If you’re like me, the older you get, the more you start to think about your overall health.

This includes the food we eat.

Processed foods with additives and preservatives are cheaper, but consumers have bought more natural and organic food than ever in recent years.

Take a look:

This chart shows the value of packaged organic foods that Americans buy.

The value of packaged organic food consumed in the U.S. will jump 42.7% from 2016 to this year.

And this trend will continue to gain popularity.

Today’s Power Stock is a leader in the organic food space: Sprouts Farmers Market Inc. (Nasdaq: SFM).

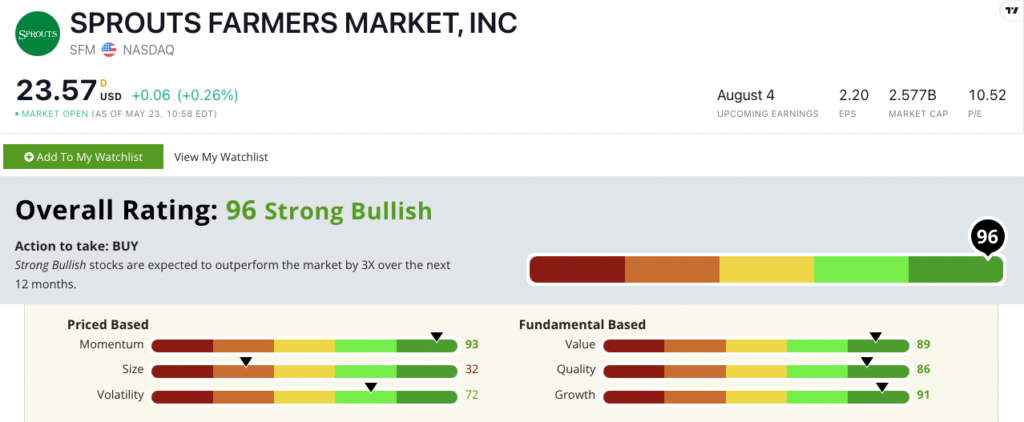

SFM Stock Power Ratings in May 2022.

Sprouts operates 379 organic grocery stores in 23 states. It sells fresh, organic food including produce, meat, seafood and dairy.

Sprouts’ stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SFM Stock: Organic Grocer With Excellent Growth & Value

Researching SFM stock, I discovered two items of note:

- Despite inflation raising the price of groceries, Sprouts recorded net sales of $1.6 billion in the first quarter of 2022 — a 4% increase year-over-year.

- In its quarterly report in April, the company noted it plans to open 15 to 20 new stores this year.

Shoppers looking for more organic grocery options turn to Sprouts. Since 2002, the company has set itself apart as a leader in providing consumers with natural foods.

You might not think of grocery stocks as growth stocks, but growth drives Sprouts’ overall Stock Power Rating, as you can see above.

Despite rampant inflation in the U.S., the company registered 4.1% growth in sales and 12.8% growth in earnings per share in the first quarter of 2022.

It earns SFM a “Strong Bullish” 91 on our growth metric.

SFM is a terrific value at today’s price, with price-to-earnings at 10.8 — a much better deal than the food and beverage retail average of 14.8.

Its price-to-sales ratio is 0.4, while its peers average 0.7. This tells us SFM is a better value than other grocery stores.

SFM reached a 52-week high in April. After revising its full-year guidance, however, the stock tumbled along with the rest of the market.

The guidance suggests Sprouts will still grow in 2022 — but at a slower pace due to inflation.

Remember, though: It’s growing even with those headwinds.

Over the last 12 months, SFM stock is down 7.7% — but it outperforms other consumer non-cyclical stocks, which are down 15% in the same time.

Sprouts Farmers Market Inc. stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

As organic foods get even more popular in the U.S., this growth will pay off for Sprouts … and for its investors.

Stay Tuned: Crude Oil Stock Looks Like an Excellent Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top crude oil stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? You can reach my team and me at Feedback@MoneyandMarkets.com.