Shopify Inc. (NYSE: SHOP) has become the e-commerce platform of choice for many small business owners looking to sell online. But does that make Shopify stock a buy as online retail becomes the new norm?

If you’re an investor looking to get into the e-commerce game, Shopify has to be on your list of stocks to watch.

The company’s platform has become increasingly popular over the past decade, as it offers small businesses and entrepreneurs a quick and efficient way to get their products out into the world.

Now is the perfect time to learn more about this innovative company and what it can do for your investments.

Let’s learn what it’s all about and run Shopify stock through our proprietary Stock Power Ratings system.

What Is Shopify?

Shopify is an e-commerce platform that provides everything from hosting, payment processing and customer support in one simple package.

It’s designed to make setting up an online store easy and efficient — and it works!

As of 2023, more than 4.4 million websites around the world use Shopify in some capacity.

In 2021, the company processed $79.5 billion in order value, according to Demand Sage.

It doesn’t take long to see why so many people are turning to Shopify for their business needs.

And it offers additional services such as marketing tools, social media integration and shipping options that make running a business even easier.

Does that mean Shopify stock will benefit from massive growth this year?

The Outlook for 2023

Like many other tech-based stocks, 2022 was tough for SHOP. After peaking at an all-time high in November 2021, the stock crashed 86%!

But the company’s platform continues to grow at an impressive rate; in fact, analysts predict that by the end of 2023 its market share will be around 15%, making it one of the most popular e-commerce solutions out there.

Furthermore, its mobile app is expected to see continued success as more consumers opt for shopping on their phones.

To see how Shopify stock is set to perform over the next 12 months, let’s look at its Stock Power Ratings.

Shopify Stock Power Ratings

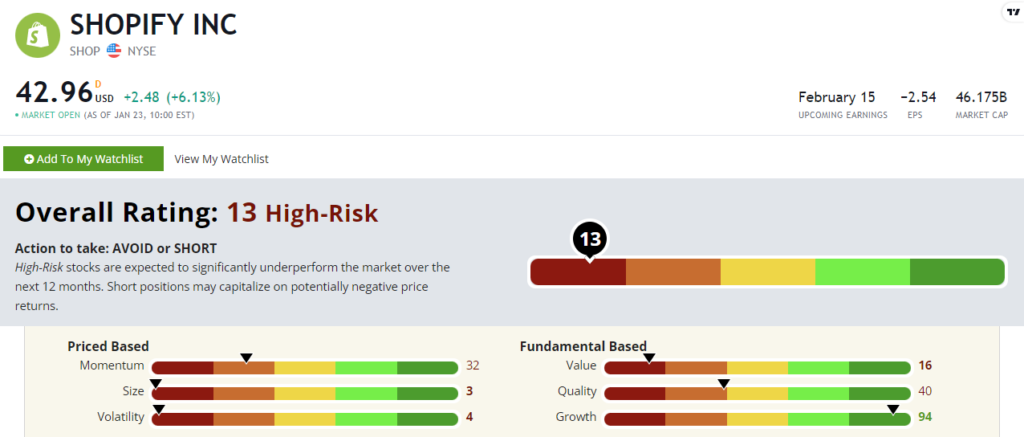

Shopify stock rates a “High-Risk” 13 out of 100. That means our system expects the stock to underperform the broader market over the next 12 months!

Over the last five years, SHOP’s revenue has grown 55.2% per year. That crushes the U.S. Software Application industry’s average of 32.8%. That’s partly why it scores a 94 out of 100 on our growth factor.

But Shopify stock’s ratings are in the red in our five other factors. I mentioned its massive loss of value over the last year or so. That’s contributed to its low momentum (32) and volatility (4) factor scores.

It’s also a massive company after so much growth within the e-commerce space. With a market cap above $54 billion as I write, SHOP is approaching mega-cap status. It’s going to take a ton of capital to move this stock’s price needle.

Bottom line: Tech stocks are in a bit of a resurgence to start the new year.

But Shopify stock rates as a “High-Risk” within our system.