Seasonals are an indicator that few traders follow. Seasonal indicators rely solely on the calendar to provide signals — making seasonals truly independent of widely followed indicators. And the seasonals are saying: Pay attention to gold mining.

Prices largely drive fundamental indicators. Popular tools like the price-to-earnings ratio, dividend yields, and other ratios are all based on the stock’s market price.

Day-to-day changes in the indicators are based solely on the price action since fundamentals change just once every three months.

Technical indicators also orbit prices. These indicators are almost all calculated with formulas adding, subtracting, multiplying or dividing the closing price. While the formulas can be surprisingly complex, they are all based on the price action.

Seasonal tendencies are found using time. They identify how often a stock or sector moves up during a given timeframe.

Seasonals are useful because the truth is some stocks will do better than others at different times of the year. The same concept applies to commodities where fundamentals are difficult to apply.

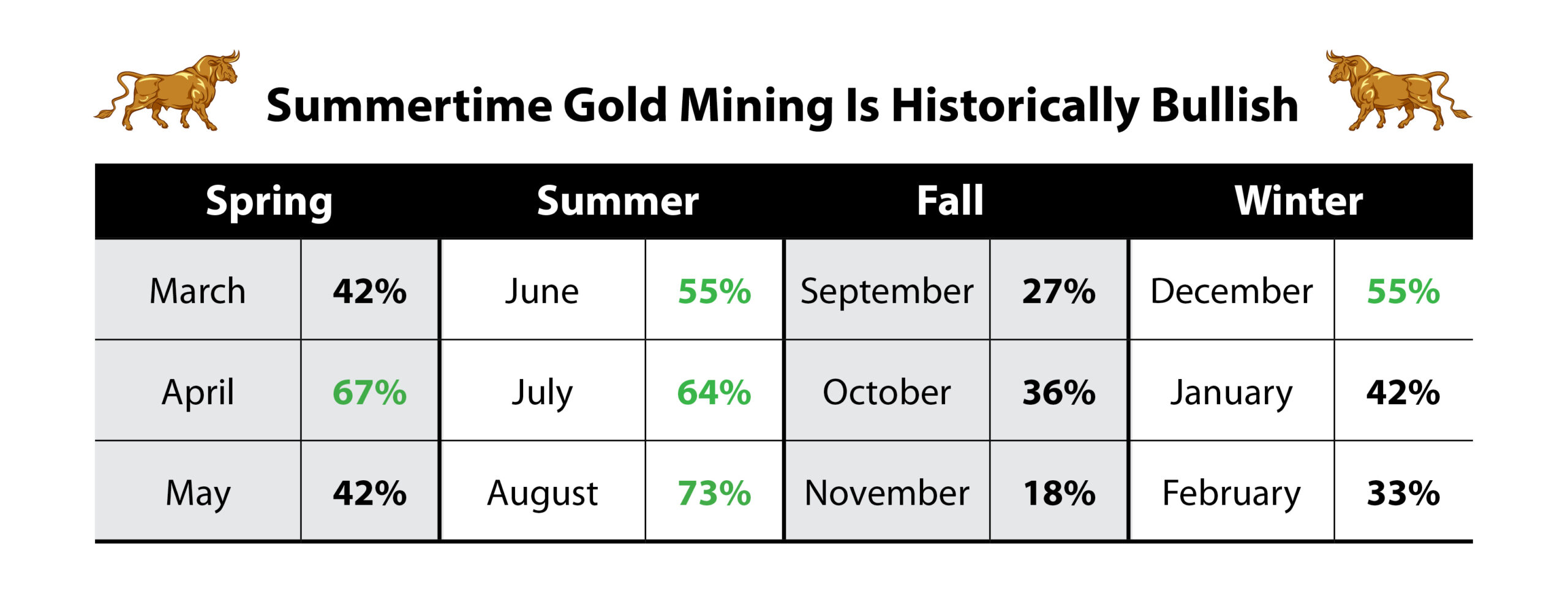

Based solely on the calendar, we are beginning an unusually bullish timeframe for gold mining stocks. The chart below shows the percentage of time VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ) goes up in any given month.

Summertime Gold Mining Is Historically Bullish

Seasonal Traders Could Benefit From Gold Miners

June through August is the most consistently bullish period for the ETF.

GDXJ includes the most speculative junior mining companies. While large mining companies and gold bullion tend to do well at this time of year as well, small gold miners tend to be the group that deliver the largest gains.

It’s possible there is an underlying fundamental reason that explains the bullish seasonal in mining stocks. It could be as simple as the fact miners produce more than expected when the weather is good in the summer months.

But seasonal traders don’t need to know the reason why the stocks go up. They can simply buy and know that they have an edge in the market.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

P.S. I’ve been telling my readers that someone could double their money in a year with this. By the end of 2020, I proved that to be true. My “One Trade” strategy has never had a losing year across 12 years of back testing. And last year’s live results were even better. Click here to see how it all works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.