As some stocks reach extreme valuations, you may be wondering if it’s time to take some profits.

That’s a reasonable thought after the recent market tear we’ve experienced begins to dip.

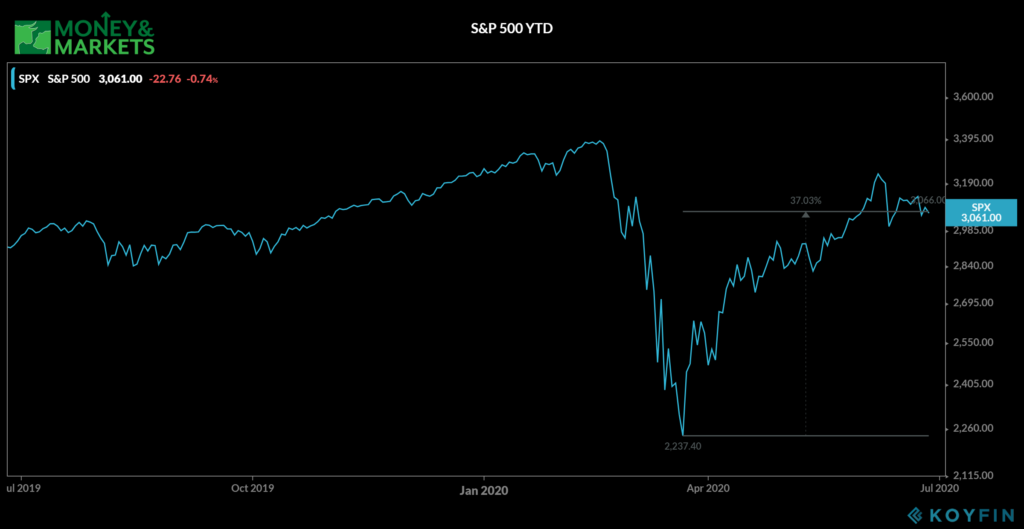

The S&P 500 has rallied 37% off its March 23 low. Seeing rapid gains like this would probably have any investor wondering when it’s the right time to get out.

That’s why you shouldn’t be afraid to take some profits here and there.

The key is to be smart about it. If you have a stock that has surged from its March lows to ridiculous levels, it may be time to sell at least some of your position.

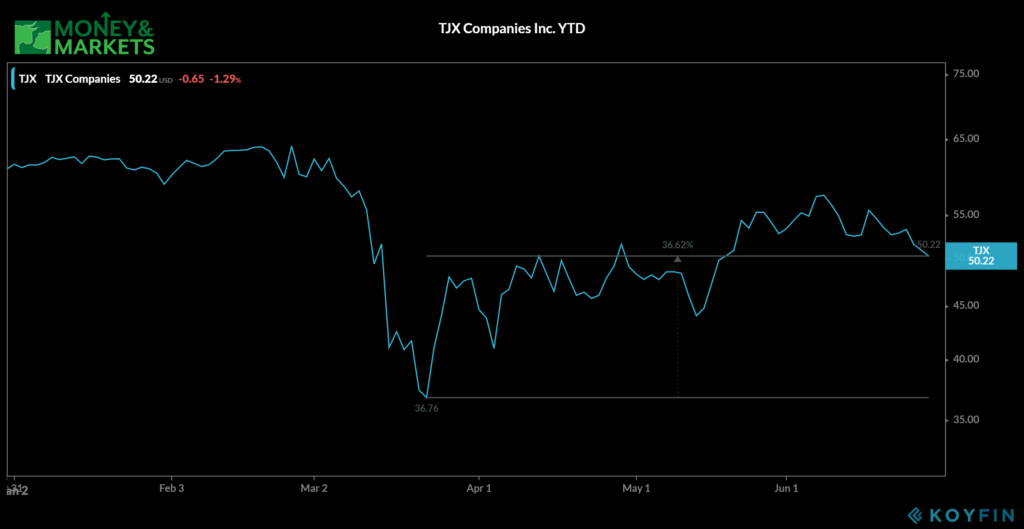

Banyan Hill Publishing’s Jeff Yastine gave a perfect example with TJX Companies Inc. (NYSE: TJX) in a recent video.

The discount retailer surged over 36% since March 23. Its price-earnings ratio has soared from 13 to over 36 as well. That’s the highest valuation TJX has ever traded at.

And it only took three months.

Investors have been jumping into so-called “recovery stocks” as the stock market continues to drive upward.

But beware.

Yastine warns not to fall into the trap of buying into what’s hot at the wrong time.

“This is a common mistake for many investors, especially when new to the stock market,” said Yastine, Editor of “So we all have to learn this one the hard way.”

TJX was a great buy a couple of months ago when it was still running up. But that may not be the case anymore as its valuation has soared.

“We all like to buy the hot stocks, the ones that are fashionable to own and that people have already made money with,” Yastine wrote via email. “Unfortunately, we often only buy them when the stocks have already moved to extreme highs — meaning their valuations are stretched as well, relative to the profits the company earns (presuming it actually has profits to begin with — many tech stocks do not).”

Yastine says to watch out for trap stocks like TJX and others that have run up big in a short amount of time.

“Soon enough, a good excuse comes along for lots of traders to sell — with plenty of new investors left holding the bag with their new ‘underwater’ stock purchases,” Yastine wrote.

And while you should avoid trap stocks like TJX, it may be in your best interest to take some profits on others that have surged.

And it doesn’t have to be a drastic move.

You may have snagged a stock at a major discount that got a little too hot, too fast. Sell off some shares to take profits while keeping the rest of your investment intact.

The fact is, this is a wild market environment with a lot of volatile swings. Its likely to stay volatile while the novel coronavirus continues to affect market sentiment.

While the rally has been great for a lot of stocks, this isn’t the most comfortable market environment. Taking some profits may be in your best interest if you are worried about where the stock market will head next.

If you want to see more about Yastine’s take on TJX and where the stock market is heading, check out his latest video below, and be sure to subscribe to his YouTube channel.