I went to a movie for the first time in at least 18 months this past weekend. I took my kids to see Black Widow, the newest installment of the Marvel Cinematic Universe.

The movie was average. But the experience was great.

After such a long stretch, it felt almost naughty to stare at the big screen and let the popcorn dribble off my chin like a total slob. Even the excessive 20 minutes of trailers and commercials felt great.

I think about this as I ponder the recent price performance of AMC Entertainment Holdings Inc. (NYSE: AMC).

AMC’s Rise and Fall

Few companies got zinged as badly by pandemic-era closures as movie theater chains. And few stocks have enjoyed as big of a trading frenzy in the “meme stock” wars.

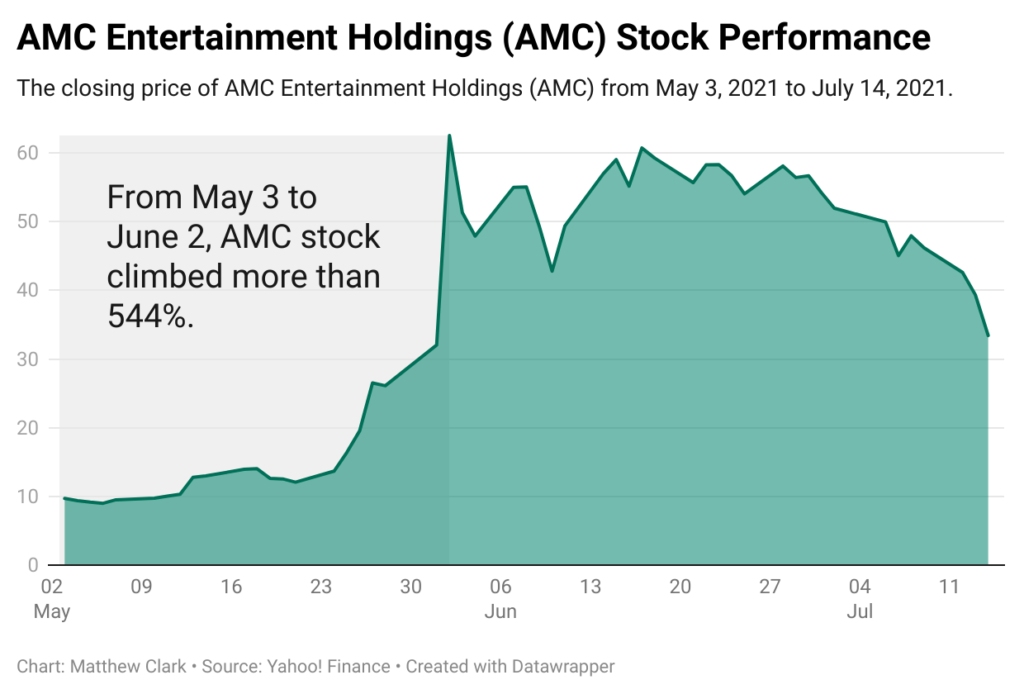

For most of May, AMC was trading at less than $10 per share. At one point in June, the stock touched $62 per share, meaning it rose by more than a factor of five in a matter of weeks. As I write this, it’s trading around $35 per share, down by more than 40%from the recent highs.

Even after losing almost half its value, AMC’s share price is well above pre-COVID levels. At the end of 2019, the stock was trading at about $7 per share.

Lest we forget, the movie business wasn’t in great shape even before the pandemic. High ticket prices, large-screen TVs and fantastic viewing options on Netflix and other streaming services keep a lot of viewers out of theaters. AMC’s shares had been trending lower since early 2015.

Today, there is no guarantee that movie theaters will ever rebound to their heyday in decades past. While I like going to the theater, it’s more nostalgia than anything else. I’d just as soon watch most movies at home to avoid dealing with crowds and crying babies.

Yet somehow, in the logic of the meme stock wars, AMC is now trading at prices far higher than it did before COVID-19.

What Is a Meme Stock?

If you’re not up on current trading lingo — and let me tell you if you don’t know what a meme stock is, I’m jealous — I can take a minute to explain.

A meme stock is a company with a sudden uptick in trading volume fueled by retail investors on social media. It could be an influential tweet from Elon Musk or a post on Reddit that goes viral. Any number of things can spark initial interest, but all of the meme stocks have a few things in common:

- Trading is driven primarily by smaller retail investors acting in concert.

- Social media is the tie that binds retail investors together.

- There’s little in the way of fundamental news driving the price movements. Many of the stocks involved are facing financial distress (AMC is carrying $5.5 billion in debt right now, for crying out loud).

- Often, though not always, professional investors target these stocks as short opportunities. (Think back to the GameStop short squeeze at the beginning of this year.)

It’s Tough to Ignore Meme Stock Gains

Now, you know me. I’m the stodgy dividend guy. But I’m not going to tell you to steer clear of meme stocks. If you love the thrill of trading, this is where the action is. By all means, knock yourself out trading them.

Now, you know me. I’m the stodgy dividend guy. But I’m not going to tell you to steer clear of meme stocks. If you love the thrill of trading, this is where the action is. By all means, knock yourself out trading them.

Just don’t do it with your serious money. Do it with your play money … the cash you’d be comfortable using for a trip to Vegas or a Super Bowl bet.

Here’s why.

When you trade a meme stock, there is almost no fundamental basis for the investment. So, how do you know when to buy or sell?

It’s fine to jump on the bandwagon and ride a hot momentum stock higher. My friend and colleague Adam O’Dell has made a career out of identifying trends and following them.

But Adam only trades when he has a system in place, and you’d be smart to follow his lead there. You should have clear criteria in place for what to buy, when to buy it and — perhaps even more importantly — when to sell.

Most of the retail investors trading AMC, GameStop or any number of the other meme stocks go into the trades without a plan. And many of them will get burned as a result.

So…

If you want to trade meme stocks, go right ahead. Have fun! Trading is supposed to get your blood pumping, after all.

Just be smart about it. Don’t enter one of these trades unless you have a plan in place on when and how to exit.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.