It’s been a rough time for companies that provide services to the general public, but a rebound is in the offing and there are some appealing service sector stocks to buy when the lockdown ends.

From retail to entertainment to communications, the consumer services sector gives investors tons of opportunities for gains.

However, of late, the sector has taken a sizable hit because of the coronavirus lockdown that has kept millions of Americans at home.

According to S&P Dow Jones Indices, the U.S. Consumer Services Index suffered a big drop in March to a new low.

But when the lockdown ends, there are companies out there that will provide big profits, especially for savvy investors.

Service Sector Stocks to Buy When the Lockdown Ends

1. Penske Auto Group

Market Capitalization: $2.9 billion

Annual Sales (2019): $23.1 billion

Annual Dividend Yield: 4.67%

5-Year Dividend Growth: 102.5%

One fact is that people are always on the move. Whether it be for a new job or just a change of scenery, millions of Americans change where they live every year.

Penske Auto Group (NYSE: PAG) not only provides franchise automobile and truck dealerships, but also vehicle rentals for things like moving.

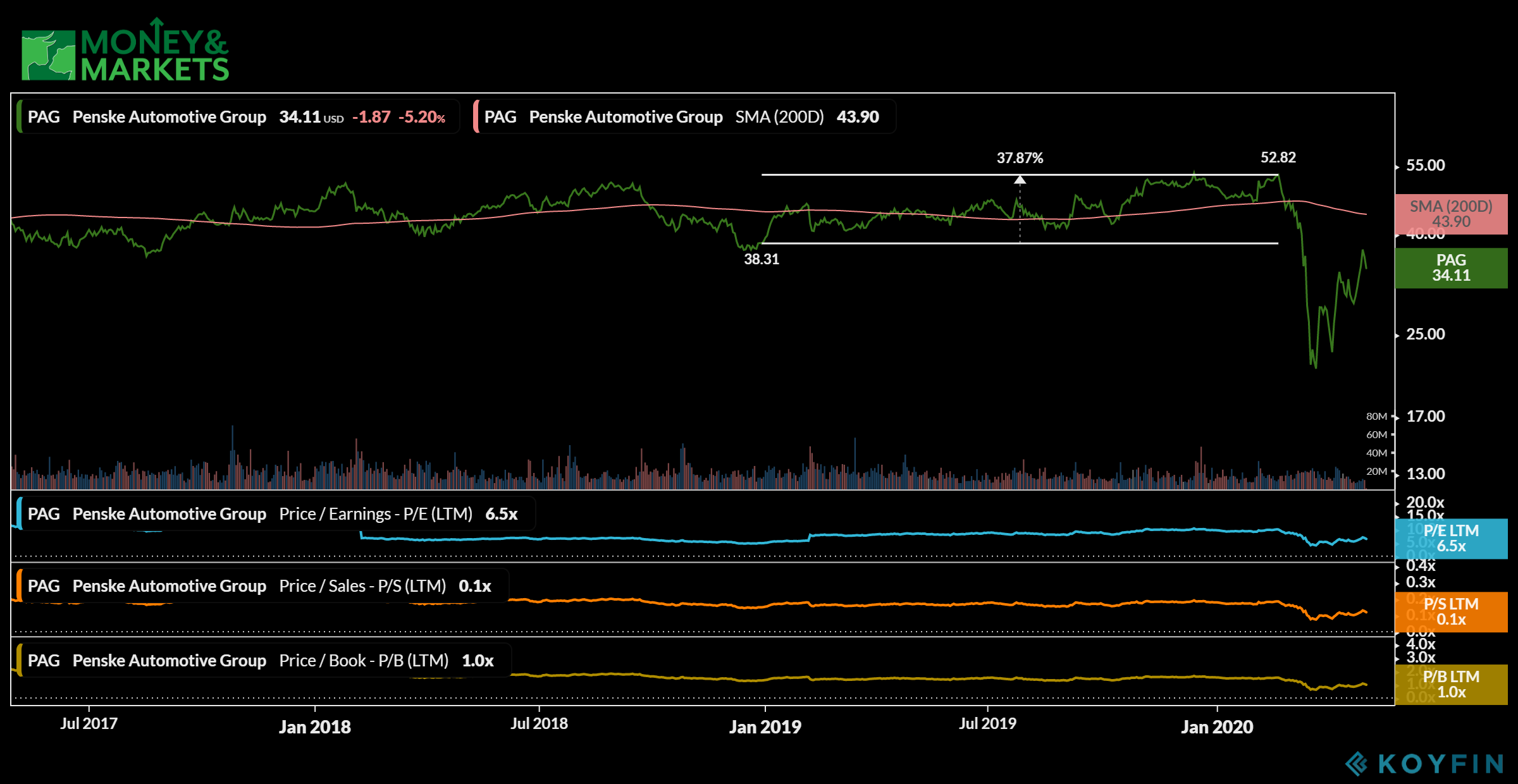

In 2019, Penske’s stock price jumped about 38%, but then pared back massively during the market selloff in March 2020.

It got about a 61% haircut off its share price in short order.

However, it has started to make a comeback and is trading just shy of its 200-day moving average.

Penske is a solid bargain right now as it’s trading with a price-to-earnings ratio of 6.4. Its price to sales is 0.1 and its price to book is at 1.

That makes it a solid value for any investor.

And, on top of all of that, Penske offers shareholders a nice dividend. The company’s most recent dividend was $0.42 per share — an increase from the previous quarter. At that rate, its annual dividend yield is 4.67%.

Because it offers something we need, and that need isn’t going away — along with an attractive dividend — Penske Automotive Group is one of the service sector stocks to buy when the lockdown ends.

2. H&R Block

Market Capitalization: $3.2 billion

Annual Sales (2019): $3 billion

Annual Dividend Yield: 6.25%

5-Year Dividend Growth: 25%

Two things are certain in life: death and taxes.

There isn’t much (legal) profit in the first, but H&R Block (NYSE: HRB) can provide investors with gains for the second. H&R Block is the world’s largest income tax return filing service, helping millions file every year.

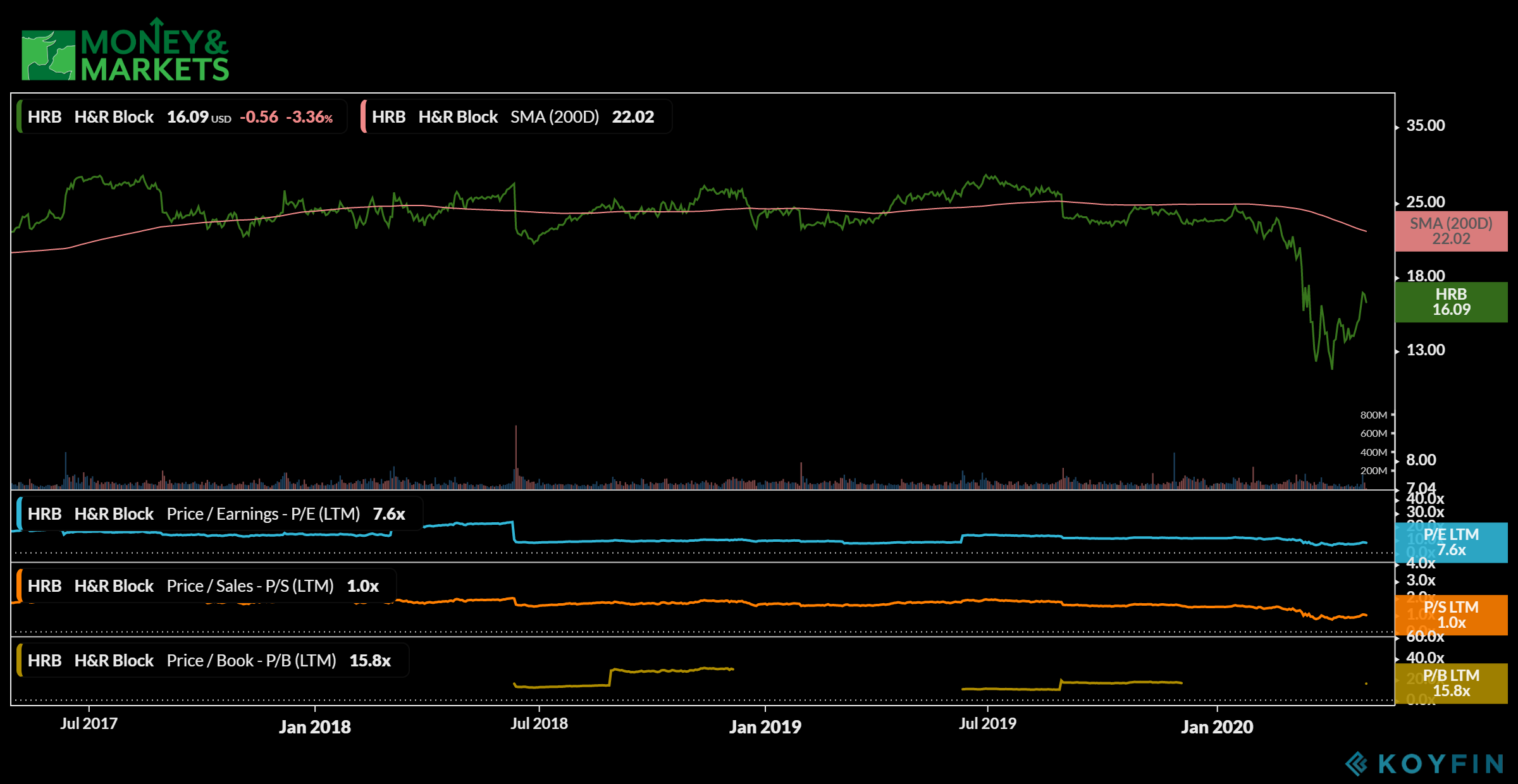

The company traded fairly flat in 2019 but reached a high of $27.77 in June 2019. Like Penske — and just about every other company — it fell off a cliff in March 2020.

But it’s also started to rebound off that low of near $12 per share. Now, the company is trading just $6 per share off its 200-day moving average.

H&R Block is currently a solid value for investors. Its price-to-earnings ratio is 7.6. It has a price-to-sales ratio of 1. The price to book is a little high at 15.8, but it still doesn’t take away from the overall value of the company.

It also offers a solid dividend, especially compared to its stock price. H&R Block is currently trading around $17 per share. It’s March 2020 dividend payment was $0.26 per share. That gives it an annual dividend yield of 6.25%.

And, the company has not only maintained but actually increased that dividend in the last two years.

We all do our taxes — or, at least we’re supposed to — and because it’s a leader in providing that service, H&R Block is one of the service sector stocks to buy when the lockdown ends.

3. Costco Wholesale

Market Capitalization: $133.8 billion

Annual Sales (2019): $152.7 billion

Annual Dividend Yield: 0.86%

5-Year Dividend Growth: 83.4%

One company that has survived the coronavirus lockdown has done so because it continues to provide a service, despite people forced to shelter in place.

Costco Wholesale (Nasdaq: COST) is an international chain of membership warehouses that carry brand name merchandise, typically at a lower cost.

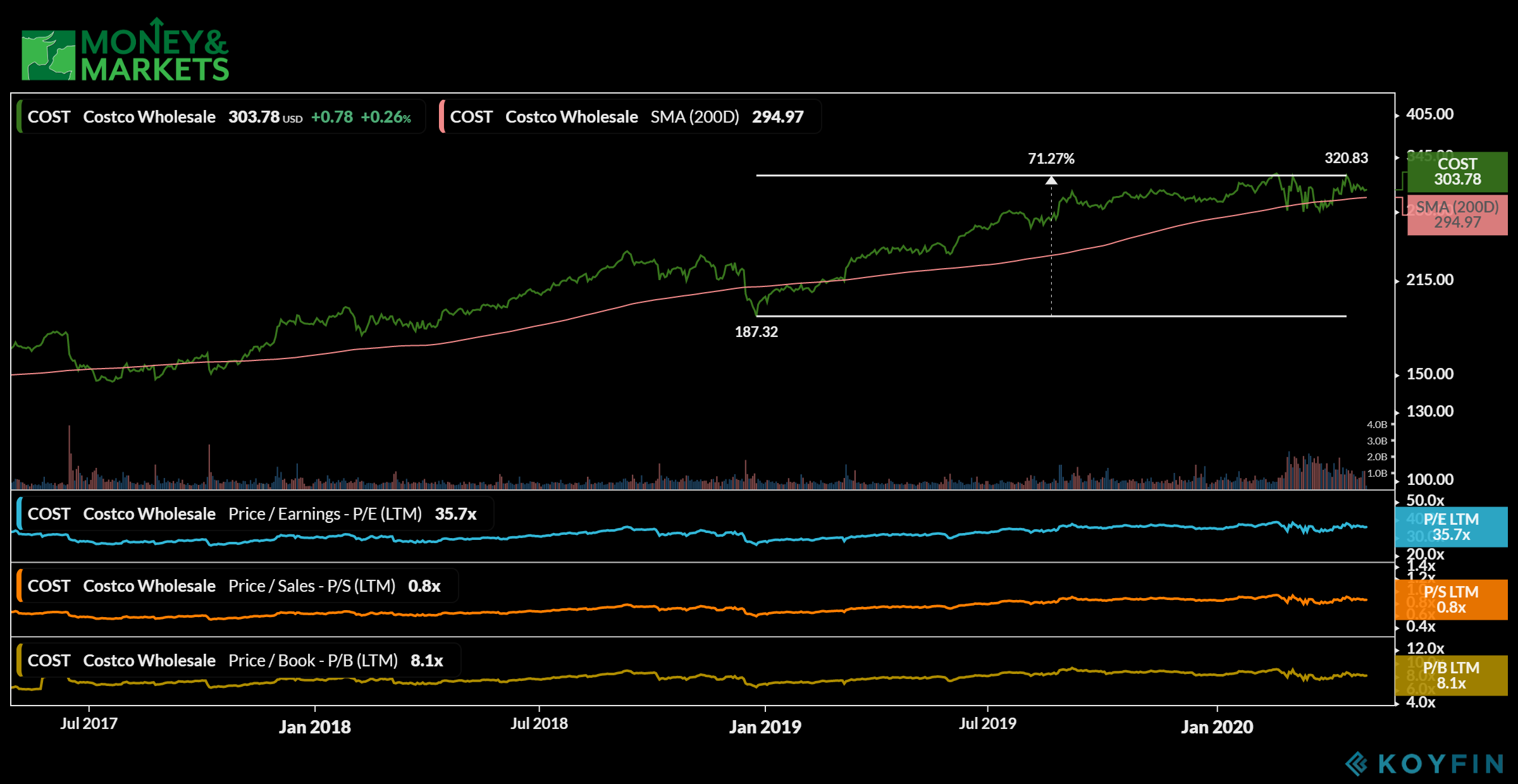

Unlike the other two companies on our list, Costco has continued to show growth, even when the rest of the market trended down.

From December 2019 to April 2020, Costco stock has risen by more than 71%. It is one of the few equities still trading above its 200-day moving average.

But Costco is the most expensive company on this list, trading around $303 per share. However, the company remains a bargain with a price to earnings of 35.7, a price to sales of 0.8 and a price to book of 8.1.

The other benefit of owning Costco stock is its quarterly dividend. At the end of April 2020, the company paid a dividend of $0.70 per share — an actual increase from its February 2020 dividend payment.

And that dividend has steadily increased the last two years.

Because of its consistent dividend and continued upward mobility, Costco Wholesale is one of the service sector stocks to buy when the lockdown ends.

So, here you have a list of companies that range in what they provide. But they all provide something that isn’t going away — no matter if there continues to be a lockdown or not.

And they all are showing signs of continued growth and solid dividend payments for investors.

That’s why they are the service sector stocks to buy when the lockdown ends.