We inch ever closer to the cold winter months.

After Russia’s invasion of Ukraine and the subsequent shut-off of 40% of its natural gas supply, European countries are desperate for this key element in heat generation.

In the U.S., the Energy Information Administration estimates there are about 2,926 trillion cubic feet of recoverable natural gas across the country.

By 2050, the U.S. expects to produce 33.67 trillion cubic feet of gas and oil from shale — a 35.2% increase over last year.

I’ve found a different way to play the demand for oil and gas.

Today’s Power Stock owns royalty and mineral interests in Texas and Oklahoma: Sabine Royalty Trust (NYSE: SBR).

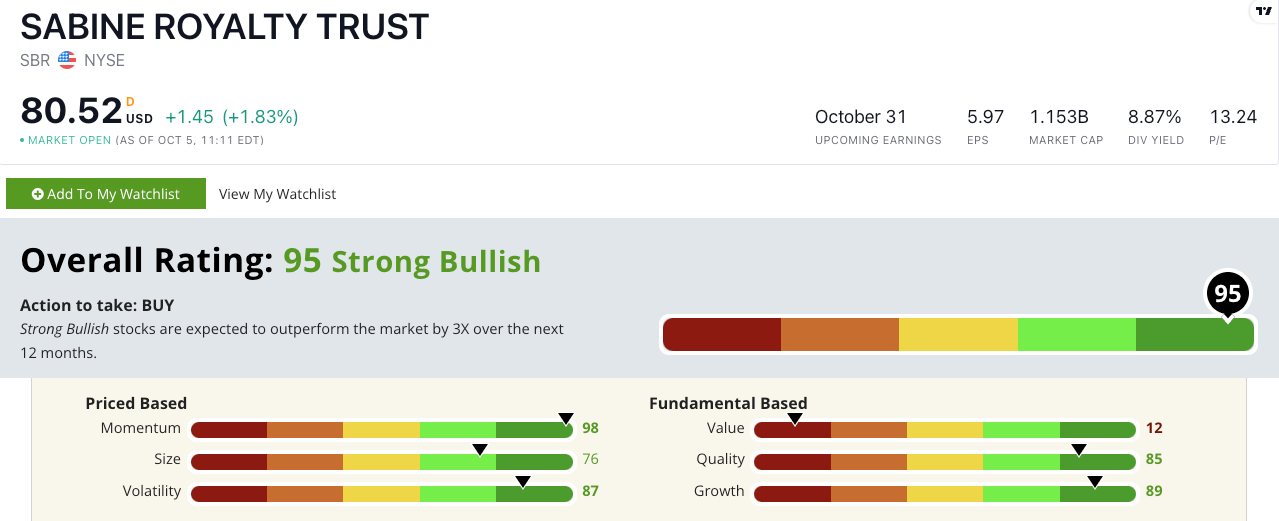

SBR Stock Power Rating October 2022.

SBR is a pass-through company for royalty payments. It collects royalties on minerals recovered on land and turns the profits over to stockholders.

Sabine Royalty Trust stock scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months.

SBR Stock: Strong Momentum, Quality and Growth

SBR released strong quarterly numbers:

- Reported royalty income of $28 million for the quarter — a 117% year-over-year increase!

- Its distributable income (money after paying administrative costs) jumped 125.6% as SBR reduced administrative costs.

You can see why SBR stock earns an 89 on our growth metric.

Sabine Royalty also knocks our quality metric out of the park.

SBR has a return on assets of 920.3%. Its peers only average 2.4%.

It’s the same with return on equity and investment… SBR’s returns are 1,078.7%, while the investment services sector averages between 3.5% and 4.2%.

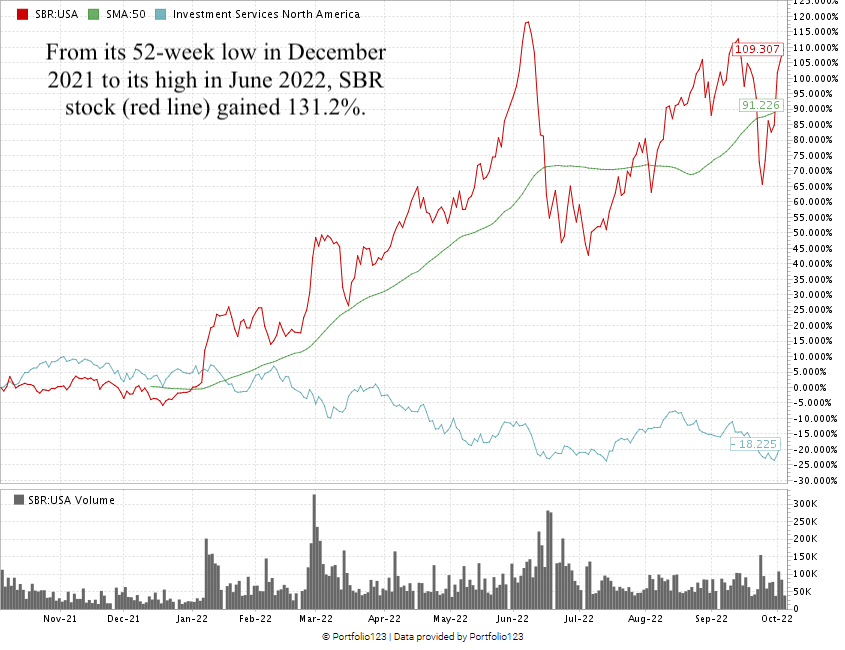

SBR scores a 98 on our momentum factor:

Created October 2022.

SBR stock hit its 52-week low in December 2021. It bounced 131.2% to its 52-week high in June 2022.

Market pullback pared those gains, but SBR looks to be back on the rise. It shows the “maximum momentum” we love in stocks.

Sabine Royalty Trust stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Oil and gas production remains big business worldwide.

SBR is a unique play, as it doesn’t drill, but collects money on what’s pulled out of the ground … and pays shareholders the profits.

This is why SBR is a great candidate for your portfolio.

Bonus: SBR has a forward dividend yield of 12.69%. That earns shareholders $10.03 per share per year, and it pays its dividends monthly.

Stay Tuned: Capitalize on Rising Oil Demand With Refining Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on the best stock to trade if you want to capitalize on the rising demand for oil — which experts predict to surpass pre-pandemic levels.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.