at StockPower@MoneyandMarkets.com.