Consumers have been shopping online for years. When the pandemic shut down brick-and-mortar stores, the trend to online shopping accelerated.

Many analysts highlighted some of the side effects associated with this “new economy” trend. The most popular storyline involves the adverse impact on retail property. Online competition forced many national chains into bankruptcy.

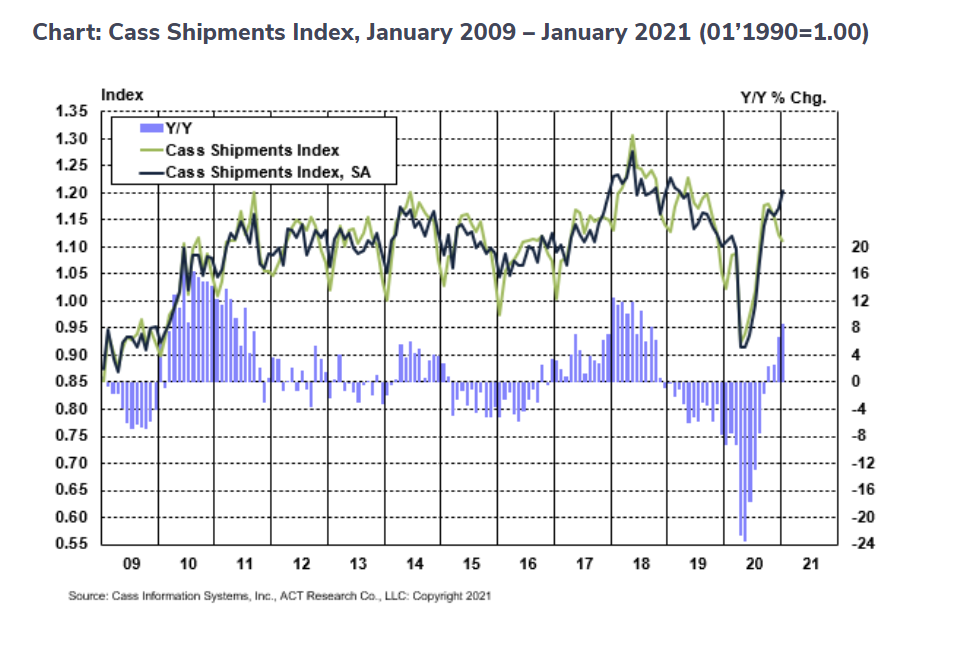

Less recognized was the positive impact online shopping has on the shipping industry. All those boxes from Amazon, Chewy.com and other online retailers need to be delivered. The increased demand for shipping can be seen in the chart below.

Shipping Cost Reaches 2-Year High

Source: Cass.

Shipping Is an Overlooked Inflationary Pressure

Cass Freight Indexes use data from Cass Information Systems, a company that works with hundreds of shipping companies. The index includes data from truckers, railroads and air freight companies. It reflects information derived from about 33 million invoices that Cass processes.

The shipments component of the index increased 8.6% compared to January 2020, reaching its highest level since January 2019.

Based on the data, Cass found shipping rates are up 10.1% compared to a year ago. Many shipping contracts reset annually, so price increases for many companies lock for the rest of the year.

Online retailers have often absorbed the shipping cost in the short run to increase customer loyalty in the long run. Higher freight costs indicate some retailers may be forced to pass along some of the costs to consumers.

Shipping costs can have a relatively large impact on consumer prices. Shipping from retailers to consumers is just one step in the supply chain. Retailers also incur costs paid to move products from manufacturers to distribution centers. Manufacturers pay shipping costs for raw materials, and there could be several intermediate steps for manufacturing.

The cost of shipping is another inflationary pressure building up in the supply chain, one that many investors and economists might be overlooking in the new economy.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.