Economists often assume that people behave rationally. Based on this assumption, consumers allocate resources to what they need the most. This explains why consumer staple stocks like Proctor & Gamble and Conagra perform well in recessions.

Businesses are also rational. They hire more employees and increase production when consumers demand more goods and services. They scale back on production and lay off employees when demand drops.

Rationality also extends to borrowing. Now, with low interest rates, is an ideal time for consumers and businesses to borrow.

Businesses seem to be acting strategically. The Wall Street Journal reported: “Businesses are sitting on record amounts of unused credit from U.S. banks, another quirk in the economic recovery that bankers say could help unleash pent-up spending in the coming months.

Bank executives said their business clients have in recent months ramped up requests for credit lines that can be drawn quickly for spending on inventory, labor or expansions.

Companies aren’t actually drawing the money into their bank accounts just yet. Businesses are already stuffed with cash, and supply-chain issues and labor shortages have crimped their ability to spend it. But bankers say the activity in recent months is evidence that businesses are planning to turn on the spending spigot. That could help the economy shoot higher.”

Businesses now have record piles of cash and unused credit lines. That is perfectly rational in a low interest rate environment.

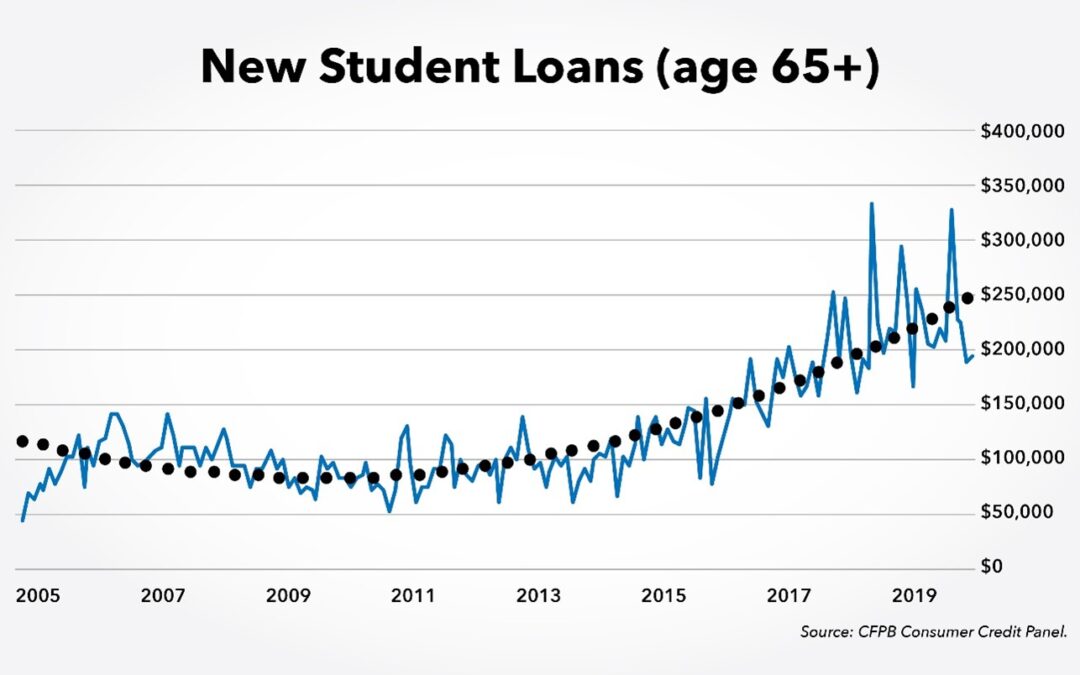

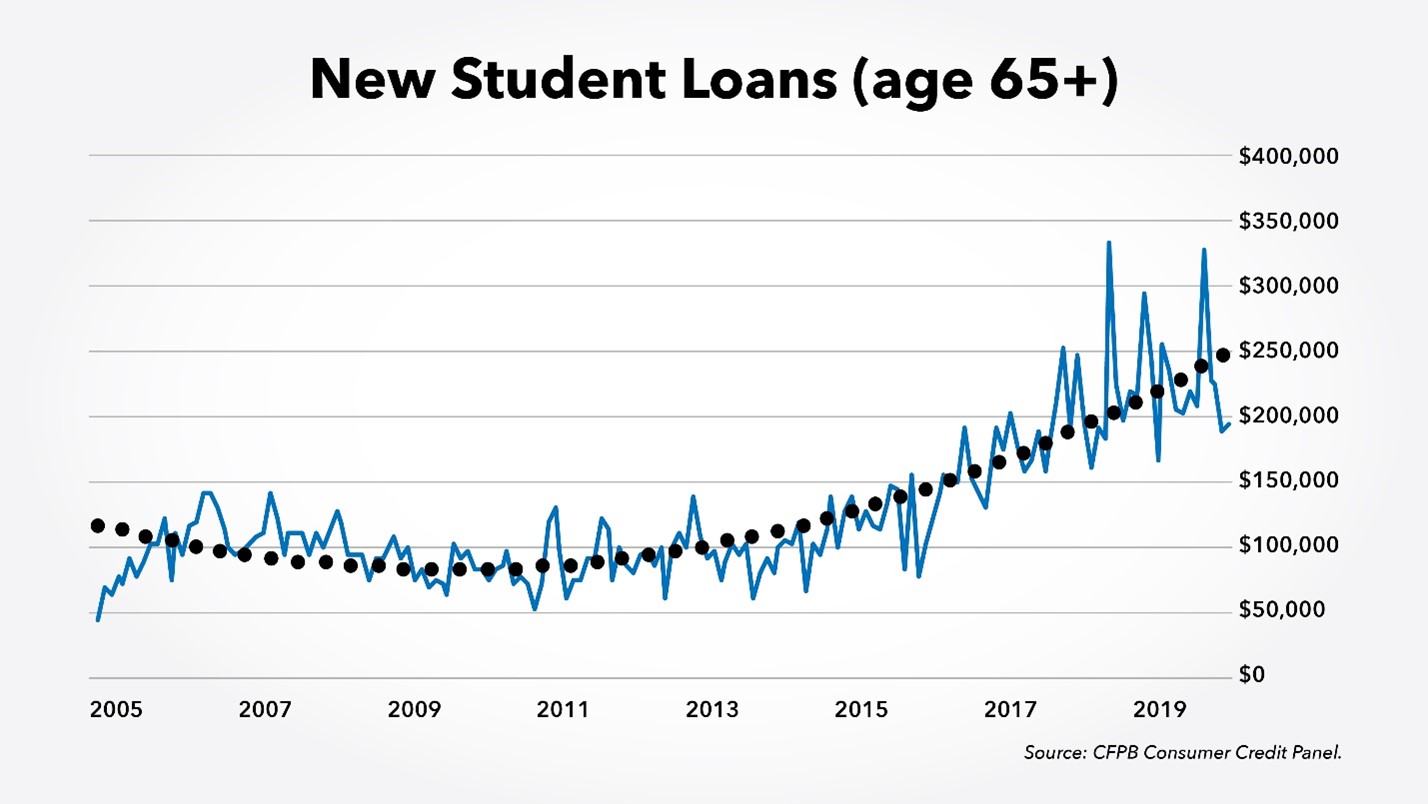

Borrowers are also behaving rationally, as the chart below shows.

New Student Loans Rising for Seniors

Source: Consumer Financial Protection Bureau.

Student Loans to Seniors Offset Living Expenses

This is a chart of student loan debt among those over age 65. This group should be increasing their borrowing if they are rational.

If a retiree is on a fixed income, borrowing from the government to fund education expenses could be the best possible financial decision. Loan limits allow funds for living expenses. Payments can be deferred while the senior is enrolled in school.

After finishing school, the seasoned citizen is likely to be over 70. A 20-year income-based repayment plan makes sense for a 70-year-old who may end up with a payment of $0 every month. If economists are right and consumers are rational, this chart should show exponential gains in the years ahead.

This is a bad deal for taxpayers who will pay when the loans to senior citizens are forgiven. But the chart does show these older students are acting rationally.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.