It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just five minutes.

Let’s get started!

Santa Claus Rally … or Return of the Grinch?

So far, December has been more like the Grinch and less like Santa Claus for investors.

Last week, the Federal Reserve did little to stoke the possibility of a Santa Claus rally when it cut interest rates by 25 basis points but became hawkish on future rate cuts in 2025.

Despite that, the S&P 500 remains up more than 23% for the year.

Attention now shifts to the last five trading days of the year, coupled with the first two trading days of the new year, to provide some spark to the market.

According to the Stock Trader’s Almanac, since 1969, those seven trading days have yielded an average gain of 1.3% — otherwise known as the Santa Claus rally — to the benchmark.

Last week’s Fed announcement, coupled with the fact that eight of the 11 S&P 500 sectors remained in negative territory in December, suggests the market may be on Santa’s naughty list.

It doesn’t help that 10-year Treasury yields reached as high as 4.55% on Thursday before paring back to 4.5% Friday afternoon.

It’s entirely possible the rally came early this year as the benchmark index posted a 5.7% gain in November on the back of Donald Trump’s U.S. presidential election.

Enjoy the Holiday!

Stock and bond markets will keep different hours over the next two weeks due to the Christmas and New Year’s holidays.

The Nasdaq will stop trading at 1 p.m. Tuesday, December 24 and remain closed Wednesday, December 25.

It will reopen for regular trading on Thursday, December 26.

The New York Stock Exchange will operate at the same hours as the Nasdaq: closing early Tuesday, remaining closed Wednesday, and reopening Thursday.

Both markets will also be closed on Wednesday, January 1, 2025, in celebration of New Year’s Day.

Bond markets will close at 2 p.m. Tuesday, December 24 and remain closed on Christmas Day. They will also close at 2 p.m. on Tuesday, December 31 and remain closed on New Year’s Day.

Tariffs On My Mind

Back at the height of the Roman Empire, Rome taxed imports of foreign goods at a rate 25 times higher than domestic trade.

It is one of the first records of tariffs.

After the 1929 stock market crash, the U.S. government imposed nearly 900 different tariffs, sparking retaliation from other countries and a contraction of global trade.

When he takes office in January, President-elect Donald Trump vowed to raise tariffs on goods imported from China, Mexico and Canada. He’s even floated the idea of extensive tariffs on goods imported from Europe.

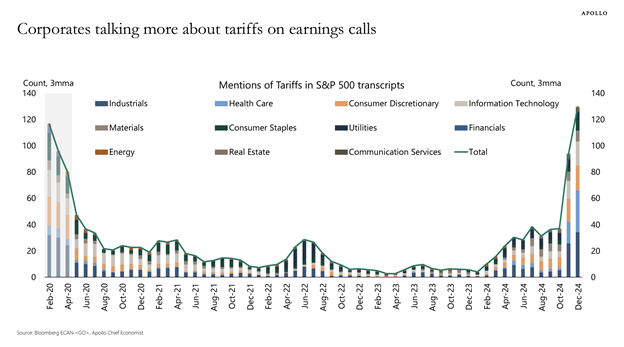

While tariffs may not be on your mind during this holiday season, they certainly are for company CEOs.

Earnings transcripts show that firms in the industrial, health care, consumer discretionary and information technology sectors are discussing tariffs more frequently.

The mention of tariffs is at a high this month, just weeks before Trump officially takes office.

All I Want Are Those Dividends

Looking for a way to increase your dividends? All it takes is a chart-topping holiday hit…

Mariah Carey’s holiday anthem “All I Want for Christmas Is You” has been streamed more than 2 billion times globally on Spotify. The music streaming service announced it was the first holiday song to cross that mark.

Law firm Manatt, Phelps & Phillips estimates that it has raked in $103 million in earnings since it hit the airwaves in 1994!

There’s no telling how much of that is actually landing in Carey’s bank account … estimates mention her earning between $2.7 million and $3.3 in 2022. But with control over both the music composition and sound recording royalty streams, she’s getting paid twice for each play.

Time to dust off the old guitar…

Your 2025 Goals

It’s that time again…

As 2024 comes to a close, we’re looking ahead to the new year. And we want to know if you’re thinking about your goals for 2025 yet.

Click below to participate in our latest poll. We’ll review the results after the holidays.

Have a safe holiday!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets