I’m a data nerd. I pore over charts and graphs because data tells a story without opinion or subjectivity.

And this chart blew my mind:

Even if you know nothing about data storage, the astronomical growth is clear.

In 2020, the world created and stored 64.2 zettabytes (64.2 billion terabytes) of data.

By 2025, that will jump a massive 181%.

But where will all that data go?

We’ll need to store it.

That leads me to today’s Power Stock: Silicon Motion Technology Corp. (Nasdaq: SIMO).

Hong Kong-based SIMO designs, develops and sells controllers used in solid-state data storage drives. (You’ll find these in computers, data centers and smartphones.)

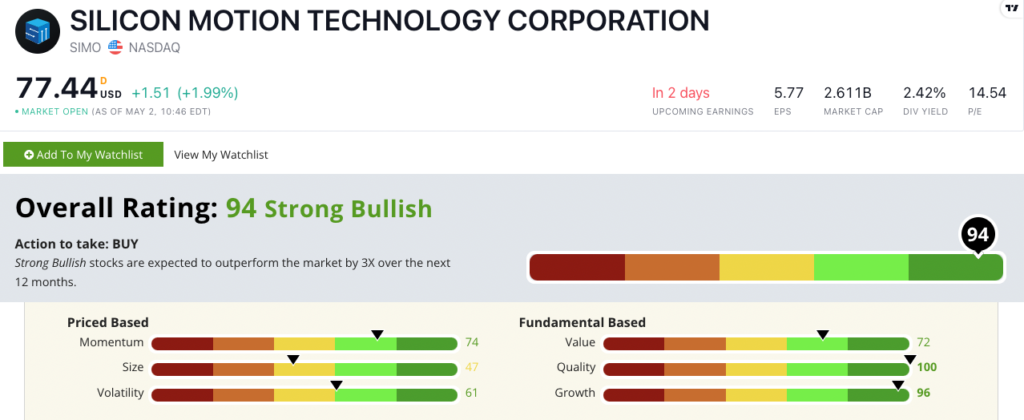

Silicon Motion scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SIMO Stock: Outstanding Quality and Growth Potential

Two highlights I found when I researched SIMO:

- Last year’s net sales were $922.1 million — up 71% over 2020 sales. SIMO had an incredible year.

- SIMO set records for its full-year revenue and earnings per share.

SIMO’s quality is unmatched. It scores a perfect 100 on the metric, as you can see from its Stock Power Rating above!

The company’s returns on assets of 23.4% eclipse its industry peer average of negative 1.6%.

SIMO’s return on investment of 32.5% crushes its peer average of 4%.

Its annual sales growth rate was 71%, while its earnings-per-share growth rate was 150.8%.

And it’s carried that performance into 2022. SIMO notched an earnings-per-share growth rate of 999% and a sales growth rate of 84% in the first quarter, compared with the same period last year.

SIMO earns a 96 on our growth metric — putting it in the top 4% of stocks in our universe on the metric.

The chart above shows SIMO’s downturn from its January 2022 high as investors sold out of tech stocks.

Another market sell-off at the end of April pushed the stock down, but it shows signs of a rebound.

For the last 12 months, SIMO is still up 12.1%, while the broader technology industry is down 4.5%.

Silicon Motion stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The company had an outstanding 2021, and I believe its performance will get stronger in the years ahead.

Bonus: SIMO’s forward dividend yield is 2.44%. It pays shareholders $1.85 per share per year to own SIMO stock.

Stay Tuned: Ride a New Wave of Robotics

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an automation and robotics company that grew over 70% … just last quarter.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got questions or a request for my team and me? You can reach us anytime at Feedback@MoneyandMarkets.com!