The ongoing and record-long government shutdown has unveiled how few Americans are financially prepared for the next recession and even worse, how highly vulnerable many people are with few protections in place.

A full 10 years after the Great Recession, the recovery we’ve had also has left millions of people behind with little to no savings. And according to MarketWatch’s Sven Henrich, the shutdown is a preview for what’s about to happen once unemployment starts creeping up from its near-50-year lows.

Per MarketWatch:

Within just a few weeks into the government shutdown, people are struggling to cope. We hear stories about people turning to food banks to feed their families. We hear stories about people who are in dire straits because they can’t get loans. We hear stories about people who can’t pay their mortgages. That’s not even one month into the shutdown.

Why do a few weeks without pay turn into a crisis for many families? Simple: Nearly 80% of Americans live paycheck to paycheck. That’s a problem when you have little to no savings. In fact, it’s akin to playing financial Russian roulette.

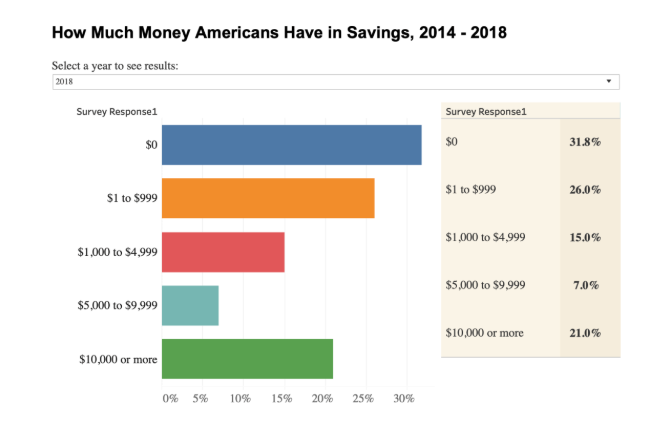

And the problem is terrifyingly pervasive. According to a recent GoBankingRates survey, only 21% of Americans have more than $10,000 in savings, with nearly 60% having less than $1,000 in savings:

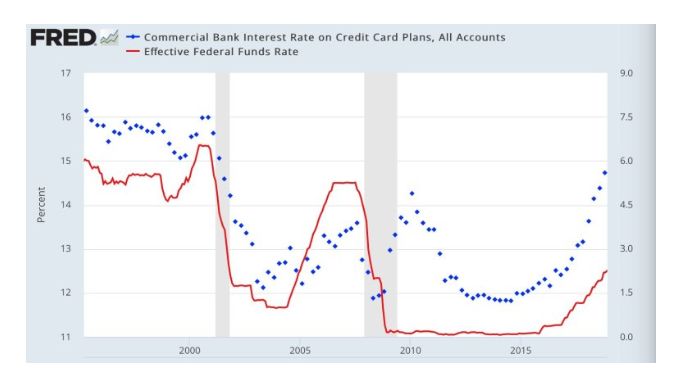

This savings-free game of complacency works as long as people have a steady paycheck coming in and as long as interest rates stay low. But they are not staying low, even though the Federal Reserve may be patient again this year, as it has proclaimed in recent days.

As a matter of fact, the cost of carrying debt, especially the revolving credit-card type, have exploded higher since the Fed tempered rate increases. Think I’m exaggerating? How about this: Interest rates on credit cards by commercial banks are now as high as they were in 2000:

How far can families go if one or two income earners lose their jobs? With nearly 60% of Americans having less than $1,000 in savings and the next 15% having less than $5,000, I submit: Not very far.

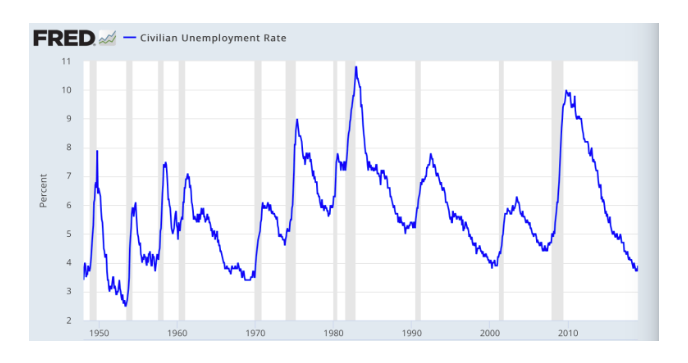

The unemployment rate, thankfully, is at decades-long lows. That’s the good news — as long as it stays that way.

But here’s the problem: Every economic cycle ends, despite the rosy attestations of those who wish to keep confidence high. There is nothing in history that suggests that extremely low unemployment can be maintained for an extended period:

Indeed, it is precisely at the end of an economic cycle that low unemployment rates tend to reverse rather suddenly.

And when they do, recessions soon follow and generally tend to produce unemployment rates between 6%-10%. The data show that most Americans will be in big trouble during the next recession.

The government shutdown exposes this vulnerability. Fortunately for those affected by the shutdown, they have back pay to look forward to when the shutdown ends. The future unemployed will not have any such certainty, and with little to no savings to fall back on, they are playing with fire, betting on the second-longest expansion to continue indefinitely.

America has added record debt over the past 10 years while financing its recovery with low rates, yet all this spending has done little for the wealth of the general population. Most are left woefully unprepared for when the recovery ends.