With dividend stocks, boring is beautiful.

It makes perfect sense to accept the risk of a wildly cyclical business if you’re looking for market-crushing capital gains. That comes with the turf.

But for a long-term income holding, consistency is the single most important factor. You don’t want risk if you’re just looking for a steady 3% to 6% in income.

So, with that in mind, let’s take a look at the J.M. Smucker Company (NYSE: SJM). Smucker is best known for jams and jellies. But the company does a lot more than that. It also owns the Folger’s and Dunkin’ coffee brands, Jif peanut butter, Carnation condensed milk and other consumer food and snack brands. It also owns a host of pet products, including Meow Mix, Kibbles ‘n Bits, Milk-Bone and several other popular brands.

At first glance, coffee, jam and dog food don’t have a lot in common; but, they are all basic consumer staples with steady demand. The unemployment rate or GDP growth isn’t likely to affect how much jam you spread on your toast, how much coffee you drink or how many treats you feed your dog.

This rock-solid consistency allows Smucker to raise its dividend with the precision of a Swiss watch. It’s raised its payout every year since 2002. Over the past 10 years, the stock has compounded its dividend growth rate at 7.2% per year, which was enough to more than double the payout since 2010. At current prices, Smucker yields just north of 3%.

Three percent isn’t a monster yield by any stretch. But it is competitive in this market, and importantly, it consistently grows at well over the rate of inflation. And, with a dividend payout ratio of just 45%, there is plenty of room for further growth.

Let’s see how Smucker stacks up on our Green Zone Ratings model.

J.M. Smucker’s Stock Rating

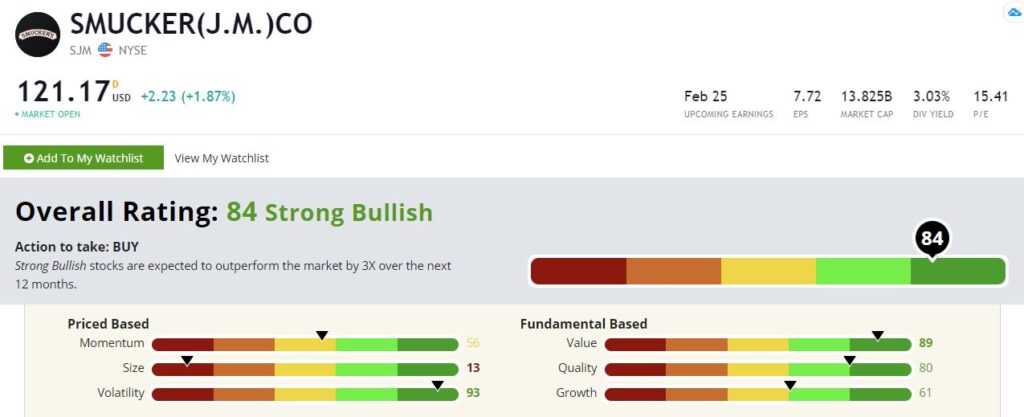

At first glance, J.M. Smucker stock looks well-positioned for gains to go along with its solid dividend. It rates an 84 out of 100 in our system. “Strong bullish” stocks (rated 81-100) should outperform the market by three times over the following 12 months, according to our research.

J.M. Smucker’s Green Zone Rating on January 26, 2021.

Let’s break it down further.

Volatility — As we would hope to see in a good long-term dividend stock, SJM rates exceptionally well based on volatility, coming in at 93. This means that Smucker is less volatile than 93% of all stocks in our universe based on our metrics. You don’t want to suffer through wild price swings in pursuit of a 3% yield.

Value — SJM also rates highly on value, rating at 89. By our metrics, Smucker is cheaper than almost 90% of all stocks we rate. That hasn’t mattered for much in the growth-centered markets of the past several months. But early signs in 2021 point to a possible shift in preferences from growth to value, which should benefit cheap stocks like SJM.

Quality — SJM is a high-quality stock, coming in at 80. We measure quality objectively based on a number of metrics mostly centered on balance sheet strength and profitability. Smucker maintains low leverage and consistently generates healthy margins due to its strong branding. This is the definition of a high-quality company.

Growth — This is by no means a hyper-growth company. Smucker sells jam, coffee and dog food, for crying out loud. All the same, it rates firmly in the top half with a growth rating of 61. Not bad for a boring dividend stock like SJM.

Momentum — Smucker falls into the middle of the pack in terms of momentum, rating a 56. This is to be expected. The past several years favored tech and hyper-growth names. The fact that a consumer staple like Smucker makes the top half based on momentum is actually pretty impressive.

Size — We’re not going to get much of a small-cap bounce from SJM, alas. As a $13 billion company by market cap, it rates a 13 out of 100 based on size.

Bottom line: J.M. Smucker looks like a nice dividend stock to hold for the long-haul. This is a stock you can buy, dump in a drawer and forget about for years with no real stress or headache. The fact that SJM could triple overall market gains over the next year is just gravy … or maybe jam.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.