Just moments ago, I released the latest revision of my free $5 Stocks to Watch Now report. (If you already signed up to receive the first, you should have it in your inbox now. But if you haven’t, go here to access it.)

Those following along know I started with a list of 298 stocks trading under $5 with potential based on my systematic analysis.

Due to a set of rules from the SEC, major institutions largely don’t trade these stocks. However, when they cross above $5, those rules are no longer a factor and they can buy with both hands.

That brings me back to the latest revision.

I’ve removed 171 of the stocks that were originally on the list. Over half of them.

Based on my analysis, not one of these 171 stocks is worth the $5 it takes to own a share of them.

How did I make this decision?

Quite simply, the stocks were flawed based on my Stock Power Ratings system.

We’ll break that down in just a minute…

But first, I want to show why I’m so focused on the small-cap space right now, and why you must be too if you want to outperform the market in the months and years to come.

Why the Small-Caps Buying Opportunity Is Now

To start, a simple and powerful fact.

Over the long arc of market history, small-cap stocks have outperformed large-cap stocks.

A large number of research studies on U.S. stocks, as well as foreign developed- and emerging-market stocks, have proved this.

Of course, U.S. large- and mega-cap stocks had a fantastic run during the latter half of the last bull market. And that’s why everyone I talk with seems unaware of the long-run advantage of buying smaller companies.

I’m on a mission to educate my readers on this advantage … and I’m biasing the portfolios I build in my stock research services — Green Zone Fortunes and especially 10X Stocks — to the “small” side.

Now is the perfect time to be building an overweight small-cap portfolio.

While small-cap stocks tend to experience outsized volatility during bear markets and recessions…

That volatility represents buying opportunities, particularly in the type of high-quality small-cap companies that tend to outperform like gangbusters in the wake of a recessionary pullback.

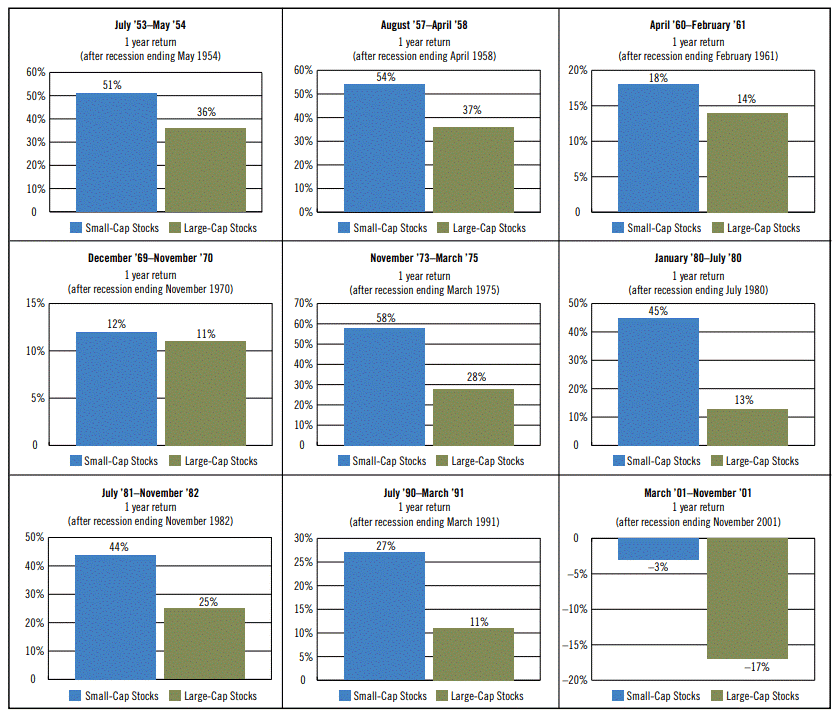

Consider this chart from a Prudential study, which shows small-caps have outperformed large-cap stocks following the last nine recessions…

Source: Prudential.

That’s why I’m gearing up for what I expect to be a massive run of outperformance in small, high-quality companies over the next two to three years.

Indeed, there are risks that come with investing in small-cap stocks. Relative to large companies, small companies typically are characterized by the following:

- A smaller capital base, reducing their ability to deal with economic uncertainty.

- Greater volatility of earnings.

- Greater uncertainty of cash flows.

- Less depth of management.

- Less proven business models (in some cases).

- Less information availability, due to fewer analysts covering them.

- Greater volatility of share price.

Of course, unless you for some reason believe in “free lunches,” the unique risks that come with investing in smaller companies are precisely why investing in smaller companies offers a higher return.

You just have to know which small-cap stocks are worth buying.

And for that, we turn to the Stock Power Ratings system.

Why 171 Stocks Are Off the List

In short, every single one of the stocks I removed from the watchlist today rated a 20 or below on the Stock Power Ratings system.

That means each of these companies’ composite ratings was dragged down based on poor scores on some combination of momentum, size, volatility, value, quality and growth factors I use within my program.

Stocks with this “High-Risk” composite rating are expected to significantly underperform the market over the next 12 months. They’re no place for hard-earned money.

This is so important to understand, because after this bear market, a lot of stocks that previously did very well now might look like “bargains” to the untrained eye. Especially stocks that were hugely popular in the last bull market and are now in “small-cap” territory.

Let’s look at a few examples you may have heard of.

Here’s crypto company HIVE Blockchain Technologies Ltd. (Nasdaq: HIVE)…

I would forgive a new investor who looks at this chart, sees that Hive Blockchain is still operating and believes it could potentially return to its 2021 highs someday. Maybe when there’s another crypto bull market.

But my analysis says you shouldn’t go anywhere near this stock.

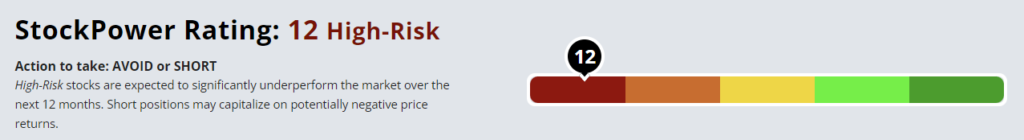

It rates a 12 on my Stock Power Ratings system, axing it from the $5 stocks watchlist.

HIVE's Stock Power Ratings in April 2023.

Here’s another sub-$5 stock from the first watchlist, cannabis company Canopy Growth Corp. (Nasdaq: CGC)…

Again, we have what looks like a potential bargain. Canopy Growth was once a $50 stock — and not too long ago. It’s still around, even if its share price has been decimated. Buying it up at these prices seems like it could make for a strong small-cap post-recession investment.

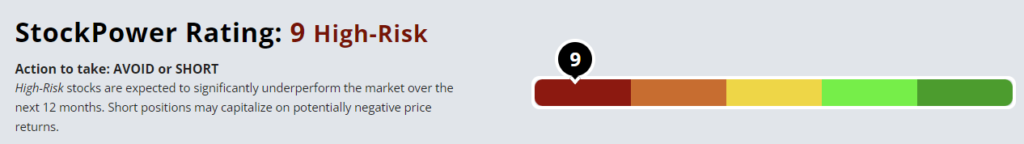

But my system is screaming that this would be a big mistake. It currently rates a 9, putting it firmly in the “High-Risk” category.

CGC's Stock Power Ratings in April 2023.

Here’s another name you’ve seen at your local grocery store: Oatly Group (Nasdaq: OTLY)…

This is a more recent public listing, but the dynamic is the same. Oatly is a nationally recognized milk-alternative brand. At one point, it traded as high as $30 per share. Today, it trades around $2.36.

What does the Stock Power Ratings system say? It’s not pretty…

OTLY's Stock Power Ratings in April 2023.

This is no bargain … it’s a trap.

I point these companies out because they’re some of the high-flyers that tempted investors back during the last bull market. They might think this is the repeat of the dot-com bubble, where countless companies’ share prices fell off a cliff, and think they can pick the “Amazons” and “Googles” of today.

And that’s certainly possible. But you won’t do it by simply buying stocks that are down big from their bubble-era highs.

Instead, utilizing sound fundamental and price analysis — through a system that’s proven to historically outperform the market — is the key.

Pair that up with the dynamic of quality small caps doing well in the aftermath of bear markets and recessions … and the SEC’s $5 rule, encouraging major investors to only buy stocks once they cross above $5, and we have a systematic set of parameters to find those winners of the future.

If you aren’t already, I highly encourage you to follow along with my latest revision of the $5 Stocks to Watch report. All the stocks in this new report are not in the “High-Risk” category and are worth a second look.

But even more, I encourage you to stick around for my third revision next week, where I’ll trim it down to stocks with the greatest potential for 2023.

In the meantime, consider perusing the newest report and plugging in the tickers on the Money & Markets website. You’ll quickly be able to see the difference between a quality $5 stock and a lousy one.

Regards,

Adam O’Dell

Chief Investment Strategist, Money & Markets