We watch the renewable energy mega trend at Money & Markets every day.

There’s no question the world is moving toward more sustainable energy generation.

But that takes time.

Crude oil use in gasoline, jet fuel and other products continues to grow demand:

In 2020, demand for crude oil dropped to its lowest point since 2013.

The International Energy Agency projects that demand to expand beyond pre-pandemic levels by 2023 — reaching ever higher in the years following.

Imperial Oil Ltd. (NYSE: IMO) is today’s Power Stock. It refines crude oil into different petroleum products.

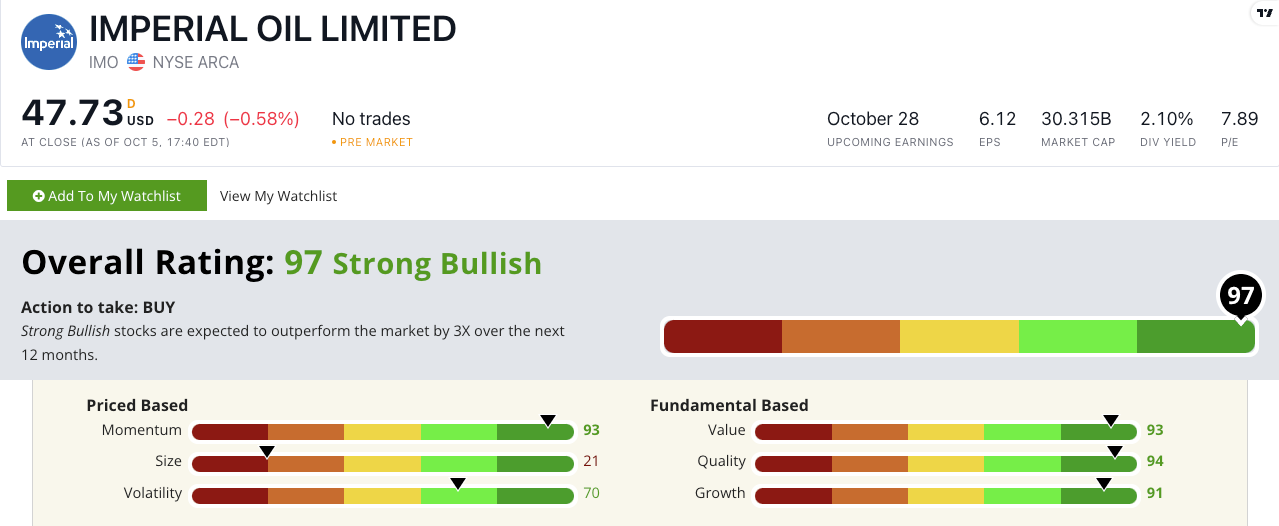

IMO’s Stock Power Ratings in October 2022.

Canada-based IMO not only refines, but also explores and produces oil, natural gas and synthetic oil.

Fun fact: Imperial Oil was started in 1880 — 19 years before the creation of Standard Oil Co., John D. Rockefeller’s now-defunct petroleum company that was once the largest of its kind in the world.

IMO stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

IMO Stock: Great Value + Strong Momentum

Imperial Oil reported a strong second quarter.

Highlights include:

- Quarterly income of $12.6 billion — 113% higher than the same quarter last year!

- For the first six months of the year, total revenue increased 42% year over year.

IMO is a terrific value stock, scoring a 93 on that factor in our Stock Power Ratings system.

Its price-to ratios (earnings, sales, cash flow and book value) are all lower than the oil and gas industry’s.

This tells us IMO is a better value stock than its peers.

Created October 2022.

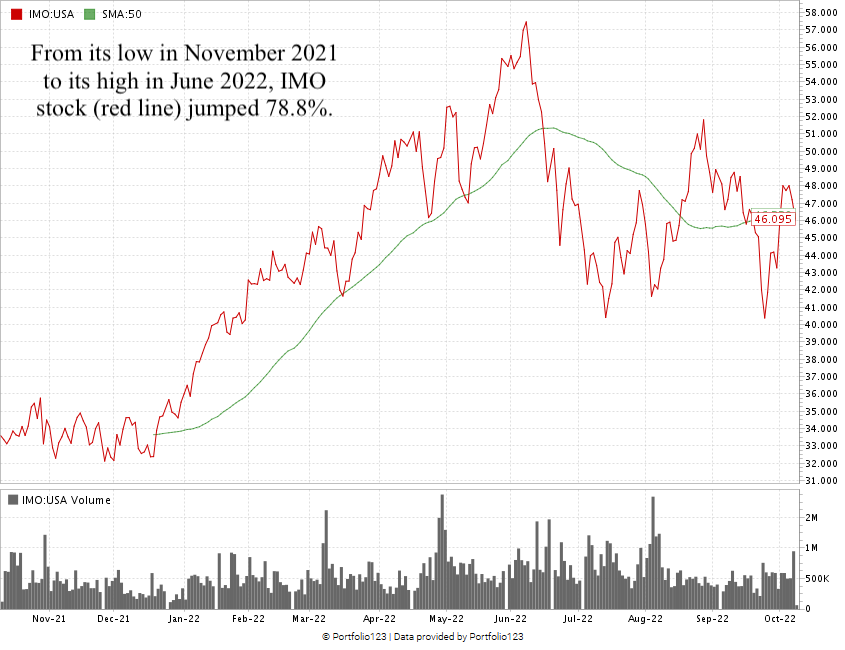

Over the last 12 months, IMO is up 46%.

You can see IMO’s 78.8% spike from its November 2021 low to its June 2022 high.

Imperial Oil Ltd. stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The world is moving more toward renewable energy … but it’s a slow process.

That’s why our demand for crude oil is only going to expand.

I’m confident you’ll agree that IMO is a strong contender for your portfolio.

Bonus: IMO’s 2.11% forward dividend yield pays shareholders $1.01 per share per year to own the stock.

Stay Tuned: Ride-Sharers Are All the Rage, but Steer Clear

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a popular ride-share service that rates an abysmal 2 out of 100.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.