Researching stocks last week, I read about glass manufacturing.

I learned that a main component of glass is a chemical known as sodium carbonate, or soda ash.

Soda ash is derived from a mineral called trona — a mix of sodium carbonate, sodium bicarbonate and water. You’ll find it in the Green River Basin of Wyoming.

Soda ash is used in dry laundry detergents, paper and baking soda.

Soda ash production declined from 2017 to 2020 (as shown in the chart above).

However, in 2021, production ramped back up and reached a four-year high.

I have high conviction that this trend is just getting started.

Today’s Power Stock is a major producer of soda ash: Sisecam Resources LP (NYSE: SIRE).

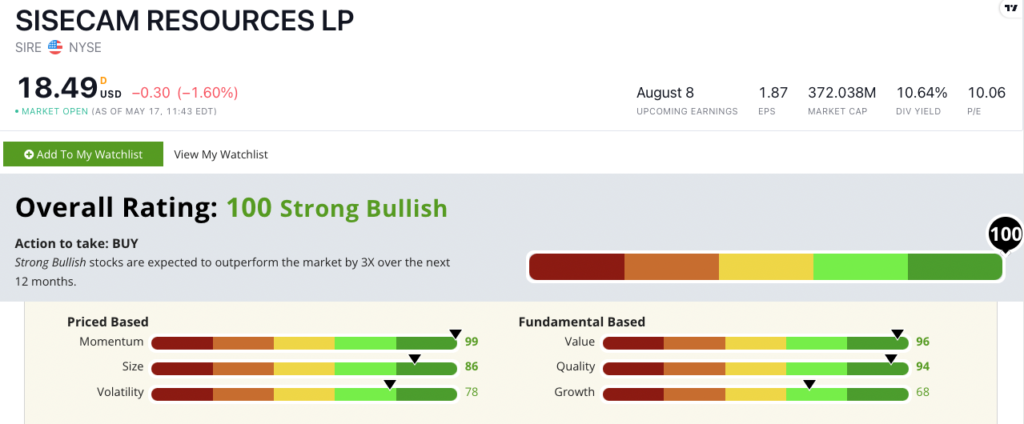

SIRE Stock Power Ratings in May 2022.

SIRE mines trona ore, produces soda ash and sells the final product in the U.S. and abroad.

The company owns 23,500 acres of mining land in the Green River Basin.

In February, it changed its name from Ciner Resources to Sisecam.

SIRE scores a “Strong Bullish” 100 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SIRE Stock: Excellent Value + Solid Quality

Two items stood out in my research:

- In the first quarter of 2022, the company increased its net sales by 27.9% over the prior year’s first quarter.

- The company increased its net income by a massive 467.9% to $31.8 million from the first quarter of 2021!

SIRE stock is a terrific value at today’s prices. Its price-to-sales ratio is a super low 0.65, while its mining peers average an inflated 40.44.

The company’s price-to-cash flow is also well below the industry average.

These figures earn SIRE a 96 on our Stock Power Ratings system value metric — putting it in the top 4% of all stocks we rate!

As for quality, the company scores a 94 on that metric, thanks to positive returns on equity and investments and a 23.4% gross margin.

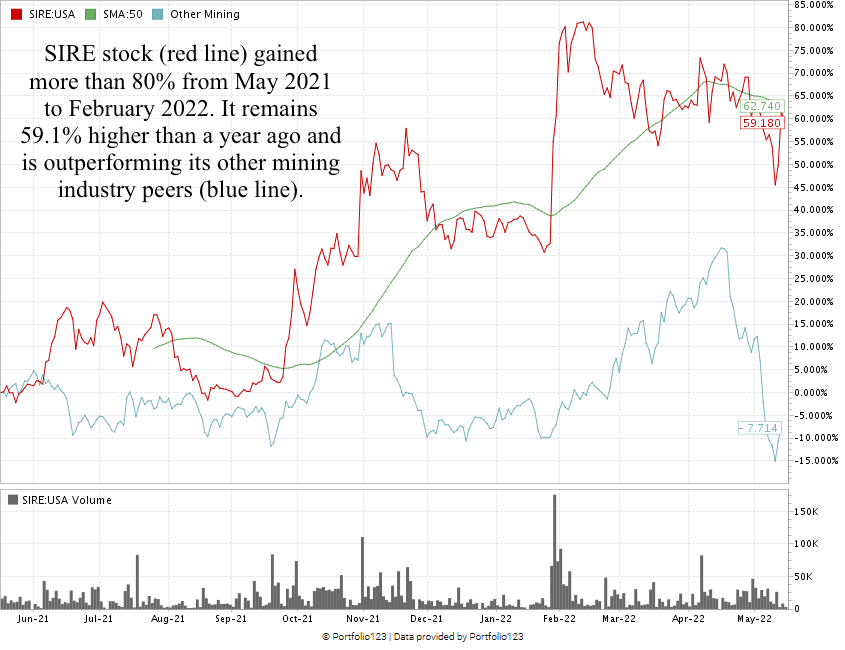

As you can see above, SIRE climbed more than 80% from May 2021 to February 2022 to reach a 52-week high.

Although those gains pared back in the past three months, it remains 59.1% higher than it was a year ago. SIRE’s performance beats its peers’ by a wide margin — other stocks in the industry are down an average of 7.7%.

The stock is closing in on its 50-day moving average (the green line in the chart above).

Sisecam Resources LP stock scores a perfect 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

SIRE mines and produces a necessary component of everyday items including detergent, glass and even paper. It delivers on a need across a wide range of industries, making it essential.

Bonus: The company’s forward dividend yield is an excellent 10.64%, meaning shareholders earn an additional $2 per share, per year to hold the stock.

Stay Tuned: Oil & Gas Power Stock Rates 95

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an energy stock that’s up triple digits in the last year — and has plenty of room to run!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment for my team and me? Reach us anytime at Feedback@MoneyandMarkets.com!