Wall Street really can be infantile sometimes. It’s hard to keep a straight face when you see otherwise serious men in blue designer suits talking about the “Santa Claus rally” this time of year. The phrase was first officially recorded in the Stock Trader’s Almanac in 1972 and has been a part of every December market conversation ever since.

Still, calendar effects are a very real thing. And stock prices really do tend to rise in the last five trading days of December and the first two of January. Stocks are higher close to 80% of the time during that window, with the average gain being around 1.3%.

As for the “why,” there are a couple of reasons. To start, a lot of institutional investors are away from their desks that time of year, so trading volumes tend to be thinner. That makes it easier for mom-and-pop investors to push the market higher. The end of tax loss harvesting is also a possible factor. Investors are usually finished selling their losers for the year by mid-December, so the lack of selling pressure contributes to a bounce.

And then finally, there’s the normal optimism that surrounds the coming of a new year… and investors often have a little extra money in their accounts from Christmas bonuses.

So, with all of that as background, let’s take a look at what sectors performed best in the week before Christmas.

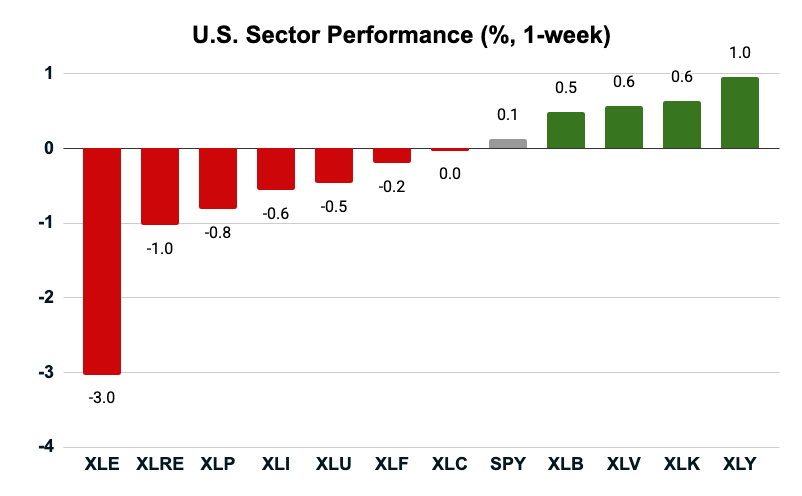

Investors bought the dip in tech stocks. The State Street Technology Select Sector ETF (XLK) returned a respectable 0.6% after a terrible performance the week before. But the best performer was the consumer discretionary sector. Perhaps hoping that the U.S. shopper still has some shopping left to do this season, the State Street Consumer Discretionary Select Sector ETF (XLY) was up a solid 1%.

Energy was the biggest loser last week, with the State Street Energy Select Sector ETF (XLE) down about 3%.

Key Insights:

- We’re now in “Santa Claus Rally” mode, when stocks have traditionally performed well.

- Consumer discretionaries are showing momentum.

- Energy stocks really took a beating.

It’s always a mistake to read too deeply into a single week’s returns, particularly this time of year when there are seasonal factors at play. But let’s take a moment to do a deeper dive into the consumer discretionary sector to see if there are any presents worth unwrapping.

A Tesla Under the Tree?

I normally scan for the biggest winners of the week that are still trading within 10% of their 52-week highs. The idea is to look for strong stocks breaking out and trending higher. I had to relax that criterion this week because, frankly, there weren’t enough stocks fitting that description to make a list!

In fact, most of the outperformance of the consumer discretionary sector came from one single company – Elon Musk’s Tesla (TSLA). Tesla makes up fully 22% of the sector, so as goes Tesla, so go consumer discretionaries.

Unfortunately, Tesla doesn’t rate well on my Green Zone Power Ratings system. At 28, it rates as distinctly “Bearish.”

Tesla has always been a bet on Elon Musk and his vision for the future. And today, Tesla bulls are betting that Musk’s humanoid robots, scheduled to hit the market in 2026, will be a hit. There’s also a lot of enthusiasm surrounding Tesla’s push into AI chips. Whether or not the company’s namesake electric vehicles continue to gain market share, Musk’s plan is to position the company as an integral piece of the AI economy.

Will he be successful?

We’ll see soon enough. But for now, my system is advising caution, and not just for Tesla. The only stock on this list rated as “Bullish” is homebuilder NVR, Inc. (NVR). And it just barely makes the cut.

Buying the Dip in Energy?

Energy stocks took a pounding last week. But might there be some value in the wreckage?

Let’s do a deeper dive.

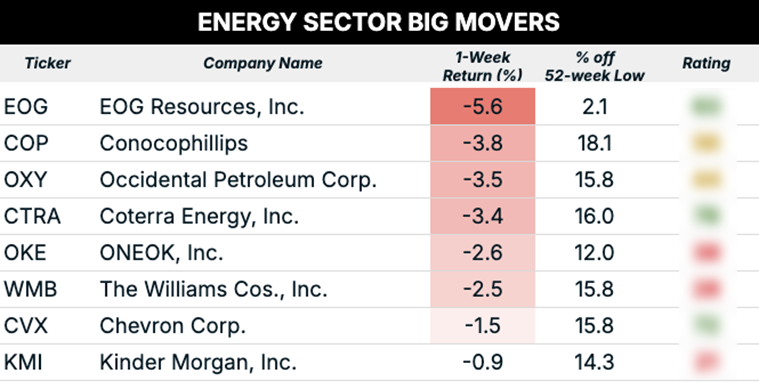

Normally, I would run a screen of the biggest losers of the week that were still within 10% of their 52-week lows. But, after a year that has really seen the market blast higher, virtually all of the energy stocks were more than 10% above their lows.

Apart from the pipeline stocks – ONEOK (OKE), Williams Companies (WMB) and Kinder Morgan (KMI) – which rate as “Bearish,” the rest of the list rates “Neutral” or better. Three stocks – EOG Resources (EOG), Coterra Energy (CTRA) and Chevron Corp (CVX) – rate as “Bullish.”

I generally shy away from big “macro” calls. You’re not going to find me predicting an exact date or level for a market top or bottom. I’ve been in this game long enough to know that is a fool’s errand.

That said, I’ve been writing for months that the data suggests turbulence ahead in tech and specifically the megacap Mag 7.

The last time we saw a real bear market following a tech boom was in 2000. Tech stocks went through a brutal bear market that saw the Nasdaq fall 80%.

Care to guess how energy performed over that period?

Including dividends, XLE returned over 350% between 2000 and its peak in 2014.

I can’t promise we’ll see a repeat of that move next time around. But if you’re looking to diversify outside of the expensive and overowned Mag 7, my system suggests there are plenty of “Bullish” rated gems to choose from.

To good profits,

Adam O’Dell

Editor, What My System Says Today