The S&P 500 and the Nasdaq 100 are the two most-closely watched U.S. stocks indexes.

But just behind them is the Russell 2000, a “small-cap” index.

Investors should pay attention to small-cap stocks for two reasons.

- Academic research has proven well the “size premium,” whereby smaller companies tend to outperform larger companies. We’ll get into why that’s the case in just a bit.

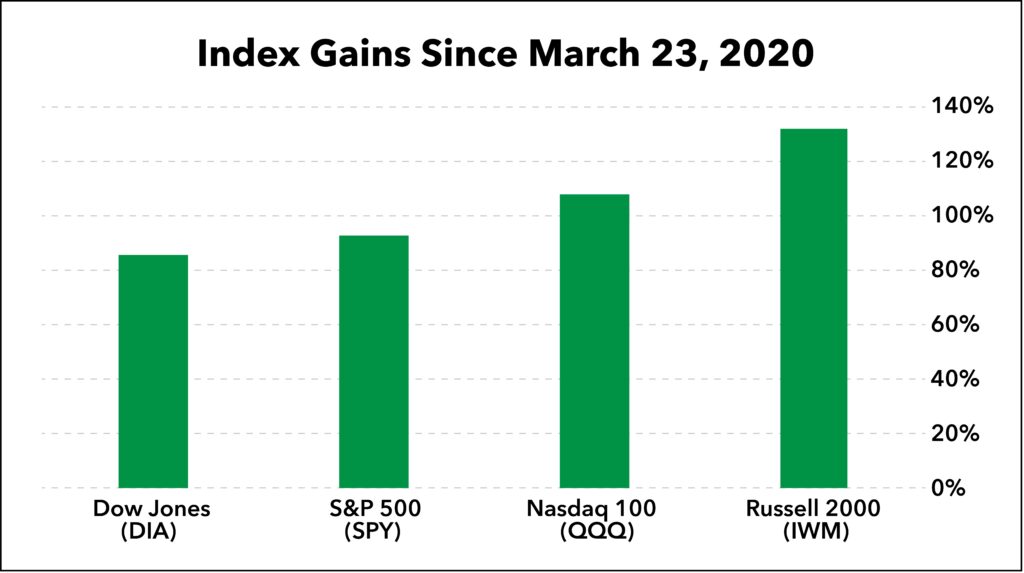

- Small-cap stocks have been one of the strongest performing slices of the market since the March 2020 bottom. The Dow Jones Industrial Average (DIA) is up 86% … the S&P 500 (SPY) has gained 93% … and the Nasdaq 100 (QQQ) is up 108% since the March 23, 2020 low. Meanwhile, the small-cap Russell 2000 (IWM) is leading them all with a 132% return!

Now, the specific mix of stocks that make up that Russell 2000 Index isn’t the same today as it was over the past 12 months.

See, the small-cap Russell 2000 Index, along with its sister large-cap Russell 1000 Index … rebalances once a year, between May and June.

Some of last year’s small-cap stocks have grown so large that they “graduate” up to the large-cap index.

And some of last year’s “micro-cap” stocks — which were too small to be considered “small-cap” — also grew larger and now make the cutoff to be included in the Russell 2000.

And of course, stocks that went public in the last 12 months — whether by a traditional IPO, or by the now-popular SPAC avenue — are eligible for inclusion, if they meet each index’s size criteria.

“Small” Is Bigger These Days

Interestingly, the size cut-off that separates the “small-cap” and “large-cap” universes has increased. Last year, a $3 billion market-cap branded a company as large-cap. This year, that level increased to $5.2 billion.

This is largely a reflection of how well stocks have performed over the last 12 months. The total market cap of the 3,000 companies that make up the Russell 2000 and Russell 1000 grew from $31.4 trillion at last year’s rebalance to $47.7 trillion this year.

The Russell 2000 Index alone grew from $1.9 trillion to $3.5 trillion — nearly a double, at +84%.

Notable changes to the Russell 2000 include:

- 45 companies dropped down from the large-cap Russell 1000.

- 52 companies graduated up from the Russell Microcap Index.

- 38 IPOs were added to the Russell 2000.

- 136 companies joined the Russell 2000 from outside the Russell indexes.

Meanwhile, there were 323 stocks that exited the Russell 2000 in June:

- 30 of them graduated up to the Russell 1000 Index.

- 286 companies dropped down to the Russell Microcap Index.

As you can see, some stocks “graduate” up as they become more successful and grow in size. And some stocks drop lower when they shrink or simply don’t keep pace with the overall market’s growth.

Russell 2000 Benefit No. 1: It “Fixes” a Small-Cap Risk Issue

Being added to the Russell indexes can be a huge boon for small-cap stocks.

As I mentioned, the academic literature proves that in aggregate a portfolio of smaller stocks will tend to outperform a portfolio of larger stocks.

That’s in large part because smaller stocks are generally riskier.

I’ve published the risks inherent in small-cap stocks before. But I’m highlighting two today because they are largely “corrected” when a small company is included in a well-known and respected index, like the Russell 2000.

- The shares may not qualify as “buyable” for large institutional investors with restrictive mandates.

- They garner less analyst attention and media coverage, decreasing transparency.

Russell 2000 Benefit No. 2: More Attention, More Potential Gains

You see, new entrants into the Russell 2000 get a shot at proving themselves on this widely-watched index. Inclusion in the index can bring with it a whole host of advantages, including increased coverage by Wall Street analysts and a wider pool of investor capital, some of which is constrained to invest only in the major indexes.

That is the case with one of the stocks we’re holding in the Green Zone Fortunes portfolio. My partner and Green Zone Fortunes co-editor, Charles Sizemore, and I recommended to our readers a small company that’s leading the way in the large-scale battery market.

We got our readers into the stock in early June. By the end of June, it was announced this stock was being added to the Russell 2000 small-cap index. And then, within a week of that, a Credit Suisse analyst began coverage on the stock, initiating it with an “Outperform” rating and a price target that’s nearly 50% higher than the price our subscribers paid.

As I told our readers in a weekly update video, this stock’s inclusion in the Russell 2000 will likely open up a massive pool of buyers — folks who aren’t willing or permitted to invest in stocks that are too small to be in the Russell 2000.

Knowing this, Charles and I were excited to see not one but two of our Green Zone Fortunes positions being added to the Russell 2000 this year. The battery company I just mentioned went public this year via a SPAC. The other company that’s being added is even smaller — its market cap is just over $400 million — and it’s a yet-to-be-discovered innovator in the commercial aquaculture industry.

All told, increased exposure to institutional investors and more coverage from analysts means these stocks won’t stay under the radar for much longer. But there’s still time to get into them now.

Click here to join us at Green Zone Fortunes and gain access to the detailed research my team and I have done on two of the newest entrants to the Russell 2000.

To good profits,

Adam O’Dell