The initial public offering “pop” is described as the short-term boost in a stock price a company received after launching an IPO.

Most, if not all companies, get it and it usually leads to sharp declines in price immediately thereafter.

A lot of companies factor in the “pop” when they price their IPO, and it can provide some confidence among long-term investors. But the drawback is simple: the price of the IPO goes down … a lot.

Uber, for example, told investors its IPO could be priced between $48 and $55 a share, but after the “pop,” those shares dipped below $45.

The Commonality of the “Pop”

Jay Ritter, a finance professor at the University of Florida, found that IPO “pops” are not uncommon. His data found that, in 1999, stock closed up 71% over its initial IPO price. That increase was about 56% the following year.

However, companies releasing IPOs in those two years lost nearly $67 billion collectively following those first-day “pops,” according to Business Insider.

Slack Technologies Inc., whose IPO released today, has done things a little differently.

Similar to Spotify, Slack decided to allow employees and initial investors sell their shares on the public market. This varies from traditional lPOs who go through institutional investors. What typically happens is there is no “pop” priced in, and the price the shares are sold on the public market initially is the price the company sells its shares openly.

Slack Is Doing Other Things Differently

Traditionally, the relationship between investors and a company launching an IPO is handled by underwriters.

However, Slack is handling all of the official relationship management, according to Business Insider.

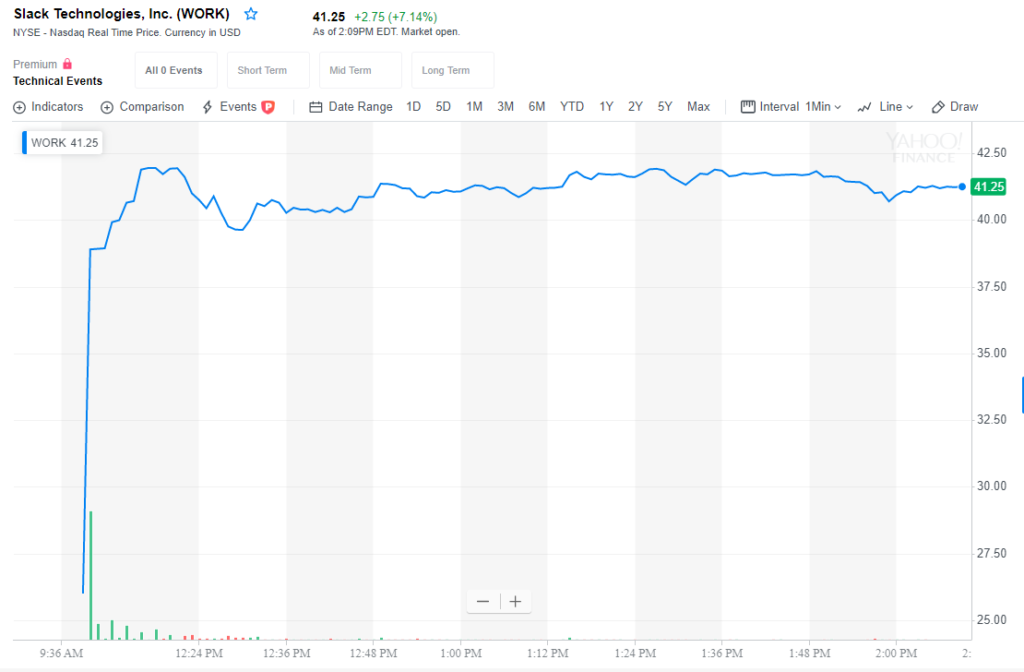

Advisers to Slack have also looked closely at the New York Stock Exchange’s reference price, which was set at $26 per share on Wednesday.

Despite that, Slack’s opening price on the exchange was $38.50 per share, giving the company an early value of $19.5 billion. It climbed to more than $41 per share in early afternoon trading.

In simple terms, what Slack and its advisory team did was take buy and sell orders Thursday morning to determine the initial price of the stock, rather than set the price themselves.

It also turns the focus to humans to set the price. Designated market makers will play a critical role in directing the IPO price, rather than relying on a more digital option.

There Is A Risk

Now, don’t go thinking that because Slack is doing things differently, their IPO is on solid ground.

One big risk to a direct listing, as it is called, is that there are no new shares issued and no bank underwriters. That means there is less information available to potential investors, thus a risk of significant price swings.

“You don’t necessarily know the number of shares coming to market and you don’t really have an exact sense of the price that investors are looking to pay for the shares,” Joe Mecane, head of execution services at Citadel Securities, told Business Insider. “That puts additional focus on opening up the stock.”

The last, and first, direct listing for the NYSE was done by Spotify. According to Business Insider, the NYSE set a reference price of $132. The following day, Citadel Securities — the same company handling Slack’s direct listing — opened the price at $165.90. By the end of trading its first day, Spotify shares had dropped to $149.01.

That price has held relatively firm as the company is currently trading at $149.87 through Thursday afternoon.

That said, Slack will likely see its IPO price drop, but because it is a solid brand and there is not really a big need for the company to raise a lot of cash, that “pop” will likely be minimal, especially compared to the tech “pops” seen in 1999 and 2000.

Only time will tell the full story.

Editor’s Note: There have been a lot of big-name IPOs in the last two years that have started strong, only to fall flat. Does Slack’s method of a direct listing make it more enticing for you to invest in? Why or why not? Leave us a comment below.